One of India’s longest-serving mutual-fund managers, Prashant Jain, the chief investment officer of HDFC AMC, quit in late July, leaving behind a rich legacy.

Here is the full, unedited text of सार (read as 'saar', which means essence), a note written by Jain over a month after he resigned from his position:“Son, I am extremely sorry, the sought-after roles in merchant banking, project appraisal, marketing have been filled up and I can only offer you equity research”. These are the words of Late Shri N Sriram, GM, SBI Mutual Fund, someday in May 1991.

Thus began my journey in the world of investing. I became the second member of the equity research team of SBI Mutual Fund (first being E A Sundaram). It was he who introduced me to the world of EPS, P/E, ROCE, ROE etc. (valuation metrics like EV/EBITDA, EV/Sales etc. originated later.)

While I was still grappling with the basics of equities, I was given additional responsibility of handling the money market desk – one more reminder of the importance or lack of it of equity research in those days. My introduction to the world of lending happened precisely at the time of the securities scam. My brief stint was an eventful one, but this is not the space to discuss that. I came out unscathed, in my opinion, ironically due to my lack of experience and my discomfort with lending hundreds and thousands of crores. Also, an early morning call (I used to hit the office by 8 am to escape the rush in Mumbai local trains) from someone who had the details of a deal maturing that day (which he was not supposed to have) made me cautious.

As a reward probably of SBIMF coming out of the scam unaffected, I was made in-charge of a scheme. This threw me headlong in the world of equities and accelerated my learning of equities. My immaturity and the desire to reduce my commuting time led me to join a four- member team from SBIMF with the brief to set up 20th Century Mutual Fund in 1993. Few years later this Fund was acquired by Zurich Financial Services (renamed Zurich India Mutual Fund); it soon merged with ITC Threadneedle Mutual Fund consequent to the acquisition of Threadneedle by ZFS globally before

being sold to HDFC Mutual Fund in 2003. I thus changed a few business cards with no effort.

It was because of my brief stint in fixed income at SBIMF, that I was assigned Centurion Prudence Fund, a close ended balanced fund in 1994. This Fund was renamed Zurich India Prudence Fund, HDFC Prudence Fund and finally HDFC Balanced Advantage Fund (BAF) over the years. On turning open ended in 1999, the Fund shrank to a mere Rs 9.9 crore (1 crore: 10 million), probably because the NAV was above par. From this to approximately Rs 46,000 crore in July 2022 when I handed over the reins

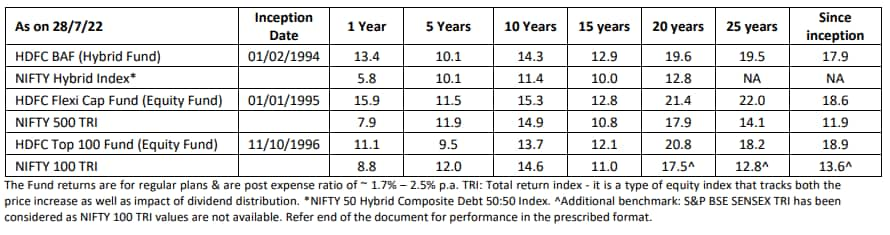

of this Fund has been a journey beyond my imagination – made possible among other things by this period coinciding with the coming of age of mutual funds in India ( aided in no small measure by the vastly improved regulatory framework for capital markets in general and mutual funds in particular), HDFC brand and a consistency in approach and communication. This Fund has delivered a CAGR of 17.91% in this 28 years 7 months. The Fund was also at the top of peer group in its category as on 28th July 2022 across time periods from 1 year to 25 years except 5 years where it was 2nd. Rs 100 in this Fund has thus become Rs.10,940 over this period; this reminds one of what Einstein observed – Compound interest is the 8th wonder of the world, those who understand it, they earn it, those who

don’t, they pay it.

