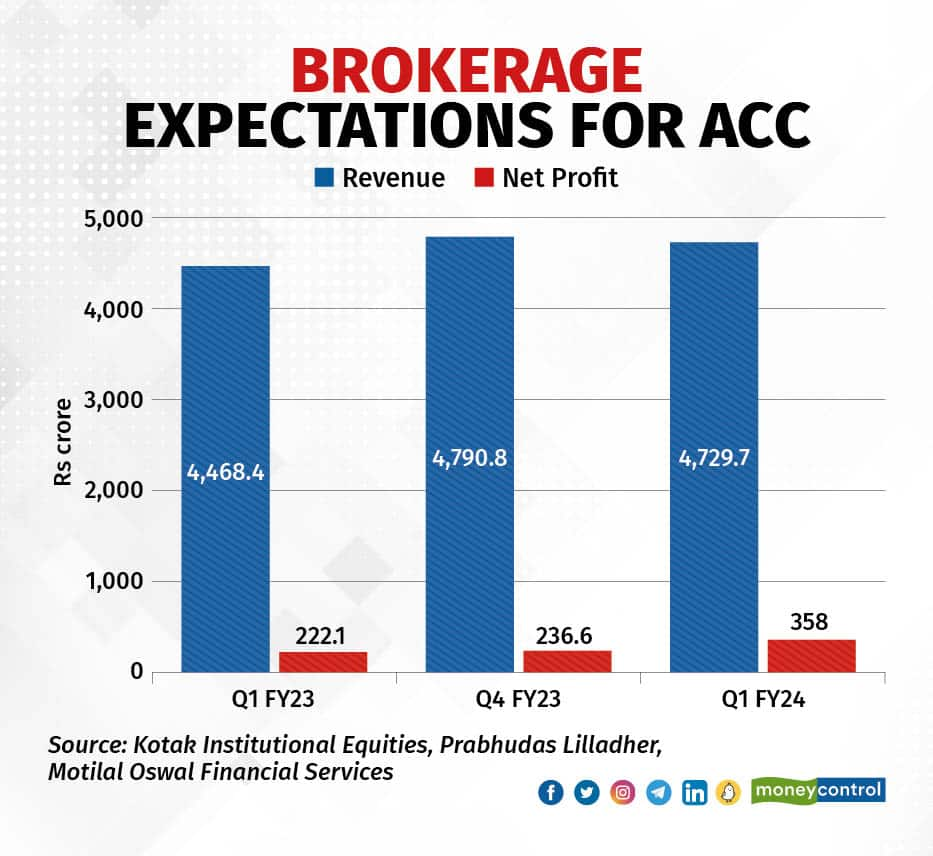

ACC Ltd is likely to post a 61 percent growth in consolidated net profit on yearly basis in Q1FY24 at Rs 358 crore. Sequentially, the cement maker is seen reporting a 51 percent growth in profit after tax, according to an average of three brokerage estimates. It is slated to announce the quarterly numbers on July 27.

Both Kotak Institutional Equities and Axis Securities expect net profit of the Adani Group company to almost double in the June quarter on a YoY basis. The former sees the net profit at Rs 403 crore while the latter at Rs 413 crore.

Higher sales and lower costs will drive net profit higher, as per Axis Securities.

On the other hand, revenue is likely to come in at Rs 4,729.7 crore for the quarter under review, implying a 6 percent YoY growth and a 1 percent drop sequentially. The slight increase in revenue is most likely due to higher volumes, analysts believe.

VolumesKotak Institutional Equities has estimated a volume of 8.7 million tonne, meaning a 15 percent growth on year and over 2 percent sequential rise, in 1Q of FY24, factoring in strong growth in April-May 2023 and seasonal tailwinds.

Meanwhile, realisation is seen falling marginally to Rs 5,772 per tonne in Q1 FY24 from Rs 5,911 per tonne in the corresponding quarter last year but slightly higher as compared with Rs 5,636 per tonne in the previous quarter, according to Axis Securities.

With cost pressure easing, the cost to produce one tonne of cement is also expected to drop.

Kotak Institutional Equities has estimated costs per tonne to decline around 8 percent YoY and 3 percent QoQ, largely led by power-fuel costs and operating leverage. Cement EBITDA per tonne will increase to Rs 701 per tonne, an over 25 percent YoY and 28 percent QoQ jump, led by lower costs and stable prices, it added. Motilal Oswal Financial Services sees EBITDA per tonne at Rs 610 and Axis Securities at Rs 838.

EBITDA per tonne gauges the earnings generated by a company for each tonne of cement it produces. This metric reflects the efficiency of the company in converting its output into profitability.

Motilal Oswal Financial Services believes profitability will improve because of the cost reduction initiatives. Axis Securities sees the operating margin at 14.5 percent in the June quarter as compared with 9.8 percent in the previous quarter and 9.5 percent in the corresponding quarter last fiscal, whereas Kotak Institutional Equities sees the margin at 12.4 percent.

Pricing trendDuring the June quarter of 2023, the cement price remained stable in the majority of markets, showing no significant change compared to the preceding quarter. Although cement manufacturers attempted to raise prices during this period, the market did not absorb these price hikes successfully.

According to Motilal Oswal Financial Services, in Central India, the average cement price increased by 1 percent compared to the previous quarter, driven by price hikes in early April 2023.

In the North region, prices remained unchanged but in the East, the average price declined by 1 percent due to the implementation of various schemes and discounts offered in May 2023. Moreover, it is expected that the average cement prices in the South and West regions will fall by approximately 2 percent compared to the previous quarter.

The brokerage firm is optimistic about the cement industry in the next few years given the increased demand from the infrastructure and housing sectors, industry consolidation, cost-efficiency measures like green power plants and blended cement, and product premiumisation focus.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.