Foreign institutional investors (FIIs) have turned net sellers, pulling out more than Rs 2,000 crore in from Indian markets in the past four days. The move was not on account of the Budget but on global growth concerns, say experts,

Finance Minister Nirmala Sitharaman will table the Budget on February 1. The Nifty has slipped more than 1 percent, so far, in January, and about 3 percent from the record high of 12,430 recorded on January 20.

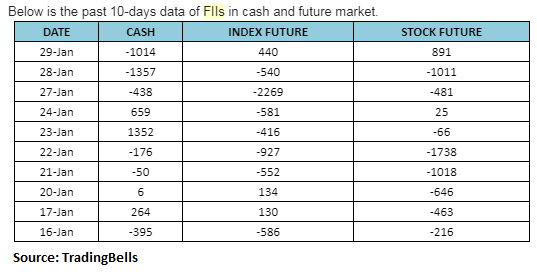

A snapshot of the 10-day activity of foreign investors suggests that the consensus seems to be short in index futures largely because of global growth concerns fuelled by coronavirus outbreak.

The World Health Organization on January 30 declared the coronavirus epidemic in China a public health emergency of international concern, said a Reuters report. Most economists have already lowered the growth forecast for China by 100-200 bps.

“FIIs are selling aggressively in the Indian equity market for the last few days but it has no correlation with the upcoming Union Budget because they are pulling out their money from emerging markets amid fear of short-term economic slowdown due to worries over coronavirus,” Amit Gupta, Co-Founder, TradingBells, told Moneycontrol.

“It is a global issue which is worrying FIIs because as per past behaviour, emerging markets tend to underperform amid such kinds of issues. FIIs are not only selling in the cash market, they are also betting on the short side via the F&O market,” he said.

Gupta added that FIIs have 60% net short positions in the index futures and these shorts may help in the short-covering rally if something major positive comes up in the Budget.

Even the rollover activity for the February series suggests a cautious stance by traders ahead of the big event.

The Nifty rolls stood near 66.30 percent, compared to the three-month average of 72.13 percent. Market-wide rolls stood at 86.45 percent against the 3-month average of 90.19 percent.

“As the D-Day of Budget 2020 draws nearer, FIIs have pulled back 2,371 crores of funds from the market in order to reduce their exposure and analyse the market. The last few days have been full of quarterly results thereby causing required price changes,” said Gaurav Garg, Head of Research at CapitalVia Global Research Limited- Investment Advisor.

“The Federal Reserve fixed the rate between 1.50-% 1.75%, FIIs seem to be planning to wait for perfect opportunities and invest in handpicked value stocks on the Budget Day and afterward.”

What will cheer FIIs in Budget?Investors are pinning hopes on some relaxation in personal tax and tweaks in the Long-Term Capital Gains (LTCG) and the Dividend Distribution Tax (DDT). A low fiscal slippage will also make FIIs happy, say experts.

“The abolishment of LTCG and the rationalisation of DDT may change FIIs' sentiments for the Indian equity market. If the government comes out with any major reforms to boost consumption in the economy, then FIIs will once again head towards the Indian equity market,” says Gupta of Gupta TradingBells.

“There are some worries about the fiscal deficit but if the government will be able to give proper road map that it will manage to bring back the fiscal deficit in a comfortable range in the future then FIIs will be happy,” said Gupta.

He added that there is a high demand from the FIIs community from the government to come out with significant steps to strengthen the Indian financial sector which is the key worry of foreign investors for the last one year.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.