The answer to this should be straightforward, right?

We all know that 2022 was a terrible year for US stocks... in fact for all asset classes across the world for nearly a century.

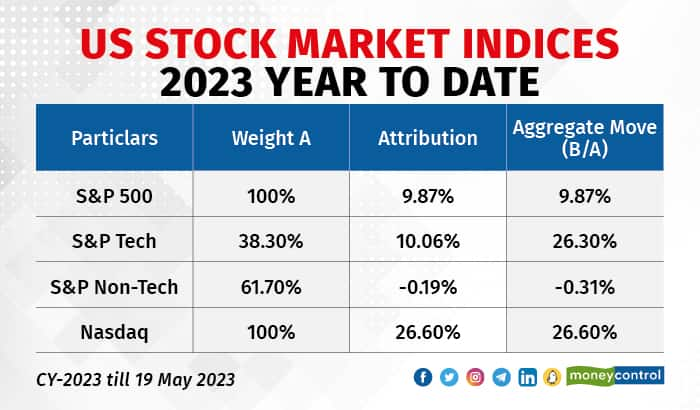

Coming to 2023, this is the data so far (up to the third week of May) for the US stock market.

The Nasdaq is up 26.6 percent and the S&P 500 is up almost 10 percent.

The story seems clear, doesn't it?

There has been a massive bull run in technology stocks (which the Nasdaq broadly represents) but the rest of the US market has done reasonably well too.

Not so fast! A drill-down shows what ISN'T apparent at first glance.

While, we think of the Nasdaq as a shorthand for tech and the S&P 500 as non-tech, many of the heavyweights in the S&P 500 are also technology majors.

If we do this bifurcation, we find that the tech weight in the S&P 500 is up 26.6 percent, whereas the non-tech part of the S&P 500 is DOWN!

There's a stealth bear market in US non-Tech stocks that doesn't show up in the headline indices

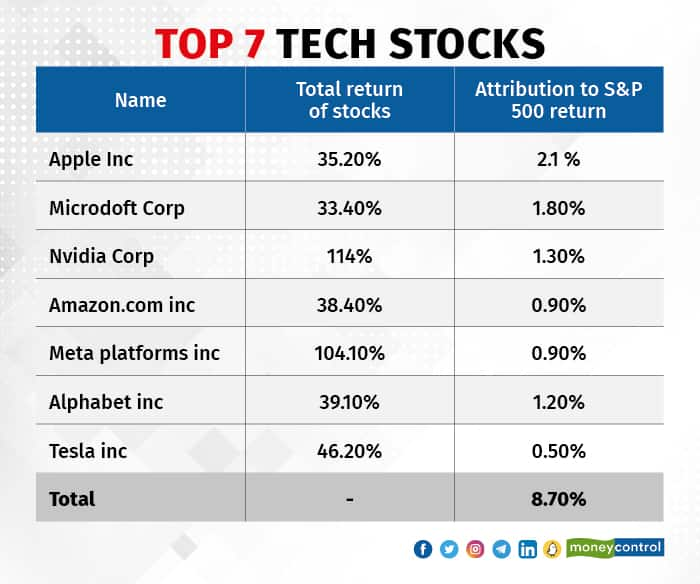

Further analysis shows that out of the top 10 stocks in the S&P 500 (on the basis of weight), 8 are tech stocks (including Tesla, and Alphabet/Google counted twice). These tech stocks have contributed 8.7 percent out of 9.9 percent of S&P 500 rally. So basically the top 7 tech stocks have contributed 88 percent of the rally in CY23.

Think about it: just 7 stocks have contributed almost 90 percent of the S&P 500 move. That is why it has been virtually impossible to outperform this rally unless you were at the very highest risk range.

Even being invested in these stocks was not good enough unless you had greater than index weight. Everything else was mostly in the negative category.

Therefore, unless you were invested at an index weight minimum you'd underperform.

In short, it has been an extremely narrow bull market in just about a handful of stocks, whereas the rest of the market has been languishing in the doldrums.

Just 7 stocks, to be precise! This skewed the market, which is not something that is widely understood.

(The writer is the Founder and Chairperson of First Global, a leading Indian and global investment management firm. She is a gold medalist from IIMA and has been in the investment business for over 30 years. She tweets @devinamehra and can be contacted at info@firstglobalsec.com or www.firstglobalsec.com)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.