Global markets, including India's, have been bleeding for the past 2 months due to fears around fast-spreading coronavirus.

Covid-19, which originated in China's Wuhan, has now spread to over 70 countries and has been declared a pandemic by WHO.

Nifty, Sensex have fallen around 30 percent each and many stocks are trading at their multi-year lows.

ICICI Direct has envisaged the impact of coronavirus (COVID-19) on its midcap coverage universe based on the revenue contribution from both the US as well as Europe.

Since the brokerage believes these two geographies are witnessing an upsurge in patients infected by coronavirus, there is a high probability of city lockdowns in the near future as witnessed in a few European countries recently.

"We expect this to largely hamper manufacturing growth compared to the services sector, going ahead."

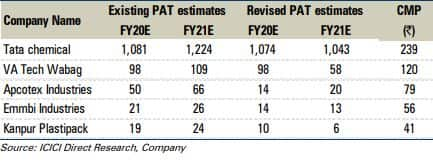

In its midcap universe of 11 companies, the research house expects Tata Chemicals, VA Tech Wabag, Emmbi Industries and Kanpur Plastipack to be the most affected stocks given that all these have revenue contributions in excess of 30-35 percent each from the said geographies.

"The rest, from our universe, could be affected by supply chain issues related to raw material, which, we believe, is largely discounted in the stock price," it said.

In terms of raw material requirements, the majority of the chemical inputs are imported from China.

"With China returning to action recently albeit, at lower utilisation, we do not expect much impact from the supply side. However, the real impact can come from the demand side due to the cascading impact of the slowdown. This can eventually lead to suppressed prices and, thereby, financial growth of most companies," ICICI Direct said.

"Further, a cash flow crunch can impact the debt repayment schedule. However, we expect the same to be refinanced largely as most economies are coming out with quantitative easing (QE) leading to lower interest rates," it added.

However, the brokerage expects companies with a high levered balance sheet or low cash flows to face challenges to refinance. Thus, it believes one should select strong balance sheet companies with low leverage and higher cash flows during these turbulent times.

It further believes the majority of the negative outcomes from COVID-19, for at least the next two quarters, have already been discounted across global indices.

"However, either any delay beyond that or a substantial increase in infection can result in more negative outcomes. Hence, the probability of a further downside in equity indices cannot be ruled out."

However, ICICI Direct believes a majority of the stocks are available at suppressed valuations; therefore, this is the right time to build a portfolio in a gradual manner to gain from the roller coaster ride ahead.

Here are top five midcap picks from the brokerage in this falling market:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.