The market had a good run up in March, with the Nifty rising more than 3 percent on the back of highest ever FII inflows in a single month. Foreign institutional investors bought nearly Rs 30,000 crore worth of equity shares in March.

In fact, the entire financial year 2016-17 was also strong for the market as the Nifty surged nearly 19 percent and FIIs invested close to Rs 50,000 crore in Indian equities.

In March, not only India but also other emerging markets received good inflow of foreign money, the main catalyst for strong risk-on trade.

The strong inflow pushed the MSCI EM index into the bullish territory as the index has now moved up over 11 percent in Q1 2017. This also helped MSCI EM currencies to appreciate sharply while MSCI EM Currency Index is up 4.8 percent (largest monthly gain since September 2010).

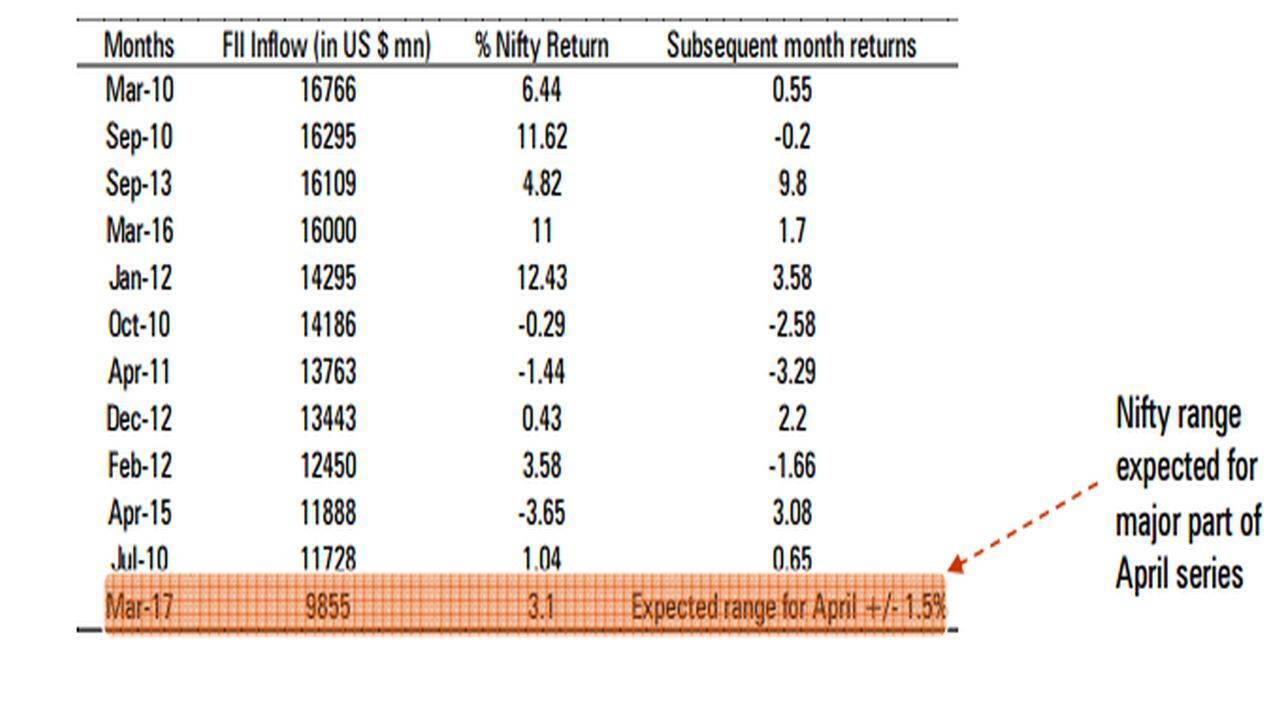

With such strong inflows, ICICIdirect feels that could lead to a consolidation in April. Historically also, strong emerging markets EM flows have triggered a consolidation in the next month, it says.

Source: ICICIdirect report

Source: ICICIdirect report

In the above analysis, strong inflows in a particular month have pushed the Nifty into consolidation in a narrow band of plus or minus 1.5 percent on a monthly closing basis in the following month (with only exception of September 2013). Hence, plus or minus 1.5 percent of last month closing (9,173) gives narrow Nifty range for April series, ICICIdirect says.

But the full year (FY18) outlook for the market is positive considering strong macroeconomic indicators and the implementation of GST, says IIFL in its report.

Experts expect the Nifty to hit 10,000-mark if earnings in FY18 deliver better performance than forecast. Timothy Moe of Goldman Sachs says he expects the Nifty to reach 9,500 in 12 months and 10,200 by 2018-end as earnings recovery gathers pace driven by 12 percent and 15 percent profit growth this year and next.

Given that the long term trend for the markets is positive which will be driven by an expected turnaround in earnings, which in turn would be a function of the economic recovery, Yes Securities suggests that any corrections should be used as an excellent opportunity to pick up quality stocks.