I was also managing HDFC Flexi Cap Fund since 2003 (for approximately 19 years) and HDFC Top 100 Fund since 1999 (for approximately 23 years). The table below gives a summary of the performance of these funds as on 28th July, 2022 in five year buckets and since inception

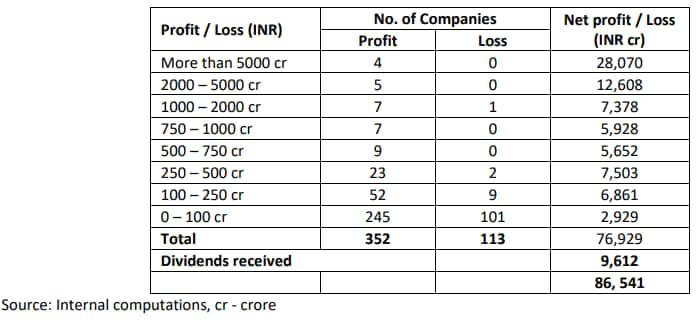

The table below gives a summary of the scorecard (distribution of gains / losses) between October 2003-July 2022 across the 3 funds that I managed. Data prior to this is not available but given the very small size of the funds then, the difference will be insignificant.

As is evident, investments were made in a total of 465 stocks. One in four resulted in a loss. Of the total net gains of approximately 87,000 crores (including dividends), 55 stocks accounted for a gain of more than 74,000 crores (including estimated dividends) i.e. 85% of total. If only one had the wisdom of avoiding 90% of the investments and instead invested more in the 55 stocks!

Looked in another way, this journey of Rs 100 going to Rs.10,940 was largely a result of 6-8 key decisions.

1. IT cycle of mid to late 90’s – Between Jan 1996 to February 2000, IT index went up a massive 95 times. This was a time when the economy was being opened up, imports were being eased, inflation and interest rates were running high and manufacturing was in pain due to years of high protection and inefficiencies. I distinctly remember having purchased Tata Steel bonds (SPNs) at 22% YTM and that Tata steel employed approximately 70,000 to make 2.7 mt of steel compared to less than 40,000 today (Indian operations) to make 20 mt of steel!

2. Old economy strikes back - The rapid growth in IT sector and pain in manufacturing / economy did the inevitable. While IT stocks multiplied, the rest of the markets suffered. As this trend gained momentum it created excesses at both the ends. This is where, based on some very basic working the portfolio went underweight IT and overweight old economy (capital goods, auto, metals, cement etc.) towards the end of calendar year 1999. After some sharp but brief pain, the results were extraordinary. As commodity prices rose (coinciding with China entering the rapid growth phase), as capex recovered, as manufacturing gained in efficiency and as

government allowed entry of private sector in power generation, capital goods, commodities, real estate, infrastructure and utility stocks went into overdrive. The capital goods index went up by 27 times between March 2000 to January 2008. The list of mispriced assets is a long one - utilities were trading around 4 times book, an NBFC that went bust had market cap of the

leading private sector bank etc. There were several multi-baggers in the portfolio over this period.

3. The turn of FMCG / Pharma - What happened to commodities, capital goods, auto, etc. in the IT bull cycle happened to FMCG / pharma etc. next. The rapidly rising share prices and consequent popularity of capex, commodities, NBFC, power etc. led to FMCG / pharma dropping out of favour and over time many companies in this space were available for a song. Believe it or not, many argued and advised that FMCG is a mature business not worth 15-20 multiples! Compare that with the 50-80 multiples today as GARP (Growth at reasonable price) gave way to BAAP (buy at any price) over the last decade. Fortunately, the Fund was rightly positioned, had lightened up on leaders of the last cycle due to excessive valuations and

shifted focus to FMCG/ Pharma to a decent extent. Once again, this caused sharp and brief underperformance in the last leg of the pre-Lehman rally but set the Fund on a strong footing for the next several years. This was the third big wave that benefitted the fund. There were multi baggers in this phase as well, though the number and magnitude of gains were lower.

