Tata Consultancy Services (TCS), despite its weak performance in Q1FY21 as compared to its peer Infosys, emerged as the preferred choice for long-term investment, a Moneycontrol poll of readers showed.

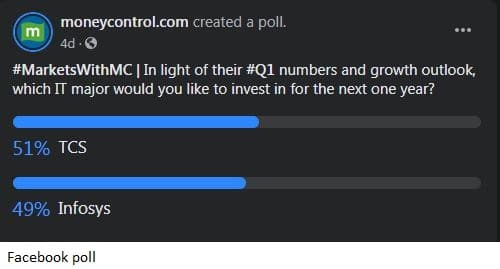

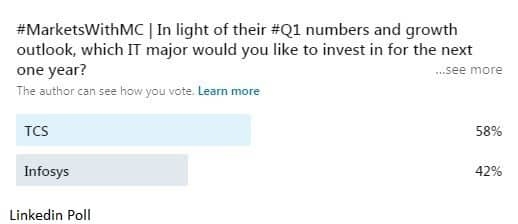

In a social media poll conducted on Facebook, 51 percent of respondents favoured TCS for investment for the next year while on Linkedin, 58 percent of votes were in favour of TCS.

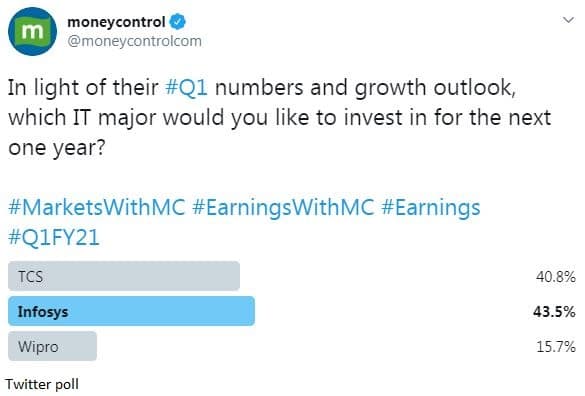

However, on Twitter, the majority (43.5 percent) went with Infosys. TCS fetched 40.8 percent votes and Wipro 15.7 percent.

TCS reported a 13.8 percent year-on-year (YoY) fall in Q1 profit, partially impacted by a 67.8 percent YoY decline in other income to Rs 456 crore.

On the other hand, Infosys posted an 11.5 percent YoY growth in net profit at Rs 4,233 crore while Wipro posted a flat 0.11 percent YoY growth in net profit at Rs 2,390.40 crore.

The June quarter numbers are expected to come weak due to coronavirus pandemic. Experts advise treating Q1 numbers as aberrations and focus more on the outlook and management commentary which is what seems to have helped investors maintain their faith in TCS.

"The revenue impact of the pandemic played out broadly along the lines we had anticipated at the start of the quarter. It affected all verticals, with the exception of life sciences and healthcare, with varying levels of impact. We believe it has bottomed out, and we should now start tracing our path to growth," Rajesh Gopinathan, CEO and Managing Director of TCS, said when the Q1 earnings of the company were announced on July 9.

A tug of warThe Q1 numbers garnered mixed reviews for TCS from top global brokerages. On the other hand, they hailed Infosys for its surprising Q1 show.

Global brokerage firm CLSA kept 'outperform' rating on TCS after the results and raised the target price to Rs 2,260 from Rs 2,240.

"The Q1 margin was a miss but cashflow is stable and the outlook is optimistic. The company has exuded confidence of a recovery in the second half of the year," CLSA pointed out.

The BFSI demand showed that there is a better resilience with the healthy deal pipeline. It has changed FY21/FY22 EPS estimates by -3 percent/0 percent, CNBC-TV18 reported, quoting CLSA saying so.

Motilal Oswal Financial Services, which has a 'neutral' rating on the stock with a target price of Rs 2,300 underscored TCS should be able to better navigate through challenges against the rest of the industry.

"Over the medium-term, we expect TCS to be a key beneficiary of the COVID-19-driven increase in technology intensity across verticals," Motilal said.

Macquarie downgraded TCS to neutral from outperform, with a target price of Rs 1,900 and said the company's growth recovery will be gradual given the uncertainties, while margin drag will remain till the growth recovers.

Macquarie said the EBIT margin of TCS may decline 80 bps in FY21 & improve 160 bps in FY22.

The result of Infosys surprised analysts and the market. Top global brokerages, such as UBS (target price: Rs 810), CLSA (target price: Raised to Rs 1,000 from Rs 860), Nomura (target price: Rs 975) and Citi (Target price: Raised to Rs 1,000 from Rs 825) recommended a 'buy' on the stock after the results were announced.

UBS said that the company’s Q1 numbers beat expectations, while FY21 guidance is a big positive and should help narrow valuation discount to TCS.

CLSA said the company could be the only scale player to report YoY growth in FY21.

CLSA raised FY21/FY22 EPS estimates by 9 percent and said with the restoration of formal guidance, PER gap with TCS should decline.

As per Nomura, the company’s digital positioning, silver linings during the COVID-19 outbreak, bodes well for the demand recovery.

Citi raised EPS estimates of the company by 6-7 percent for FY21E-23 and increased the target multiple to 23 times FY22 from 20 times.

Jyoti Roy DVP- Equity Strategist at Angel Broking said in light of the Q1 numbers and management guidance, Infosys appears better-placed at the current prices as compared to TCS over the next one year.

"While TCS numbers came below street estimates, Infosys reported numbers which were well above street estimates with dollar revenues contracting by 2.4 percent QoQ, as compared to street estimates of 4-5 percent degrowth," Roy said.

The management’s revenue growth guidance of 0-2 percent growth in constant currency terms for FY2021 also surprised markets positively and helped reaffirm the market's faith in the company.

"At the current levels, Infosys is trading at P/E multiple of 19.5 times FY22 EPS estimate which is at nearly 12 percent discount to TCS. Though the valuation gap has narrowed significantly post the Infosys numbers, we expect Infosys to continue outperforming TCS in the near-term and expect the valuation gap to narrow further from current levels," Roy said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.