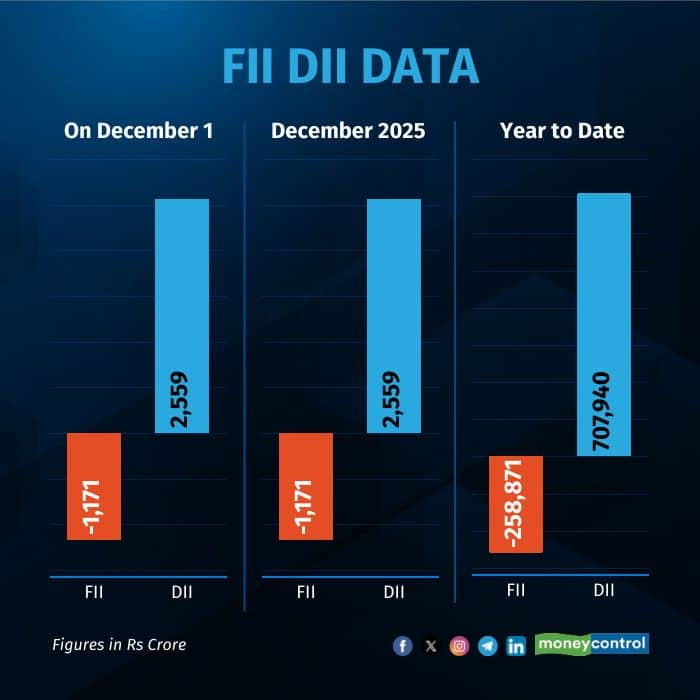

Foreign investors (FIIs/FPIs) were net sellers of Indian equities again on Monday, December 1 after selling shares worth Rs 1,171. At the same time, domestic institutional investors (DIIs) net bought shares worth Rs 2,559 crore, according to provisional exchange data.

DIIs purchased shares worth Rs 13,025 crore and sold shares worth Rs 10,466 crore. In contrast, Flls bought shares worth Rs 8,979 crore but sold shares totalling Rs 10,151 crore.

For the year so far, FIls have been net sellers of shares worth Rs 2.59 lakh crore, while DIls have net bought shares worth Rs 7.08 lakh crore.

At close, the Sensex was down 64.77 points or 0.08 percent at 85,641.90, and the Nifty was down 27.20 points or 0.10 percent at 26,175.75. BSE Midcap and smallcap indices ended flat.

Nifty Bank index touched fresh record high, crossing 60,000 for the first time, however, closing marginally lower at 59,681.35.

Nifty Midcap 100 indices also jumped to fresh record high of 61,311.25, intraday, closing flat at 61,043.40.

Interglobe Aviation, Bajaj Finance, Max Healthcare, Sun Pharma, Trent were among top losers on the Nifty, while gainers were Adani Ports, Tata Motors PV, Kotak Mahindra Bank, Eicher Motors.

Among sectors auto, IT, PSU Bank, metal rose 0.3-0.5% each, while realty index was down 1% and consumer durables, pharma indices were down 0.5% each.

On today's market, Vikram Kasat, Head Advisory, PL Capital noted that markets surrendered early gains and pulled back sharply from record highs as profit-booking set in amid weak global cues and a cautious interest-rate outlook. "The rupee touching an all-time low added to the risk-off mood, prompting investors to pare exposure after last week’s strong rally. Broader indices remained subdued, and sentiment was further weighed down by concerns over expensive valuations and lack of triggers from global markets. With macro data and central-bank commentary in focus this week, markets may continue to trade with a consolidation bias," he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.