December 24, 2020 / 15:49 IST

Rohit Singre, Senior Technical Analyst at LKP Securities

Nifty maintained the bullish momentum for the third consecutive session and closed the day at 13,749 with gains of more than one percent, forming an inside bar kind of candle pattern on the daily chart.

Now, the index has reached its upper band of resistance which was at 13,775.

Going forward, if the index manages to sustain above the said level, then we may see the extension in the rally, otherwise, we may see some profit-booking in the index. Support for Nifty is near 13,680-13,600 zone.

December 24, 2020 / 15:46 IST

Nish Bhatt, Founder & CEO, Millwood Kane International

The Indian rupee hit the 77 per dollar mark earlier in the year. The fall in the Indian rupee is understandable given the economic uncertainties and fall in growth rate that led to global investors rush to the greenback which is considered as a safe-haven. The depreciating rupee has had a positive impact on Indian exporters, IT companies.

The Indian rupee has depreciated over 3.5 percent (YTD) in the year 2020. This will be the third straight year of decline for the rupee. It is one of the worst years for the Indian rupee among its Asian peers. The fall in INR vs the USD is despite record inflows from FIIs/FPIs in the Indian equity market and other PE investments. The regular market intervention by the RBI to absorb the excess dollar flow is one of the reasons behind depreciating INR despite strong inflows.

As we approach the year 2021, the rupee movement will be guided primarily by the RBI intervention in the currency market to keep the INR in check. The RBI forex reserves are near all-time high levels. Any fall or softening in the prices of crude oil will support the rupee as India imports the bulk of its oil requirements, the pledge by global central banks to keep the system liquidity in excess is likely to weaken the USD, supporting the INR.

December 24, 2020 / 15:43 IST

S Ranganathan, Head of Research at LKP Securities

Ahead of a long weekend and a tranche of expected rural stimulus, bulls were in complete control buoyed by a stellar listing of Bector Foods. Financials & pharmaceuticals led the rally while investors bought into insurers and consumer durable names across the broader market.

December 24, 2020 / 15:38 IST

Market closing:

Market benchmarks Sensex and Nifty ended in the green for the third consecutive session amid positive global cues.

Sensex closed 529 points, or 1.14 percent, higher at 46,973.54 while Nifty settled at 13,749.25, with a gain of 148 points or 1.09 percent.

Mid and small-caps underperformed their large peers as the BSE Midcap and Smallcap indices closed 0.06 percent and 0.59 percent up, respectively.

December 24, 2020 / 15:27 IST

Ashis Biswas, Head of Technical Research, CapitalVia Global Research

The market witnessed the continuation of a strong pullback rally after a big correction that occurred on Monday.

While sustaining above 13,750 is the key factor from a short-term perspective, a decisive breakout above the zone of 13,760-13,780 could open the gate for a movement till 13,990.

Momentum indicators like RSI, MACD are indicating a positive outlook to continue and market breadth to improve further after the decisive level breakout of the resistance zone.

December 24, 2020 / 15:21 IST

Natural gas futures drop over 2%

Natural gas futures trade weaker at Rs 187.50 per mmBtu on December 24. Natural gas price had declined 6.2 percent yesterday on the NYMEX.

Natural gas price had a negative open and extended slide to trade at a low point of the day in the afternoon session on lower than expected decline in inventory.

The US Energy Information Administration (EIA) reported that US natural gas inventories fell by 152 billion cubic feet (bcf) for the week ended December 18 against market expectations of 160 bcf.

Natural gas prices were weighed down by rising output and mixed weather forecast denting outlook for residential heating demand.

MCX iCOMDEX Natural Gas Index inched down 53.01 points, or 2.25 percent to 2,306.45.

December 24, 2020 / 15:08 IST

Market update:

More than 200 stocks, including Asian Paints, Bajaj Auto, Infosys, Kotak Mahindra Bank, Nestle India and TCS, hit their 52-week highs on BSE.

Majesco, Reliance Infrastructure, Lyka Labs, Ankit Metal & Power and Tanla Platforms were among the 330 stocks that hit their upper circuits on BSE in today's session so far.

December 24, 2020 / 14:59 IST

Market update:

Market update:# Market benchmarks Sensex and Nifty rose over a percent each while BSE Midcap and Smallcap indices traded with mild gains.

In terms of index contribution, Reliance Industries, HDFC twins, ICICI Bank, Kotak Mahindra Bank and Axis Bank featured at the front. On the flip side, Infosys, Nestle India, HCL Tech, Mahindra & Mahindra and Dr Reddy's Labs were the laggards.

December 24, 2020 / 14:47 IST

Sensex in today's session so far

December 24, 2020 / 14:39 IST

Yash Gupta Equity Research Associate, Angel Broking

Aurobindo Pharma and COVAXX Sign an exclusive agreement to develop and commercialize COVID-19 vaccine for India and UNICEF.

COVAXX’s UB-612 is the first multitype, synthetic peptide-based COVID-19 vaccine candidate in clinical trials and it utilises normal refrigeration (no freezing required) for distribution.

The agreement leverages Aurobindo’s existing development, commercial and manufacturing infrastructure.

Phase 2/3 clinical trials by COVAXX to begin early Q12021 in Asia, Latin America and USA. It is an important step in ensuring equitable access and global supply during the worldwide pandemic.

This is a very positive development for the company but COVAXX is going to take time as the vaccine is in the first phase of clinical trials and vaccines may take 6-9 months for getting final approvals.

December 24, 2020 / 14:26 IST

Tapan Patel- Senior Analyst (Commodities), HDFC Securities

: Gold prices traded up with COMEX spot gold prices rose to $1878 on Thursday. Gold February future contract at MCX were trading up to Rs 50,109 per 10 grams in line with recovery in global gold prices. We expect gold prices to trade sideways to up with COMEX gold resistance at $1890, support at $1860. MCX Gold February support lies at Rs 49,800 with resistance at Rs 50,400.

December 24, 2020 / 14:21 IST

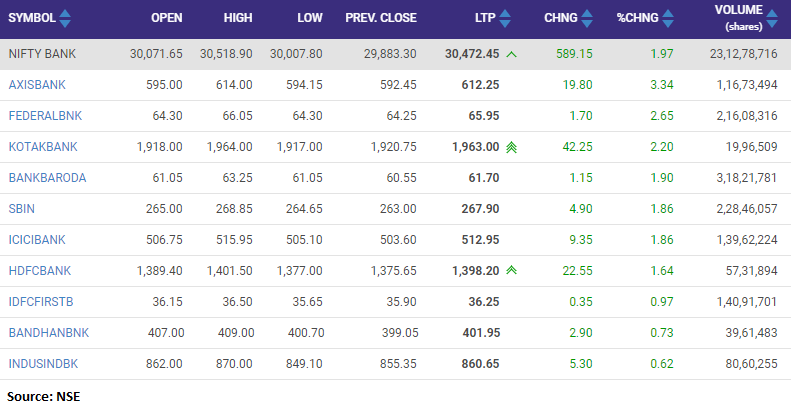

Bank Nifty added 2 percent led by Axis Bank, Federal Bank, Kotak Mahindra Bank and State Bank of India