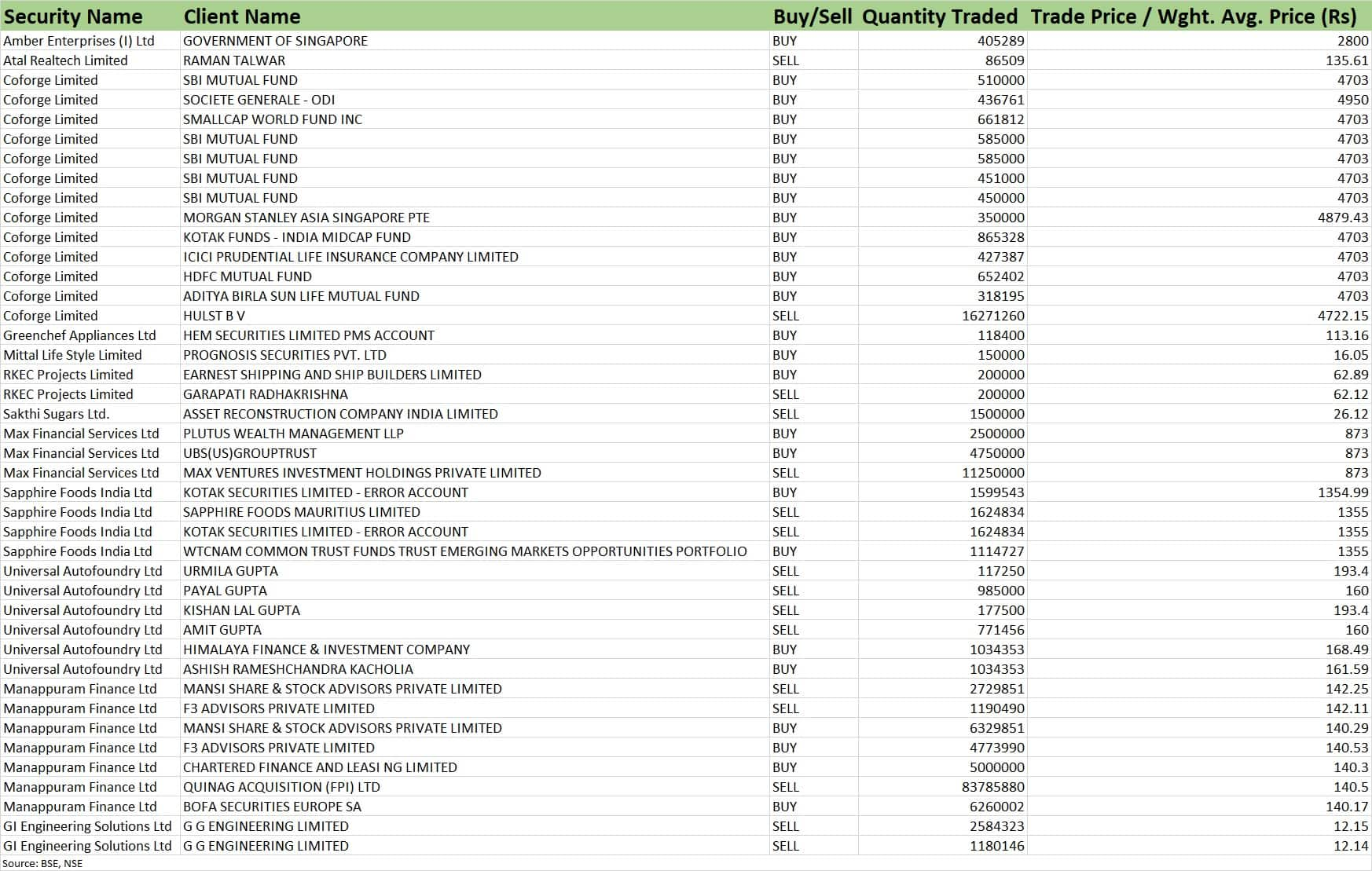

We have seen significant block deals in Universal Autofoundry, Amber Enterprises India, Coforge, Max Financial Services, Sapphire Foods India, Manappuram Finance, and GI Engineering Solutions on August 24.

Ace investor Ashish Rameshchandra Kacholia has picked up 8.54 percent stake or 10.34 lakh shares in Universal Autofoundry, via open market transactions, at an average price of Rs 161.59 per share. Himalaya Finance & Investment Company also bought 10.34 lakh shares in the company at an average price of Rs 168.49 per share.

