Muted September quarter numbers of Indian corporates, weak economic data on inflation and IIP kept the Indian market volatile throughout the week gone by.

Worrisome macroeconomic prints coincided with change in the growth outlook by Moody’s last week where it was downgraded to negative from stable for India, weighing on investor sentiment.

The S&P BSE Sensex rose 0.08 percent while the Nifty fell 0.11 percent for the week ended November 15.

In the coming week, US-China trade deal, macro data and policy measures by the government, if any, to help stressed sectors such as telecom, will be a major trigger for the market.

"While medium-term volatility is in the offing, we remain cautiously optimistic that markets will scale new highs. In the near-term, we believe the trade deal will be the major driver for the market," said global financial firm Standard Chartered.

Some analysts think that the market may see some consolidation in the coming days.

"We reiterate our consolidation view on Nifty and suggest focusing more on stock selection and position management," said Ajit Mishra, Vice President - Research, Religare Broking.

Nifty remained volatile throughout the week in a wider trading range of 11,800-12,000 and faced stiff resistance at 12,000 -mark which has been acting as a crucial resistance level.

"The short-term trend for Nifty continues to be rangebound with a slight negative bias. We expect a soft start on Monday with some rangebound trade. As long as Nifty trades below 12,050 levels, we expect some consolidation in the range of 11,800-12,000 zone," said Nilesh Jain, derivatives and technical analyst at Anand Rathi.

Here are 10 key factors that will keep traders busy this week:US-China trade dealAn amicable deal between the world's two largest economies will be a major trigger for the markets across the globe. Wall Street's main stock indexes closed at record levels on Friday, fueled by fresh hopes of a US-China trade deal.

Media reports have indicated that the United States and China are getting close to a trade agreement. However, some differences are yet to be ironed out.

The world’s largest economies have been involved in a tit-for-tat trade war that is dragging on global growth.

China’s reluctance to commit to a specific amount of farm purchases remains a sticking point in the talks, as is the US reluctance to roll back tariffs reported Reuters.

However, Commerce Secretary Wilbur Ross said there was a “very high probability” that the United States would reach a final agreement on a phase one trade deal with China, the Reuters report added.

F&O cuesMaximum call open interest (OI) of 22.14 lakh contracts was seen at the 12,000 strike price. It will act as a crucial resistance level in November series.

This is followed by 12,200 strike price, which holds 15.76 lakh contracts in open interest, and 11,800, which has accumulated 13.90 lakh contracts in open interest.

On the other hand, Maximum put open interest of 21.92 lakh contracts was seen at 11,600 strike price, which will act as crucial support in November series.

This is followed by 11,500 strike price, which holds 20.86 lakh contracts in open interest, and 11,800 strike price, which has accumulated 19.45 lakh contracts in open interest.

"OI Data is pointing a broad range of 12,200–11,700. We are seeing some good concentration of calls at 12,100 level and puts at 11,800 level. Long positions are created in calls at 12,000 and 12,100 strikes," said Mustafa Nadeem, CEO, Epic Research.

FII flowNovember so far has witnessed a cumulative inflow by the foreign institutional investors (FIIs) in equities and debt to the tune of Rs 19,251 crore, data from NSDL showed.

The Indian market has been witnessing sustained capital inflow since the month of September after the hopes of the US-China trade deal started getting stronger.

A sustained inflow of foreign funds will infuse positivity into the market which may take the equity benchmarks near their fresh all-time highs.

FOMC minutesFederal Open Market Committee (FOMC) minutes of the Fed's October policy meeting will be announced on November 21.

The minutes of policy meet will show what transpired in the Federal Reserve's October meet that resulted in the slashing of the target range for the federal funds rate to 1.5-1.75 percent, the third rate cut so far this year.

Moreover, the market will observe the tone of the Fed to get a clue about the rate trajectory of the near-term future.

Policy measuresThe winter session of the Parliament will begin from November 18 and will continue till December 13. All eyes will be on whether the government announces any fresh stimulus to stem the economy.

