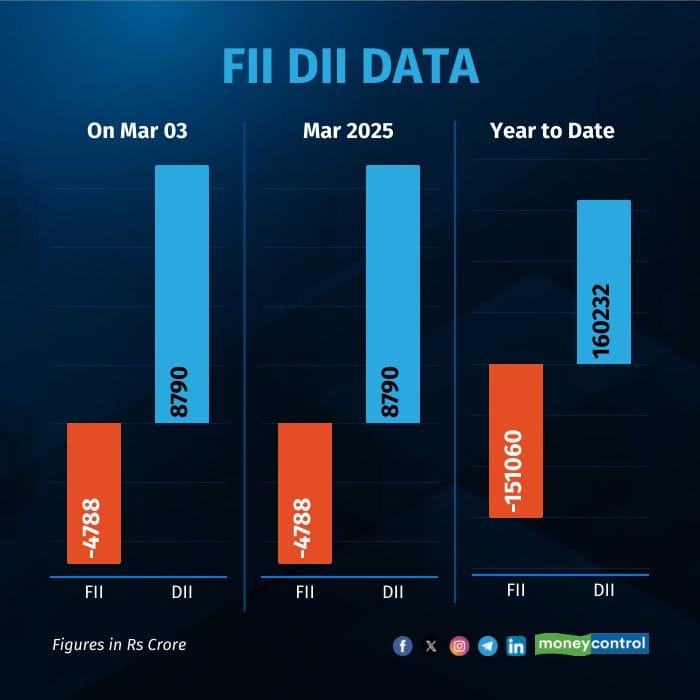

Foreign institutional investors (FII/FPI) were net sellers on March 03, offloading shares worth Rs 4,788 crore while domestic institutional investors (DII) were net buyers of shares worth Rs 8,790 crore, provisional data showed.

During the trading session of March 03, DIIs net bought shares worth Rs 17,344 crore and sold shares worth Rs 8,553 crore. FIIs purchased shares worth Rs 9,846 crore and sold shares worth Rs 14,634 crore.

For the year so far, FIIs have been net sellers of shares worth Rs 1.51 lakh crore, while DIIs have net bought Rs 1.6 lakh crore worth of shares.

The Sensex and Nifty closed little changed on March 3, recovering from an over half-percent drop earlier in the session. While weakness in oil & gas and financial stocks weighed on the Nifty, IT shares provided some support. Market volatility remained high as global trade concerns kept investor sentiment on edge.

The indices had opened higher, attempting a rebound after their longest monthly losing streak since 1996. A surprise uptick in domestic growth briefly lifted spirits, but persistent global uncertainties quickly erased those gains.

The broader market displayed a mixed trend, with the BSE Midcap index rising 0.3 percent while the BSE Smallcap index declined 0.7 percent.

Among sectoral indices, Nifty IT rose 0.8 percent as brokerage commentary turned positive after Salesforce guided for 7-8 percent growth in FY26.

Nifty Oil & Gas shed over 1 percent, dragged down by RIL, ONGC, and IGL. Reliance Industries, the second-heaviest stock on the benchmark indices, fell 3 percent to a 16-month low. Bloomberg reported that Reliance New Energy risks a fine due to delays in setting up a battery cell plant.

"Global uncertainties and sustained foreign fund outflows continue to keep market participants cautious. With the 21,800-22,000-support zone in focus, a cautious approach to the Nifty index is advisable until further clarity emerges. Banking sector performance will be crucial in the coming sessions, making it an important area to monitor for market cues," Ajit Mishra, Senior Vice President at Religare Broking said.

"Markets began the week on a volatile note but ended nearly flat amid mixed cues. The Nifty index saw a brief uptick before slipping lower in the first half, almost testing the 22,000-support level, and eventually settled at 22,119.30. Sectoral performance was mixed, with realty, metal, and IT showing a rebound, while weakness in banking and financials capped gains. Broader indices also remained choppy and closed largely unchanged," he added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.