Here are top 10 investment ideas:-IIFLApollo TyresApollo Tyres is the largest commercial vehicle tyre manufacturer in India with 25 percent market share each in the T&B (truck and bus) bias segment and in the T&B radial segment. In the passenger car radial (PCR) segment, it is the third-largest player with 16 percent market share.

The company is well poised for growth by consolidating its leadership position in-key markets through new products (launch of the two-wheelers tyre range) and increasing retail presence.

Any positive development in terms of imposition of anti-dumping duty on Chinese tyre imports will further boost the growth prospects. Also, recent price hikes coupled with correction in rubber prices will lead to margin expansion. Buy Apollo Tyres with a target price of Rs 268, implying 28 percent upside from current level.

Equitas HoldingsThe company has four key business verticals – microfinance, used commercial vehicle, micro & small enterprises (MSE) and housing finance. It is likely to commence banking operations in near future by merging all these businesses.

Equitas is currently re-organising its business by lowering high-risk micro-financing which was impacted by demonetization. There will be negative impact on assets under management and disbursement due to discontinuation of micro finance as it contributed 50 percent to AUM and 61 percent to disbursement in the coming quarters.

However, its conversion to bank and expansion of its product and service offerings will help it strengthen its business in the long term. IIFL expects it to deliver 16 percent CAGR in earnings over FY16-19. Hence, it recommends buying with a target price of Rs 195, implying 15 percent upside.

Greaves CottonGreaves Cotton boasts of 25-30 percent market share in diesel engine (50 percent of total sales) for three wheeler (3W) passenger vehicles. In 3W goods carrier (less than 1 tonne category); market leader Piaggio is GCL's single largest client.

The company has a healthy balance sheet with cash balance of Rs 500 crore and return on equity of more than 20 percent. IIFL believes a gradual pick up in auto engine volumes post demonetisation, growth in farm and aftermarket segment makes it an attractive proposition. Hence, it recommends buying with a target price of Rs 199, implying 14 percent upside.

Indraprastha GasIGL commands monopoly as an exclusive distributor of CNG and PNG in Delhi and NCR regions. It has a strong infrastructure of 419 CNG filling stations (132 self owned). It supplies PNG to around 6.9 lakh residential customers and 2,770 commercial users.

IGL's CNG and PNG volumes have grown at 7 percent and 14 percent CAGR over the last 5 years. IIFL expects volume and consolidated profit growth of around 12 percent and around 20 percent CAGR respectively over FY16-19. Given the growth prospects, healthy cash generation and strong balance sheet; the brokerage house recommends buying the stock with a target price of Rs 1,115.

Nagarjuna ConstructionNCC is amongst the top 3 construction companies in India in revenue terms. It has presence across buildings & housing, roads, water, metals, mining, power and railways. It has an order book of Rs 20,466 crore (2.5x trailing 12-month revenues).

Going forward, the management expects FY18 topline to grow at around 10-12 percent YoY and EBITDA margin to be in the range of 9.25-9.5 percent. IIFL expects it to be a key beneficiary of pick up in investment in roads, water and urban infrastructure. Hence, it recommends buying the stock with a target price of Rs 99, implying 21 percent upside.

KR ChokseySuzlon EnergyThe brokerage house has initiated coverage with a buy call on the stock. It believes that with improvement in the revenue outlook along with easing of working capital cycle and progress in the free cash flows could be the key trigger for expansion in the multiple going ahead.

Assigning a multiple of 8.5x on FY19 (lower than its average), KR Choksey has arrived a target price of Rs 31, an upside potential of 66 percent.

In terms of the peer analysis, standalone revenue of Suzlon grew at a CAGR of 40 percent over FY14-16 as against Gamesa, Vestas and Inox wind reported a growth of 22 percent, 17 percent and 68 percent, respectively. Moreover, operating margins have remained at around 14-15 percent as against other global industry players hovering at 11-13 percent.

Nirmal BangDr Lal PathLabsDLPL is India's second largest provider of diagnostic and related healthcare tests and services in India. Dr Lal Path Labs has strong pedigree of promoters.

Considering the healthy balance sheet, improving growth prospects and strong profitability, Nirmal Bang recommends buying the stock for 15-20 percent upside in 3-6 months.

Between FY12-16 DLPL's revenues grew at CAGR of 23.3 percent while EBIDTA grew at a CAGR of 24.8 percent and PAT by 31.1 percent. Nirmal Bang expect DLPL to maintain healthy growth rate of 15-20 percent going forward as well, on the back of expansion of its base, opening of 2 new national reference laboratories, eating share of standalone laboratories and increase spend by people on preventive and curative healthcare.

Motilal OswalThe brokerage house says in capital goods space, its top picks are L&T, BHEL and Crompton Greaves Consumer.

He advises buying L&T with a target price Rs 1,660, BHEL with a target price of Rs 178, and Crompton consumer with a price target of Rs 205.

Motilal Oswal says it believes that the capex activity over the next 18-24 months would be driven by government projects, post which it believes private capex activity to pick up given better demand scenario and better utilisation of installed capacities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.