During 2018, mid and smallcap stocks took a hard hit, especially after stellar run in 2017. Many investors burned their fingers in this turmoil.

The correction continues this year as well with Nifty Midcap and Smallcap indices plunging 20 percent and 33 percent, respectively, so far. In comparison, Nifty50 has gained 3 percent.

Corporate governance issues, high valuations, imposition of long-term capital gains tax, liquidity crisis and US-China trade concerns were some of the reasons for the downfall.

Generally, during periods of market corrections, quality smallcap companies with better return ratios bear less brunt of market corrections compared to rest of the lot.

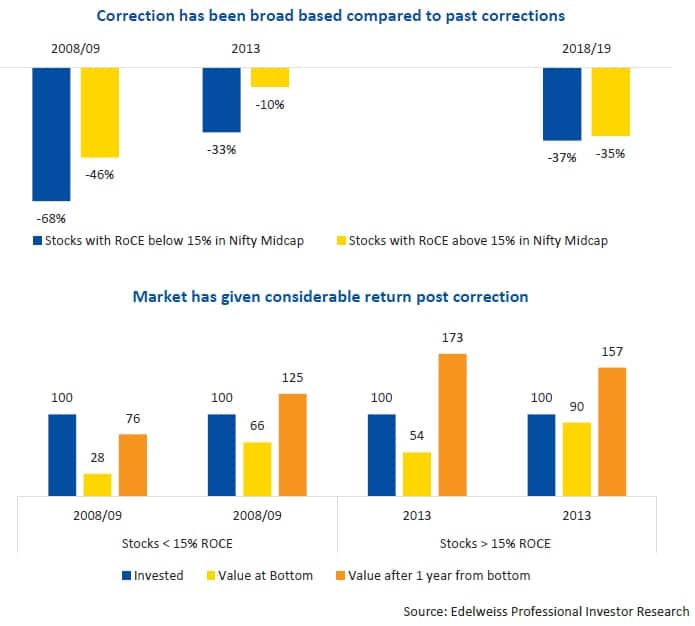

"This was evident during both the market corrections—2008/09 and 2013/14—where companies with return on capital employed (RoCE) in excess of 15 percent had experienced a drawdown of 46 percent and 10 percent, respectively, compared to 68 percent and 33 percent average drawdown, respectively, from peak for rest of the companies," Edelweiss Securities said.

Rebounds in quality stocks are also significantly stronger—while companies with RoCE in excess of 15 percent had more than tripled from the bottom hit in 2008/09, the overall Mid-cap universe catapulted 179 percent over a 1 year period, it added.

This time around, corrections are more broad based—companies with RoCE in excess of 15 percent slipped by 35 percent from peak and rest of the pack also corrected by 35 percent. This, Edelweiss believes, is an excellent opportunity to buy quality mid- and small-cap companies at reasonable valuation.

"Our conviction is anchored by: a) attractive valuations; b) Improving macro data; and c) improving sectoral trends. These, we believe, point to an imminent bounce back in stocks," it said.

Sachin Shah, Fund Manager at Emkay Investment Managers also told Moneycontrol that many quality midcaps & smallcaps have also come-off in the last 12 months, they are no more trading at frothy valuations they were at during second half of CY2017 & early CY2018. "So from that perspective cherry-picking some of those midcap and smallcap and staying with them for next 2-3 years has the potential to deliver good returns."

Edelweiss said sectoral data indicates unmistakable improvement in pivotal sectors - banking, consumption, infra and cement.

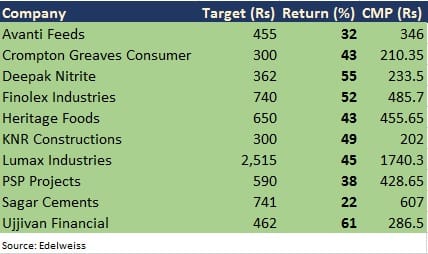

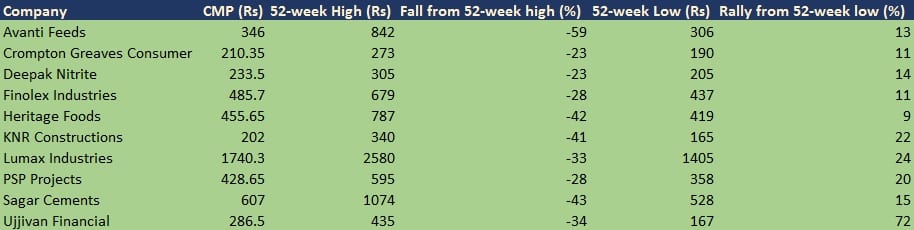

As the research house expects overall recovery in the small-and mid-cap space, it has shortlisted 10 stocks based on the quality of business, health of balance sheet, cyclical lows in their margins and return ratios RoCE trend, corporate governance and finally on valuation attractiveness.

These 10 ideas are Avanti Feeds, Crompton Greaves Consumer, Deepak Nitrite, Finolex Industries, Heritage Foods, KNR Constructions, Lumax Industries, PSP Projects, Sagar Cements and Ujjivan Financial.

Edelweiss believes stock price reaction has been severe compared to actual change in business fundamentals or any possible business disruption in the future. It found valuations of these stocks also much below their historical averages and lower than peers as well.

"We foresee maximum wealth creation opportunity over the next 12-18 months. Generally, if one buys a stock at less than 1x PEG (Price/Earnings to Growth), it can generate alpha of 19 percent. Moreover, if one buys it at 10x P/E, it will generate even higher returns," it said.

It believes this portfolio would see revenue growth of 17 percent, cash flow from operations (CFO) growth of 25 percent and PAT growth of 23 percent, while maintaining the ROCE of around 21-23 percent for the next 2 years.

The risks to above portfolio would be geopolitical tension and global recession (as there are expectations of economy slowdown in US and Europe), Edelweiss said.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.