The September quarter earnings announced so far by IT majors have been decent and impressive with strong deal wins and better operational performance.

The companies did not see any major impact of lockdown, though there were supply constraint issues initially. Consequently, expectations of strong growth in IT companies' earnings going ahead along with growing demand for digital services and share buybacks by TCS and Wipro pushed stocks prices higher in the last several months.

The Nifty IT index shot up 93 percent from March 23's closing low, surpassing the Pharma index to become the biggest gainer among sectors. IT stocks have exhibited strong price performance since announcing their Q1 FY21 results on the basis of a favourable business environment.

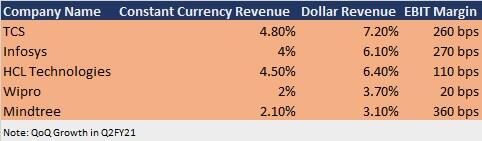

"Largecap IT stocks have showcased decent performance in the on-going quarter. Dollar revenue growth in Q2 FY21 has been impressive on a sequential basis in the range of 3-7 percent. Good deal wins positively impacted the dollar growth while operational improvements and work from home have helped companies to post decent margins during the quarter," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

Vineeta Sharma, Head of Research at Narnolia Financial Advisors said the robust results posted by IT companies were ahead of their estimates given the increased demand for digital services in the times of COVID-19.

"Most of the companies have reported 20 percent YoY growth during their Q2 FY21 results and have mostly done better than our expectations. Pandemic has given the extra push for the adoption of newer technologies like cloud and digital," she said.

"On the one hand, order pipeline looks robust giving visibility for stable earnings growth going forward and on the other hand, internal parameters like attrition, utiliSation, offshore-onsite mix, overheads, and other expenses have improved benefitting the margin."

While Infosys, HCL Technologies and TCS posted a good set of numbers for the quarter with sequential dollar revenue growth of 7.2 percent, 6.1 percent and 6.4 percent respectively, Wipro and Mindtree posted relatively subdued revenue growth numbers at 3.7 percent and 3.1 percent.

Hi-tech, life sciences, retail and CPG verticals led the rebound in growth followed by financial services and manufacturing. Verticals like Aerospace, travel tourism & hospitality continued to remain weak.

"Another trend which we witnessed was strong growth in continental Europe relative to the US given that it was the first geography which came out of lockdowns. Moreover, recovery is being led by accelerated adoption of digital technologies rather than traditional services. Due to the pandemic, there is also greater preference for offshoring which will be beneficial to Indian IT services companies given higher margins," Jyoti Roy, DVP - Equity Strategist at Angel Broking said.

Positive Stance on IT Space

Experts overall are positive on the IT space given the expected growth in longer-term. They have advised buying IT majors on every correction and are unanimously bullish on TCS, Infosys and HCL Technologies. Although, these stocks are trading at higher valuations, they added.

"While IT companies may be trading at higher multiples relative to recent historical average we believe that the sector is getting re-rated given strong growth outlook for most companies over the next few years due to faster adoption of digital technologies," Jyoti Roy said.

However, the growth trajectory will not be the same for all companies, he feels. "Companies that have a large share of revenues from digital services along with greater exposure to high growth sectors will deliver industry-beating growth rates and will continue to outperform. On the other hand, companies with large exposure to troubled verticals or lower share of revenues from digital services will underperform the sector," he explained.

Therefore, he believes that investors should hold on to IT stocks given strong growth potential and revenue visibility for the sector. Investors who do not have any exposure to the sector or are underweight can use the current correction post the numbers to buy into the sector. He advised with a positive stance on TCS, Infosys and HCL Technologies.

Vineeta Sharma, Head of Research, Narnolia Financial Advisors said earnings growth ahead and stable margin make these stocks suitable to hold.

"We are recommending fresh buying on any decline that may come as the third quarter is usually a soft quarter for IT stocks. We continue to like - Infosys, HCL Technologies and Tata Elxsi.

Gaurav Garg, Head of Research at CapitalVia Global Research said their pecking order in IT space is Infosys, Cyient, TCS, Mindtree, HCL Technologies and Wipro.

The overall performance of the IT companies, market sentiments and prevalent market conditions makes this sector a good one to invest in for a medium-term time horizon, he believes.

The December quarter is generally a weak quarter for IT players, hence experts will closely watch the valuations which are currently high.

"Q3 is generally a weak quarter for IT players, but if demand sustains and if there is good traction in key verticals, we might see the valuation to sustain in the long run," said Vinod Nair who is positive on TCS, Infosys, Wipro, and HCL Technologies.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.