4. Somewhere in mid 2010’s as FMCG / Pharma sharply rerated and capital goods, utilities, corporate banks sharply de-rated, I took the call to move from FMCG / Pharma to some of these sectors in a phased manner. This decision did not play out as anticipated for a while and tested the patience of investors, distributors, management and me alike. Covid / lockdown also hurt the economic sensitive sectors on one hand and US interest rates falling to record lows, corporate tax cut, etc. rerated FMCG even further, thus extending the period of underperformance. The downsizing in Pharma however proved to be correct and this cushioned the performance.

5. Fortunately, I not only persisted with the portfolio positioning but doubled down in some cases as with the adverse price movement, risk reward had become more compelling. Over time as normalcy returned, the performance recovered strongly and quickly. The pain of few years was gone in a few quarters. What helped in this phase was good understanding of the businesses and the strength of the investee companies that emerged winners once this phase was over. The understanding and support of management, board, trustees, investors, distributors and colleagues was invaluable in this phase and I would like to place on record my gratitude for them. In my judgement, this phase is not yet over and there is juice left in this portfolio positioning especially in energy sector.

Every mark tells a storyThe more bruised a suitcase, the more it has travelled and experienced. In the lines below I share some of the key learnings of my journey over the last three decades – a period that witnessed Indian economy opening up, the coming of age of IT industry, commodities boom, bust and boom again; the coming of age of e-mail, mobile, internet, modern retail and ecommerce, renewable power and EVs, the rise of social media, the decline of traditional

media, the rise of China, Covid - lockdown, negative interest rates and ESG as a theme, to name a few. Phew!

a. Many experts have said this before. In my experience too, efficient markets hypothesis does not hold true, especially over short to medium periods. Markets can be driven by emotion and herd behaviour for extended periods and thus keep on throwing opportunities once in a while. The best opportunities are to found either in most difficult market conditions or in most polarized markets. Investing is, thus, more about emotional

quotient than about IQ.

b. Sizing is very important. Any portfolio will have its share of big winners, winners, losers and big losers. In my case roughly 1/4 were losers, 1/100 were big losers, 1/20 were big winners and the rest were winners. However, it is interesting to note that gains on one large winner were more than the total losses of all loss making investments. This highlights the importance of sizing – of assessment of the risk-reward associated with individual

investments and sizing accordingly.

c. The data above in (b) highlights what Warren buffet has famously said – Rule no 1 don’t lose money, rule 2, don’t forget rule no 1. I have made more mistakes of omission than commission – some prominent missed opportunities were Asian Paints, Bajaj Finance, Eicher, Kotak Bank, Divi’s laboratories, etc., but successfully avoided the long list of businesses that caused large and permanent loss of capital. A list of some prominent

sectors to which many of these companies belonged were TMT, real estate, NBFCs, select banks, infrastructure, telecom, power, media etc. What is particularly satisfying is that most of these were never invested in irrespective of price.

d. Markets are reasonably efficient over long periods. The duration of mispricing or inefficiency can vary from several quarters to several years. It is important in this period to stay the course and to remain solvent (for a mutual fund manager this means to retain the job/fund). Having an alignment of interest (in the case of a fund manager this means being invested substantially in the same fund) helps at such times. Fortunately, the longer the mispricing, typically the higher is the catchup. Markets thus reward in most cases for the entire of period of pain. The only catch here is that the intrinsic value of the business per share should not erode in this phase.

e Equities are a generous asset class. The tailwind of a growing economy and growing companies overshadows mistakes of timing and security selection in diversified portfolios in most cases over long periods. The key is patience to stay invested for long periods.

This brings me to some issues where the debate is ongoing and the jury is still out. I cannot resist my two bits to add to the confusion on these issues.

