Broader indices performed in line with the main indices, which posted the biggest weekly gains since February 2021 on the back of persistent FII buying on the forecast of an above-normal monsoon and likely favourable outcome from US-India trade negotiations.

During the week, the BSE Large-cap, Mid-cap, and BSE Small-Cap indices added more than 4 percent each.

For the week, the BSE Sensex index surged 3,395.94 points or 4.51 percent to finish at 78,553.20, and Nifty50 added 1,023.1 points or 4.48 percent to end at 23,851.65.

All the sectoral indices ended in positive territory with Nifty Realty and Private Bank indices surging 7 percent each, Nifty Bank index added 6.4 percent, Nifty PSU Bank index rose 5.6 percent, Nifty Media index jumped 5 percent, and Nifty Oil & Gas and Auto indices were up 4 percent each.

"The domestic market experienced a strong resurgence during the holiday-shortened week. The rally gained momentum following a pause in US reciprocal tariffs, with exemptions granted to products such as smartphones and computers. Continued FII inflows and the forecast of an above-normal monsoon also contributed to the market's outperformance relative to other emerging economies,” said Vinod Nair, Head of Research, Geojit Investments.

“Bank Nifty led the rebound sharply, supported by a favourable monetary environment and a reduction in deposit rates by major banks, which is expected to enhance margins and benefit banking stocks. Amid global uncertainties, Bank Nifty remains a preferred investment choice and is now approaching its all-time high.”

“India has emerged as the first major market to fully recover from the losses triggered by the US tariff announcements earlier this month. Investor sentiment was buoyed by expectations that the US-China trade dispute may not harm, but rather benefit, India.”

“At present, the domestic macroeconomic environment remains supportive, encouraging investors to increase their exposure to riskier assets for the long term. Additionally, the inflation outlook appears favorable, reinforced by forecasts of an above-normal monsoon and a decline in oil prices,” Nair added.

On the flip side, the earnings growth for the fourth quarter of FY25 is likely to be insipid due to muted demand and margin pressures. Investors are advised to adopt a cautious stance, particularly with export-oriented stocks, and instead focus on pure domestic themes such as banking, consumer goods, healthcare, transportation, and infrastructure.”

“In the week ahead, a sector- and stock-specific investment strategy is anticipated, driven by upcoming earnings releases and subsequent management commentary, which will play a key role in shaping market sentiment," he further said.

After remaining net sellers for the two consecutive weeks, the Foreign Institutional Investors (FIIs) remained net buyers in the week ended April 17 as they purchased equities worth Rs 14,670.14 crore, while Domestic Institutional Investors (DII) sold equities worth Rs 6,470.52 crore.

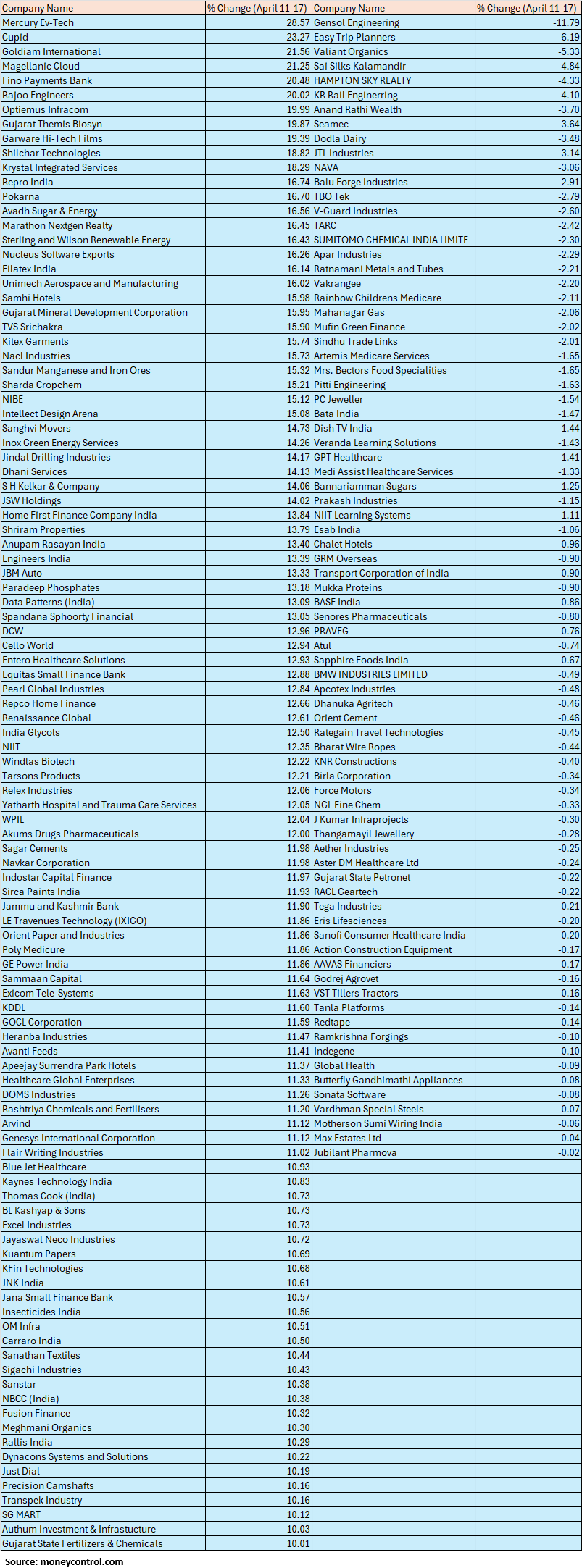

The BSE Small-cap index added 4.7 percent with Mercury Ev-Tech, Cupid, Goldiam International, Magellanic Cloud, Fino Payments Bank, Rajoo Engineers, Optiemus Infracom, Gujarat Themis Biosyn, Garware Hi-Tech Films, Shilchar Technologies, and Krystal Integrated Services gaining between 18-28 percent. However, losers included Gensol Engineering, Easy Trip Planners, Valiant Organics, Sai Silks Kalamandir, Hampton Sky Realty, and KR Rail Engineering.

From a technical perspective, the Nifty has formed a strong bullish candle on both the daily and weekly charts, indicating underlying strength. Sustaining above the 23,900 level could pave the way for an extended rally towards 24,050, where the 200-Day Simple Moving Average (200-DSMA) is placed. A decisive move above this could open the door for a further upmove towards 24,200.

On the downside, immediate support lies at 23,800, followed by 23,500. As long as these levels hold, a 'buy on dips' approach remains advisable.

Amol Athawale, VP-technical Research, Kotak Securities:During the week, the market successfully surpassed the 20-day and 50-day SMA (Simple Moving Average) zones, which is largely positive. On the weekly charts, a bullish candle was formed, and the market is holding an uptrend continuation formation on both daily and intraday charts, supporting further upward movement from current levels.

We believe that the short-term market texture is bullish; however, due to temporary overbought conditions, we may see range-bound activity in the near future.

For traders, the levels of 23,500/77400 and 23,350/76900 would act as key support zones, while resistance areas for the bulls could be found between 24,000/79000 and 24,200/79600. However, if the market dips below 23,350/76900, sentiment could change, prompting traders to consider exiting their long positions.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.