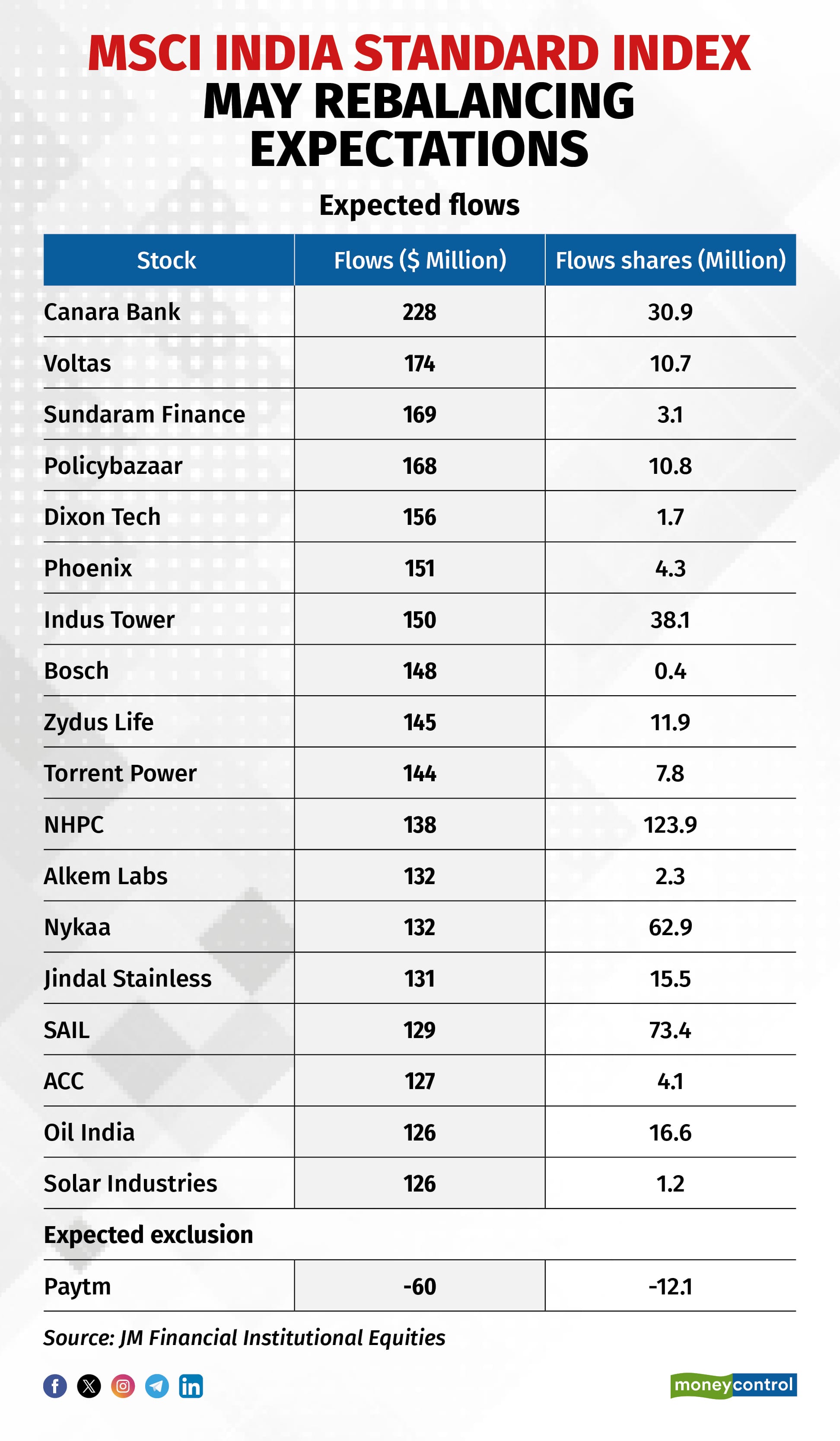

Canara Bank, Voltas and Sundaram Finance are among the 18 stocks likely to be included in MSCI India Standard Index in May, JM Financial Institutional Securities has said.

MSCI is set to unveil alterations to the MSCI global standard indices on May 14, with the adjustments slated to come into effect on May 31, it said.

Based on the current price of the 18 stocks, the index will see a total inflow of $2.7 billion. The price cutoff date for rebalancing is the last 10 business days of April.

Canara Bank is likely to see the most flows, bringing around $228 million, followed by Voltas with $174 million, Sundaram Finance with $169 million, Poilcybazaar with $168 million and Dixon Tech with $156 million.

Oil India and Solar Industries will likely see the least inflows, around $126 million each.

ALSO READ: India's MSCI EM index weightage to surge to 18.2%; Closing in on China's dominance

Paytm is likely to exit the MSCI India Standard index in the reshuffle, which may result in an outflow of around $60 million, the brokerage firm said in their report.

Analysts, however, said the list is subject to change, depending on the stock price prevailing during the cutoff period.

Global passive funds, including exchange-traded funds (ETFs), tailor their portfolios in accordance with MSCI global standard indices. Consequently, any additions, removals, or alterations in composition prompt these funds to reconfigure their allocations.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.