The Nifty 50 flaunts a brand new, shiny look, with HDFC Bank emerging as the biggest weight in the index and LTIMindtree the newest kid on the block. With a weightage of 14.43 percent after merger with parent HDFC Ltd, HDFC Bank has pipped Reliance Industries as the anchor for the benchmark index, from July 13.

It is sort of a homecoming for HDFC Bank. Back in September 2017, both HDFC and HDFC Bank had weighed heavier than RIL on the Nifty. Now, the combined entity with 100 percent public shareholding has made its way back to the top.

Reliance Industries, however, continues to be the biggest Indian company with a market capitalisation of Rs 18.69 lakh crore. Over the last 20 years, RIL has been the only stock to have stayed in the Top-10 league on the Nifty 50. Even after Jio Financial Services demerger, its weightage will remain above 10 percent, said analysts. As per various brokerage reports, the JFS share price has been pegged in a range of Rs 130-160.

HDFC Bank, on the other hand, has had a tremendous journey. Back in 2002, it was at the 14th spot with a weightage of 1.8 percent. A little over 20 years later, it is the crown jewel of Nifty 50 at a significant margin over the second in line. The combined entity of HDFC Bank is pegged at Rs 12 lakh crore market cap.

Index weights are important to track as several index funds, hedge funds and exchange-traded funds benchmark their allocation to indices. Any change in the Nifty 50 index composition can result in inflows or outflows in the stock markets.

However in this case, there will be no significant outflows from funds benchmarked to Nifty 50 as both HDFC shares will get converted to HDFC Bank. A shareholder will get 42 fully paid-up shares of HDFC Bank for every 25 held in HDFC.

"The orchestration of this merger is to ensure that the future is not constrained for any of our stakeholders. The merger marks a phase of the two entities working jointly to tackle the issues on hand,” HDFC Chairman Deepak Parekh wrote in his retirement letter.

But what about Bank Nifty?

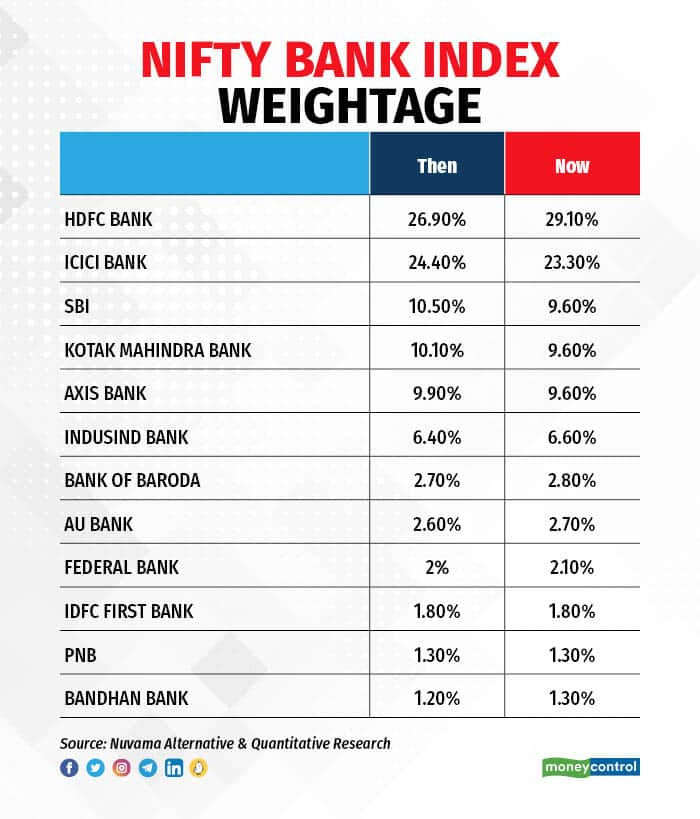

A viral WhatsApp forward says HDFC Bank will command 52.40 percent weightage in Bank Nifty. Along with ICICI Bank, the two will take up 75 percent of the index weight, it said. But investors need to note that it is not true.

To eliminate concentration risk, the NSE has a weight ceiling of 33 percent for a single stock and 62 percent for the cumulative top three free float stocks. Thus, HDFC Bank’s weight in the Bank Nifty index will go up to 29.10 percent from 26.90 percent, paving the way for passive inflows of $70 million, as per Nuvama Research.

The top three banking index stocks - HDFC Bank, ICICI Bank, State Bank of India - have a cumulative weight of 61.80 percent on the index. This will go up marginally to 62 percent after the merger.

“The index provider has already used a capping factor for HDFC Bank, which is 89 percent, and we continue to believe the capping factor can be adjusted to keep the stock’s weight below 33 percent,” said Abhilash Pagaria, Head - Alternative & Quantitative Research, Nuvama Institutional Equities.

The Bank Nifty index is trading near a crucial support zone of 44,800-44,750. “If this support zone is breached, it is likely to lead to further downside movement towards the 20-day moving average (20DMA), which is positioned at the 44,500-44,000 range,” according to Kunal Shah, senior technical and derivative analyst at LKP Securities.

The Bank Nifty index has been trading within a broad range of 44,500-45,500. In such a range-bound scenario, Shah advises traders to utilise opportunities presented by both the upside and downside movements till the key merger event is behind us.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.