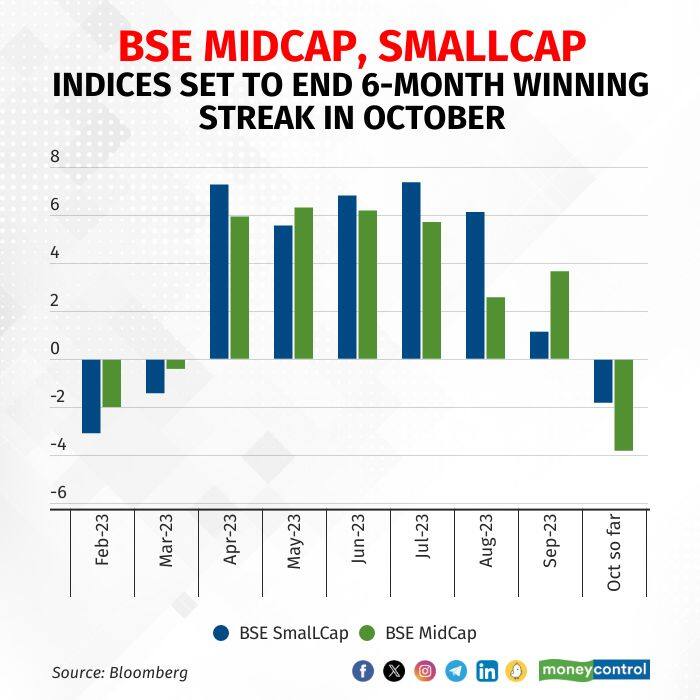

The BSE MidCap and SmallCap indices turned negative in October, their first monthly decline after six consecutive months of gains.

The BSE MidCap index had dropped by more than 3.4 percent in October, its sharpest monthly decline since June 2022, while the BSE SmallCap index fell by over 1.7 percent, which would be the most since February 2023. The last time both indices turned negative was in March 2023.

Analysts said small and mid-cap stocks were doing well but fell behind the Nifty index in October. Unless corporate results are really impressive, this trend might continue because the current high prices seem to have factored in most outcomes.

bse midcap

bse midcapAccording to Kotak Institutional Equities, mid- and small-cap stocks have seen notable declines in the past week, but they were relatively small compared to their impressive gains over the past six months. Kotak said it does not see value in most mid- and small-cap stocks within its coverage universe due to a substantial rerating of multiples over the past 9-12 months despite weakening business models and eroding competitive advantages.

Also Read: Primary market busy amid turmoil; Cello World, Mamaearth amid 7 IPOs to open this week

"In our view, large-cap stocks offer better reward-risk balance given more reasonable valuations versus lofty valuations of most mid- and small-cap stocks," Kotak said in a recent report.

Shift to qualityThe Indian stock markets faced weakness recently after US bond yields and crude oil rose. Concerns over the escalation of the Israel-Hamas conflict sparked risk-off sentiments, keeping the US dollar at elevated levels and impacting emerging market currencies. Analysts await this week's US Fed meeting, where it's likely to keep current policies. The key shift in their stance this week will be recognizing ongoing US economic strength, seen as hawkish and potentially disappointing both stock and bond markets.

JM Financial anticipates a shift towards quality large-cap stocks and potential selling pressure on overpriced small- and mid-cap stocks. It recommends buying quality large caps if there's a dip in their prices.

Koushik Mohan, lead analyst at Ashika Groups, noted that investors who profited from mid- and small-cap stocks over the past 5-6 months are now cashing in. He expects the declining trend in the mid- and small-cap space to continue in the short term but advises against panic.

Mohan suggests holding on to investments, especially with the upcoming elections next year. However, he also recommends that those looking to take profits it's a good idea to do it now and wait for lower prices before buying back in.

Kotak said in September the rapid surge in mid-cap and small-cap stock prices was driven by exuberant market sentiment, substantial inflows into related mutual funds, and a rise in new retail investors. However, it is dropping its recommended mid-cap portfolio as most non-BFSI stocks are already trading around their 12-month fair values, leaving little room for further growth.

Stocks in preferred sectors such as capital goods, healthcare, quick service restaurants, and real estate are already trading at high valuations that discount future growth. Many stocks have risen significantly in recent months, leaving limited options for portfolio adjustments. Kotak sees this as a sign of irrational exuberance in the mid-cap and small-cap segments.

Also Read: US Fed likely to pause again with rates at 22-year high

Both the BSE Midcap and SmallCap indices have jumped nearly 30 percent and 37 percent, respectively, from April 1 to October 31. The benchmark Sensex and Nifty indices have climbed 8.3 percent and 10 percent, respectively, since April 1.

The Indian equity rally started due to improved domestic macroeconomic conditions. Strong indicators such as robust GST collections, record SIP flows, on-target fiscal deficit goals, state capex, and expanding manufacturing PMI were the key factors. However, the risk of poor rainfall and low reservoir levels could affect rural recovery.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.