Unsettled issuesActive vs Passive fundsThis debate has gained traction in recent times with the growing range and market share of passives. In my opinion this debate is somewhat counterproductive. Both active/passive funds are good. Some actives will underperform and some will outperform but all should outperform fixed income over long term. Investors should focus more on asset allocation to

equities – especially given the low allocation to equities for a majority of households.

I am not able to resist an anecdote here. While sharing stage with the erstwhile CIO of a leading MNC Mutual Fund, somewhere in late 90s or early 2000s, I heard him say in his opening remarks

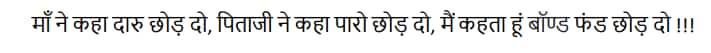

to a thunderous applause!

(This is cheeky adaptation of dialogue from a famous Hindi movie “Devdas” where in the protagonist is delving on his well wishers advising him on to get rid of bad habits or toxic relation from his life)While outperforming benchmarks is not easy and will probably get tougher, especially net of expenses, some managers should be able to outperform over time. In most cases, this outperformance is however unlikely to be linear or consistent. Significant divergence of portfolios from benchmarks and consequently a higher tracking error (that many equate to risk, though there are strong arguments to the contrary) will be needed in many cases to

overcome the hurdle of costs and to generate alpha over long periods in my judgement.

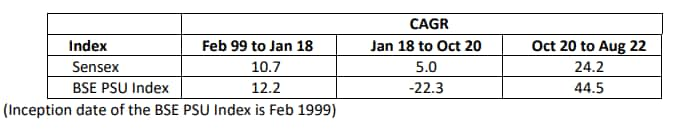

Public Sector Undertakings (PSUs)None of my meetings with investors / distributors were complete without a discussion on PSUs over the last few years. This was probably because of the sharp underperformance of PSUs in CY18-CY20 and because my funds had significant exposure to this group. The table below gives the performance of BSE PSU Index.

It is evident that PSUs have not underperformed across all time periods. However, the underperformance of Jan 18-Oct 20 was so sharp that it led to underperformance even over longer time periods, creating an impression that PSUs are no good. Such strong was this belief that people of all hues – young and old, experienced and amateurs, investment professionals and non-investment professionals, were convinced that PSUs were going to underperform perpetually. As is often the case in investing, herd behaviour and majority opinion is more often wrong than right. The sharp outperformance of PSUs in recent years (I believe the best is yet to come) has reiterated this once again. This sequence of events has further highlighted the impact that price performance has on the opinion of market participants. It is heartening to see PSUs increasingly finding their way to more and more mutual fund portfolios and I am confident they will over time find their way into more FII portfolios and direct portfolios as

well.

There were two key reasonsin my opinion behind the underperformance of PSUs during CY18-20 – ETFs and Core sectors of the economy not doing well. It is interesting to note that PSUs are not present in FMCG, Retail, pharma, IT etc. They are mainly in energy, corporate banks, capital spending, etc. Over time as ETFs were done away with and as the core economy recovered, PSUs performance has turned.

ESGAnd finally, ESG – an issue that evokes more sharp emotions than reasoned debate. ESG has noble objectives but the answer to solving these issues is not in mechanical scores (at times deficient) and in exclusion investing, rather in encouraging /incentivising companies to adopt more ESG friendly technologies, processes and mechanisms via market forces and other means. Reasonably priced energy and adequate defence preparedness are basic to a nation’s/society’s well-being. Lack of investments in these areas can lead to difficult outcomes as the world is realizing and experiencing. This can be particularly difficult for a low income country like India where energy consumption is likely to grow rapidly. There is in my opinion a need to have a realistic assessment of technological limitations, real costs, realistic timelines and the risks. The markets now seem to have had a change of heart with sharp outperformance of tobacco, defence, energy stocksincluding thermal power and coal mining. It will be interesting

to observe the continued acceptability of exclusion based investing in the face of potential underperformance. This turn of events once again highlights how rationality eventually prevails.

