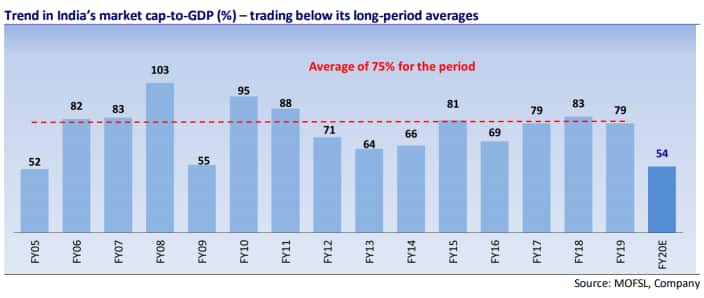

The ratio acts as a good barometer when it comes to studying market valuations, but experts differ that we have made a bottom – although, we might be trading at levels last seen during the 2008 financial crisis. The ratio is at its lowest level since FY06. “The current situation is not very promising as we can see a continuous rise in COVID cases and it is difficult to say if the bottom is here or not,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited- Investment Advisor told Moneycontrol. “Once this pandemic issue resolves, economic activity can be seen gaining momentum basically due to increased consumption and therefore a judicious investment can be made for next 5 years,” he said. This ratio acts as one of the indicators to channelize investors to remain invested at current levels. But, one may note that these indicators do not assist in the short term timing of the market and investors should not just jump and buy solely on the fact that the ratio is so attractive, suggest expert. The other reason which makes experts believe that the bottom could be some time away is the fact that we have fallen just 30 percent in 2 months while history suggests that bottom formation has taken anywhere between 10-27 months. “The final bottom in the four previous falls took 10-27 months versus less than three months in the ongoing fall,” said a CLSA report. VK Sharma, Head PCG & Capital Markets Strategy, HDFC Securities told that the market cap to GDP ratio today is around 0.53, which matches that of December end 2008. “While the Nifty, in the current bear market has fallen 39.57 percent to its low, in 2008 it had fallen as much as 61 percent,” he said. Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

The ratio acts as a good barometer when it comes to studying market valuations, but experts differ that we have made a bottom – although, we might be trading at levels last seen during the 2008 financial crisis. The ratio is at its lowest level since FY06. “The current situation is not very promising as we can see a continuous rise in COVID cases and it is difficult to say if the bottom is here or not,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited- Investment Advisor told Moneycontrol. “Once this pandemic issue resolves, economic activity can be seen gaining momentum basically due to increased consumption and therefore a judicious investment can be made for next 5 years,” he said. This ratio acts as one of the indicators to channelize investors to remain invested at current levels. But, one may note that these indicators do not assist in the short term timing of the market and investors should not just jump and buy solely on the fact that the ratio is so attractive, suggest expert. The other reason which makes experts believe that the bottom could be some time away is the fact that we have fallen just 30 percent in 2 months while history suggests that bottom formation has taken anywhere between 10-27 months. “The final bottom in the four previous falls took 10-27 months versus less than three months in the ongoing fall,” said a CLSA report. VK Sharma, Head PCG & Capital Markets Strategy, HDFC Securities told that the market cap to GDP ratio today is around 0.53, which matches that of December end 2008. “While the Nifty, in the current bear market has fallen 39.57 percent to its low, in 2008 it had fallen as much as 61 percent,” he said. Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.