The broader indices posted their worst performance in more than two months, falling between 3-6 percent, as they underperformed the main indices amid mixed global markets, subdued Q3 corporate earnings projections, and concerns over India’s economic slowdown.

This week, the BSE Sensex lost 1,844.2 points, or 2.32 percent, closing at 77,378.91, while the Nifty50 index plunged 573.25 points, or 2.38 percent, settling at 23,431.50.

The BSE Large-cap index dropped 3.2 percent, the BSE Mid-cap index declined 5.7 percent, and the BSE Small-cap index fell by 6 percent.

On the sectoral front, only the BSE Information Technology index posted gains, rising 1 percent, while all other indices ended in the red. The BSE Power index shed nearly 9 percent, the BSE Realty index fell over 7 percent, the BSE PSU index declined by 7 percent, and both the BSE Capital Goods and Metal indices lost 5 percent each.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 16,854.25 crore during the week, while Domestic Institutional Investors (DIIs) bought equities worth Rs 21,682.76 crore.

"The Indian equity markets underperformed most of the global markets. Sensex and Nifty indexes declined by ~2% this week. The correction was more severe in the midcap and the small-cap stocks. The BSE Midcap index and Smallcap index declined by 5% during the week. Almost all major sectors saw a decline this week, with the BSE Capital Goods, BSE Power, and BSE Realty indices witnessing weekly losses of over 5 percent," said Shrikant Chouhan, Head of Equity Research, Kotak Securities.

"On the contrary, the BSE IT index gained post-TCS results. TCS reported flat revenues and a 40 bps increase in EBIT margin, broadly in line with our estimates. Deal TCV grew sharply QoQ and YoY for TCS."

"Crude oil prices continued their uptrend during the week, and any significant further increase could pose challenges to the economy. Upcoming inflation data will be an important macro indicator to watch. Stock-specific action is expected over the next few weeks as companies announce their Q3FY25 results," he added.

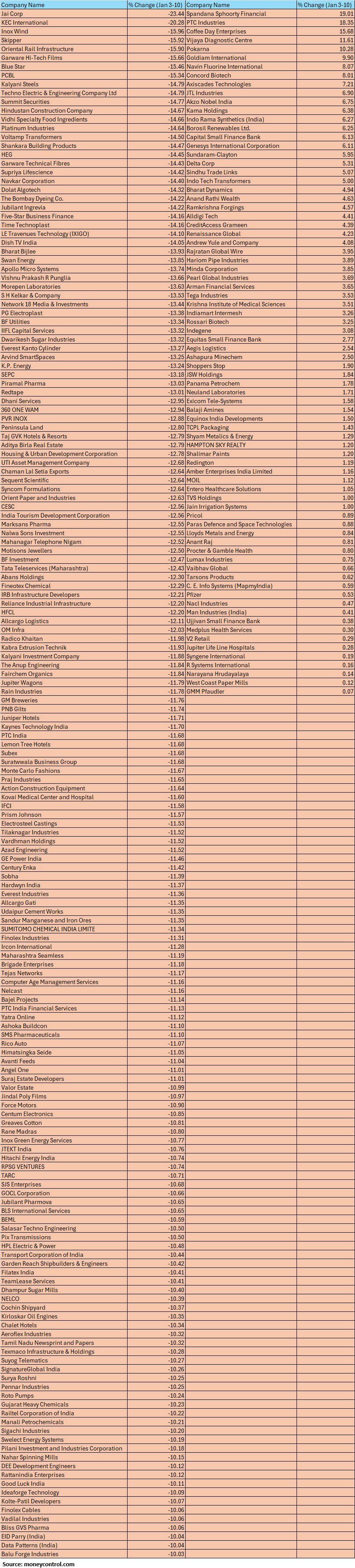

The BSE Small-cap index saw a 6 percent drop, with stocks such as Jai Corp, KEC International, Inox Wind, Skipper, Oriental Rail Infrastructure, Garware Hi-Tech Films, Blue Star, and PCBL falling between 15-23 percent. However, stocks like Spandana Sphoorty Financial, PTC Industries, Coffee Day Enterprises, Vijaya Diagnostic Centre, and Pokarna gained between 10-19 percent.

Looking ahead, corporate earnings will be in the spotlight, with major companies, including IT giants, releasing their Q3 results. Macroeconomic data, such as India's inflation rate and industrial production figures, will also play a crucial role in shaping market direction.

On the global front, updates on the U.S. economy, particularly labour market data and inflation trends, may impact FII flows. A spike in crude oil prices will add inflationary pressure. Overall, market volatility is expected to remain as investors react to a mix of earnings, macroeconomic data, and global cues.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC SecuritiesThe immediate support of 23500 has been broken on the downside but there was absence of sharp selling enthusiasm below support. Nifty is currently placed within the converging triangle on the daily chart and is now in an attempt of downside breakout of lower end of triangle.

Nifty on the weekly chart formed a long bear candle this week after a pullback of the previous couple of weeks. The weekly support of the ascending intermediate trend line has been broken on the downside as per the weekly close.

The underlying trend of Nifty continues to be negative amidst choppy movement. The next lower supports are to be watched around 23260-23000 levels. Immediate resistance is at 23600 levels.

Rupak De, Senior Technical Analyst at LKP SecuritiesThe bearish pressure continues to intensify as the index closed below 23,500 for the first time in several days. The index remains below the crucial 50 EMA, reaffirming a bearish trend. Furthermore, the RSI remains in a negative crossover, signalling weak momentum. Sentiment stays subdued in the short term, with the potential for a decline toward 23,300 or 23,000. On the upside, resistance is observed at 23,550–23,600.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.