Moving onHaving done little else than manage money for 30 years and that too in one place, it is very difficult to move on. I could have continued but I felt it appropriate to move now as all the stars were aligned. The leadership transition at the company is behind, performance has strongly recovered, “value investing” (rational investing is more appropriate in my opinion)

has proven its mettle once again over GAAP (growth at any price) investing and most important the investment team (both equity and debt) at HDFC AMC is second to none in the country and the best that I have had in my career. I had a strong desire to move when NAVs were near all-time high and when there was alpha across time periods. I thus ran out of reasons to hang in. As if this was not enough, the assets under my management crossed Rs 100,000 crores few days before I tendered my resignation – I take this as a divine nudge to me to make way for others.

I consider myself fortunate and blessed to end this innings on a winning note and to have achieved a seamless and smooth transition. Fund management is like a non-stop relay race. Each runner desires to hand the baton ahead of competition and in a seamless manner. Not only has the transition been seamless, more importantly, the funds are in very experienced hands.

अनुगृहितोऽस्मि I have an almost endless list of people to whom I am indebted to

- My parents, for the good upbringing despite the challenges they faced and for giving me a strong value system

- My teachers in school, at IIT, at IIM for the invaluable knowledge and skills imparted that have held me in good stead. I often say that a stint at IIT enhances your learnability more than learning.

- Our Chairman, Mr. Deepak Parekh, who very graciously made me a part of HDFC in 2003 and stood by me in difficult times.

- Earlier MD Mr. Milind Barve to whom this company, me and all my colleagues owe a lot

- To the current MD Mr. Navneet Munot for having accepted my request to move on and to have cooperated in every way possible in this phase. His warmth especially at this time has truly touched me.

- To the entire board, the trustee board for their support and guidance; to all my colleagues for their cooperation and for having tolerated my shortcomings – there are many

- To the regulator who has relentlessly focused on making the capital markets better, on making mutual funds cheaper, better and safer for investors – the results are there for all to see.

- All our investors and distributors – past and present for having reposed their faith in HDFCMF, especially at times when the performance was challenged.

- To all the company managements/sell side analysts, friends in sales for having patiently educated us all along.

- To my family who gave me all their love and support despite the very long hours at office and demanded close to nothing in return.

- To all my critics – they helped me reflect on my decisions, mistakes and shortcomings as also for enhancing my patience and tolerance

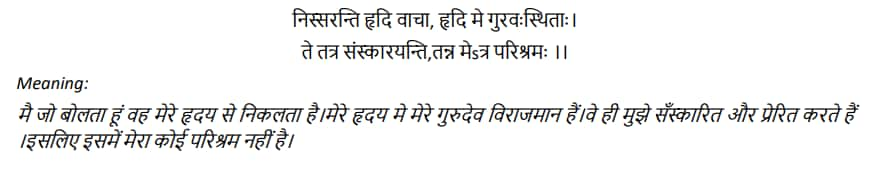

- And above all, to several Jain Saints/Gurus with whom I have spent time for all their blessings and guidance. Following their words has made me a better person and has made life more meaningful and enjoyable. Their guiding principles of equanimity, compassion for all living beings, patience, integrity in everything one does, have been a source of strength for me especially during difficult periods. I can’t thank them enough and hence,

take this opportunity to thank them by dedicating the following two Sanskrit lines which are close to my heart.

I also seek forgiveness from all those whom I have knowingly or unknowingly hurt through my thoughts, words or actions in this journey.

The last wordI don’t have words to describe the incredible journey of last 30 years. Looking back at the sequence of events, I honestly feel that I was incredibly lucky to be at the right place at the right time not once but on several occasions. Whenever I was about to take a wrong turn, some invisible hand nudged me in the right direction. The only credit I can take is that of doing my best every single day. I wouldn’t mind doing it all over again.

30th August 2022 Prashant JainNote: अनुगृहितोऽस्मि, read as anugrihitosmi, means thank you.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.