The stock was locked in 20 percent upper circuit at Rs 193.40.

However, promoters and promoter group were the selling shareholders in the iron foundries company. Urmila Gupta sold 1.17 lakh shares at an average price of Rs 193.4 per share, Payal Gupta offloaded 9.85 lakh shares at average price of Rs 160 per share, Kishan Lal Gupta 1.77 lakh shares at average price of Rs 193.4 per share, and Amit Gupta 7.71 lakh shares at average price of Rs 160 per share. They exited the company by selling their entire personal shareholdings.

Coforge has also seen strong rally after big block deal, rising 9.72 percent to Rs 5,390.85 on the NSE.

Also read: Antfin likely to sell 3.6% stake in Paytm via block deal tomorrow: Report

SBI Mutual Fund, Societe Generale - ODI, Smallcap World Fund Inc, Morgan Stanley Asia Singapore Pte, Kotak Funds - India Midcap Fund, ICICI Prudential Life Insurance Company, HDFC Mutual Fund, and Aditya Birla Sun Life Mutual Fund have bought 62.93 lakh equity shares or 10.3 percent stake in the mid-sized IT company, which amounted to Rs 2,976.5 crore.

However, promoter Hulst B V, owned by Baring Private Equity Asia, exited the company by selling entire 1.62 crore equity shares or 26.63 percent stake at an average price of Rs 4,722.15 per share, amounting to Rs 7,683.53 crore.

Amber Enterprises India was down 1.9 percent at Rs 2,800.80. The Government of Singapore has bought 4.05 lakh equity shares or 1.2 percent stake in Amber Enterprises, which provides solutions to air conditioner OEM and ODM industry, at an average price of Rs 2,800 per share. The stake buy was worth Rs 113.48 crore.

Also read: Are defence stocks on the moon as well?

Max Financial Services was also in focus, rising 2.6 percent to Rs 904.35. Plutus Wealth Management LLP has bought 25 lakh shares in the Max Group company and UBS (US) Group Trust acquired 47.5 lakh shares at an average price of Rs 873 per share. Together they bought 2.1 percent stake worth Rs 632.92 crore.

However, promoter Max Ventures Investment Holdings sold 1.12 crore shares or 3.26 percent stake in Max Financial at same price. The stake sale was worth Rs 982.12 crore.

Sapphire Foods India closed the day at Rs 1,364.15, up third of a percent. Promoter Sapphire Foods Mauritius has sold 16.25 lakh equity shares or 2.55 percent stake in the franchisee of Yum! Brands Inc, at an average price of Rs 1,355 per share.

Also read: MPC Minutes: Members express caution on near-term pick up in inflation

However, Wtcnam Common Trust Funds Trust Emerging Markets Opportunities Portfolio bought 11.14 lakh shares or 1.75 percent stake in Sapphire at same price.

We have seen big action in Manappuram Finance too, which declined 2.64 percent to Rs 142.25 with multi-fold jump in volumes. Foreign portfolio investor Quinag Acquisition (FPI) exited the gold loan financing company by selling entire 8.38 crore equity shares or 9.9 percent stake at an average price of Rs 140.5 per share.

However, another foreign portfolio investor BofA Securities Europe SA was the buyer in this deal, purchasing additional 62.6 lakh shares or 0.74 percent stake in the company at an average price of Rs 140.17 per share, and Chartered Finance and Leasing bought 50 lakh shares at an average price of Rs 140.3 per share.

Mansi Share & Stock Advisors net bought 36 lakh shares in Manappuram at an average price of Rs 140.29 per share, and F3 Advisors net purchased 35.83 lakh shares at an average price of Rs 140.53 per share.

GI Engineering Solutions continued to see buying interest for 13 sessions in a row. But GG Engineering, one of the public shareholders, has consistently been offloading shares in the engineering design company for fourth consecutive session.

GG Engineering sold 25.84 lakh shares at an average price of Rs 12.15 per share, and 11.8 lakh shares at an average price of Rs 12.14 per share. With this 4.37 percent stake sale on August 24, GG Engineering has sold 1.23 crore shares or 14.38 percent shareholding in GI Engineering in four sessions, against its 24.47 percent stake held as of June 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.