The Nifty50 finally moved above the 17,000 mark after a lot of attempts. On the daily chart, we can see that the index ended with a Doji candle pattern on December 23.

From the broader point of view, we believe that the index might consolidate between the 17,600 and 16,400 levels.

On the indicator front, the RSI (relative strength index) plotted on the daily time frame can be seen moving higher towards 50 after forming a bullish hinge near 30, indicating exhaustion in the bearish momentum in the price.

Going ahead, we expect the 17,200 mark to act as a strong resistance level. If the prices breach above the 17,200 mark, we can expect the prices to move higher towards the 17,600 level.

This analysis will not hold true if the prices breach below the 16,950 level.

Here are the three buy calls for next 2-3 weeks:HCL Technologies: Buy | LTP: Rs 1,227.45 | Stop-Loss: Rs 1,190 | Target: Rs 1,472 | Return: 20 percent

HCL Technologies on the long-term charts can be seen forming a higher high higher low pattern, indicating that the long-term trend of the stock remains strongly bullish. On the medium charts we can see that the prices are moving higher after a correction.

On the indicator front, the RSI can be seen moving higher after forming a bullish hinge near the 50 mark, indicating increasing bullish momentum in the prices.

Going ahead, we might see the prices move higher towards the previous swing high of Rs 1,378. If the prices managed to sustain above this level, we might see the prices move higher towards Rs 1,472.

We would recommend a strict stop-loss of Rs 1,190 on the daily closing basis.

Tech Mahindra: Buy | LTP: Rs 1,683.80 | Stop-Loss: Rs 1,600 | Target: Rs 1,858 | Return: 10 percent

Tech Mahindra on the medium-term charts can be seen drifting higher since October 2021. On December 23, the prices tested a fresh 52-week high.

On the indicator front, the RSI plotted on both the weekly and the daily charts can be seen placed above 50 and moving higher towards the overbought, indicating presence of bullish momentum in the prices.

The prices action and the technical parameters mentioned above point towards the possibility of the prices moving higher towards the Rs 1,752 mark. If the prices sustain above the Rs 1,752 mark, we might see the prices move higher towards the Rs 1,858.

Tech Mahindra can be seen drifting higher and testing fresh 52-week highs. One can enter Tech Mahindra at current levels and continue to hold it with a target of Rs 1,858 and maintain a stop-loss of Rs 1,600 on closing basis.

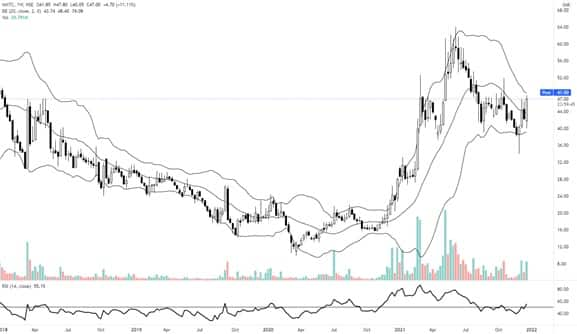

MMTC: Buy | LTP: Rs 47 | Stop-Loss: Rs 40 | Target: Rs 62 | Return: 32 percent

MMTC bounced off the Rs 34 mark on November 29, 2021 and moved higher. On December 23, the prices gained momentum and moved above the three-week high of Rs 46.35. This up move was backed by good volume build up, indicating participation in the up move.

On the indicator front, the RSI plotted on the weekly chart can be seen placed above the 50 mark and moving higher, indicating increasing bullish momentum in the prices.

Looking at the technical parameters, we expect the prices to move higher towards the Rs 53 mark immediately. If the prices move higher, we might see the prices move towards Rs 62 level eventually.

We recommend a strict stop-loss of Rs 40 on the downside.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.