Indian benchmark indices have started the week on a sluggish note with inidces trading moderately lower amid volatility. At 11 am on June Nifty is trading down 50 points at around 24250 levels.

From the data perspective, Nifty futures saw significant long additions from FIIs and their net longs have increased sharply last week to nearly 4 lakh contracts. "The net longs from FIIs are at its highest levels and profit taking risk cannot be ruled out at higher levels, " said ICICI Securities.

Retail participants have turned cautious in Nifty and are holding significantly net shorts in the system, added the brokerage firm.

At 11:21 hrs IST, the Sensex was down 156.76 points or 0.20 percent at 79,839.84, and the Nifty was down 46.70 points or 0.19 percent at 24,277.10. About 1567 shares advanced, 1866 shares declined, and 92 shares unchanged.

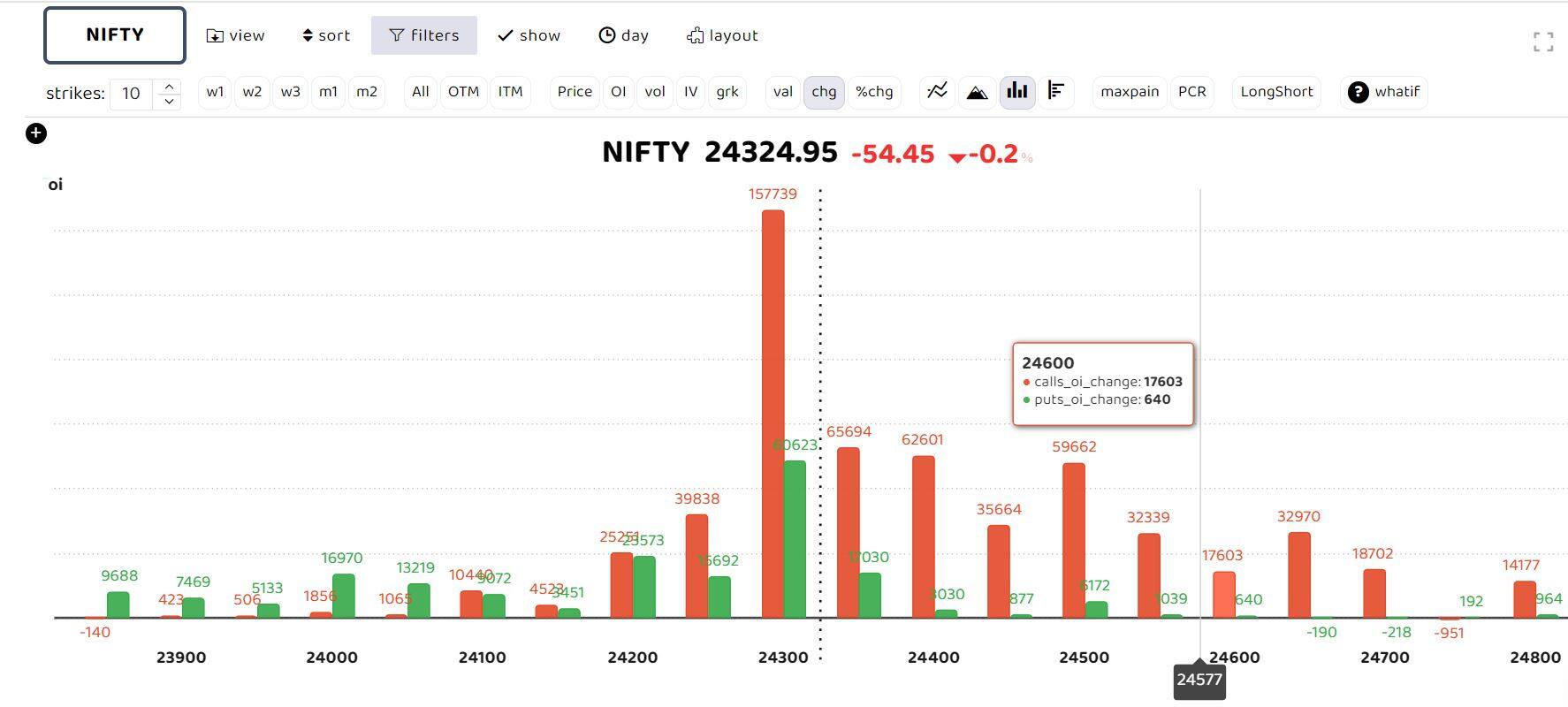

Options data shows heavy call writing across the 24,400 to 24,800 strikes, acting as strong resistance. According to Tejas Shah, Vice President of Technical Research at JM Financial, "As long as Nifty is holding above the 24,000 mark, we believe that the rally in Nifty is likely to continue and it can test the next resistance level of 24,500. The short-term moving averages are below the price action and should continue to support the indices on any decline."

Support and Resistance Levels for NiftyShah further noted, "Supports for Nifty are now seen at 24,150-24,200 and 23,975-24,000 levels. On the higher side, the immediate resistance zone for Nifty is at 24,350-24,400 levels, and the next crucial resistance is at the 24,500 mark."

Bank NiftyAccording to ICICI Securities, "Bank Nifty may spend some more time consolidating below the 53,000 levels in the coming sessions, while the 51,500 mark is likely to act as immediate support."

Bank Nifty options activity is significantly tilted towards Call options and 53000 Call strike is heavily written while no major Put base is in sight. Put option concentration is equally distributed among 52000 to 52500 Put strikes. The brokerage firm stated, "The options data suggests expected profit booking at higher levels and move below 52000 may extend the weakness in the banking index. Moreover, July series futures open interest is still on a lower side and fresh additions are likely to induce some directional movement."

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.