Market snapped two-week losing streak and ended higher in the truncated Diwali week ended November 4 amid mixed global cues.

In the week gone by, BSE Sensex added 760.69 points (1.28 percent) to close at 60,067.62, while the Nifty50 jumped 245.15 points (1.38 percent) to close at 17916.8 levels.

In Samvat 2077, benchmark indices touched fresh life-time highs with Sensex and Nifty surpassing 60,000 and 18,000, respectively, for the first time ever. However, the BSE Sensex jumped 37 percent (16,500 points), while Nifty50 index rose 40 percent (5,149 points) from the last Diwali and touched the record highs of 62,245.43 and 18,604.45, respectively.

The broader indices outperformed the main indices with BSE Midcap and Smallcap indices rose 3 percent each in the last week. However, since last Diwali, both the indices gain of 61 percent and 80 percent, respectively.

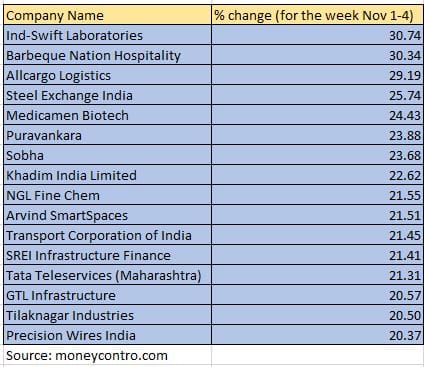

In the week gone by, 82 smallcaps rose up to 30 percent. These include Ind-Swift Laboratories, Barbeque Nation Hospitality, Allcargo Logistics, Steel Exchange India, Medicamen Biotech, Puravankara, Sobha and Khadim India.

However, Nazara Technologies, Tribhovandas Bhimji Zaveri, Saurashtra Cement, Unichem Laboratories, Rajratan Global Wire, Hikal, SIS, Solar Industries India, Alkyl Amines Chemicals, GNA Axles and DCM Shriram Industries were among major smallcap losers.

"Since it was a truncated week on the back of Diwali festival, markets remained more or less in a range of merely 300 points, where both the support and resistance range played out accurately," said Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel One.

Historically it’s observed that market do not correct during the Diwali week and this is what we witnessed in last three sessions. But we must accept the fact; markets were a bit tentative in last couple of sessions. Since there was no major action in the week gone by, we continue to remain cautious on the market," he added.

In the last week, the BSE 500 index added 2 percent with 29 stocks added more than 10 percent, including Allcargo Logistics, Sobha, Century Plyboards, Tube Investments of India, Indiabulls Real Estate, Garden Reach Shipbuilders & Engineers, La Opala RG, VRL Logistics and Mazagon Dock Shipbuilders.

Where is Nifty50 headed?Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities:Nifty has entered a corrective phase and is expected to remain under pressure for the short term. Resistance is expected around 18,000-18,100 levels, while we see value around the 17,000-17,200 mark.

Advice traders to keep a check on leverage positions while investors can use deeper correction to accumulate frontline stocks. IT and metals can be accumulated on corrections.

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:We are of the view that 17750 would act as a key support level for the day traders, and above the same we can expect one more intraday upmove up to 17900-17975 levels.

On the flip side, trading below 17750 could possibly trigger one more round of correction wave up to 17700-17660.

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:The hourly chart shows that the Nifty is facing resistance near the hourly upper Bollinger Band & the 50% retracement mark for the last couple of sessions. Thereon the index has dipped towards the hourly lower Bollinger Band, which arrested the downside for the day.

Structurally, the short term consolidation process is expected to continue further. The downside is expected to be restricted to 17600 for the short term whereas on the higher side 18000 will continue to act as a cap for the short term.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.