Finance Minister Nirmala Sitharaman on November 15 said: "We want no company to shut their operations. We want everyone to flourish."

Two major telecom companies -- Vodafone Idia and Airtel -- have posted a combined quarterly loss of about Rs 74,000 crore as they were hit by statutory dues after a recent Supreme Court ruling.

The minister further said the Committee of Secretaries (CoS), appointed to deal with financial problems being faced by telecom companies, "has not taken a final decision yet".

Despite a raft of measures, taken by the government, the signs of stress in the economy are strongly visible. Data showed that consumer spending fell to decades low. Poor macroeconomic indicators have risen hopes of fresh government measures.

Technical viewNifty remained volatile throughout the week gone by in a wider trading range from 11,800-12,000 levels and faced stiff resistance at 12,000-mark which has been acting as a crucial resistance.

On the weekly scale, Nifty has formed Doji candle for continuous two weeks, indicating that bulls and bears both are making attempts to drag the index on either side.

Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in said, in the next session if Nifty slips below 11,891 then initially it should head towards 11,802-mark and a breach of this shall further accelerate selling pressure with ideal targets placed around 11,700.

Global cuesGlobal cues will remain an important trigger for the Indian market. During this week, the market will read European Central Bank's financial stability review, retail sales data of the US for October and Japan's balance of trade data for October, among others.

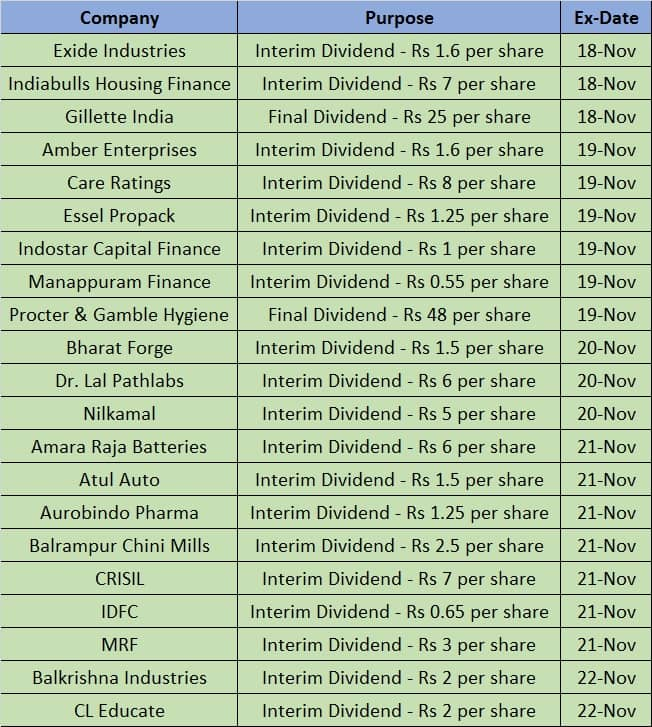

Corporate actionHere are corporate actions which will take place in the coming week:

Global crude oil prices rose nearly 2 percent, buoyed by optimism over a US-China trade deal. Oil prices have been subdued of late due to concerns that the weakness in the global economy will curtail the demand for oil.

Elevated crude oil prices may weigh on Indian equities as it distorts India's fiscal math.

Rupee's healthThe rupee appreciated by 18 paise to close at 71.78 against the American currency on Friday, extending gains for a second day.

On a weekly basis, the local unit lost 50 paise.

"Rupee has been retracing its losses for the last two sessions. From the low of 72.25 registered on November 14, the rupee has retraced back to 71.80 levels. However, we believe that the primary trend of the rupee is bearish and it is likely to find resistance around 71.50 odd levels," PTI reported, quoting V K Sharma, Head - PCG & Capital Market Strategy, HDFC Securities, saying so.

If the currency continues its upward march, riskier equities will remain favourites. In the case of rupee's weakness, gold is expected to gain.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.