A sharp sell-off in smallcaps has spooked retail investors. BSE Small cap index is down by more than 7 percent in March so far. If the broader index benchmark manages to close the month at current levels we will be witnessing the worst monthly performance in the past 2 years by BSE Smallcap index. In February 2022 BSE Smallcap index fell by more than 9 percent.

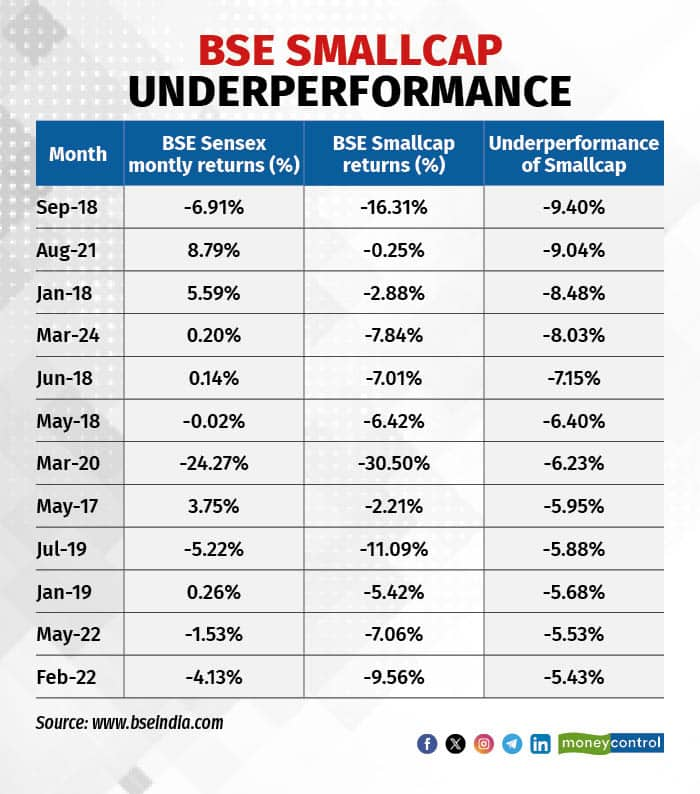

BSE Smallcap Vs BSE Sensex monthly returnsWhen we compare the performance (monthly) of BSE Smallcap index with BSE Sensex we find that the benchmark index that tracks the performance of 900+ small cap stocks across sectors is underperforming BSE Sensex by more than 8 percent in March alone, so far. This is only the 4 instance since 2015 where BSE Smallcap Index has underperformed key benchmark index by more than 8 percent in any given month.

As BSE Smallcap index weakens, there have been only 7 instances where BSE Smallcap index has fallen by more than 7 percent in any calendar month since 2015.

Also there have been only 4 instances where the BSE Smallcap index has slipped by more than 10 percent in any given calendar month. For the period July 2019, February 2016, September 2018 and March 2020 we have seen BSE Smallcap index fall by more than 10 percent with March 2020 being the worst monthly performance for the broader benchmark, recording a fall of 30 percent.

Smallcaps underperformance hit new high

Smallcaps underperformance hit new highAlso read : Promoter buying picks pace in smallcaps as stocks tumble. Here's the March list

Breadth weakens for Nifty Smallcap 250 indexFrom the basket of Nifty Smallcap 250 index we find that at least 191 stocks have fallen by more than 5 percent while only 14 stocks are up by more than 5 percent in the past one month.

Mid and smallcap shares have fallen sharply this month on a combination of factors.The Securities and Exchange Board of India's (SEBI's) warning of "froth" in small and midcap shares, mutual fund body AMFI asking its members to moderate inflows into small and midcap equity schemes, advance tax payments leading to a liquidity crunch and the Enforcement Directorate raids on entities allegedly laundering the funds of Dubai-based hawala operator HS Tibrewala, all have weighed on market sentiment.

Says Purvesh Shelatkar, Head of institutional broking, Monarch Networth Capital, “Even though the correction in broader markets was expected the sharp sell-off could be an overreaction by the markets. The earnings growth have supported the rally in smallcaps and midcaps in the past two years. The PE expansion hasn’t been much. Investors should always choose stocks with high positive cash flows immaterial of their market capitalisation.”

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.