Vedant Fashions, which owns ethnic wear brand Manyavar, will launch its initial public offering (IPO) next week on February 4. This would be the third public offer of this year after AGS Transact Technologies and Adani Wilmar.

Here are 10 key things to know about the public issue:1) IPO DatesThe offer will open for subscription on February 4 and the closing date is February 8. Anchor book will open for a day on February 3, 2022.

2) Price BandThe price band of the IPO has been fixed at Rs 824-866 per equity share.

3) Public Issue SizeThe company is planning to mobilise Rs 3,149.2 crore by offering 3,63,64,838 equity shares, which is entirely an offer for sale by investors and promoters.

Click Here To Read All IPO Related NewsThe offer for sale comprises 1,74,59,392 equity shares by Rhine Holdings, 7,23,014 equity shares by Kedaara Capital Alternative Investment Fund-Kedaara Capital AIF 1, and the remaining 1,81,82,432 equity shares by promoter Ravi Modi Family Trust.

4) Objectives of IssueVedant Fashions will not receive IPO proceeds as all the money will go to selling shareholders.

The objective of the offer are to achieve the benefits of listing the equity shares on the stock exchanges; and carry out the offer for sale of 3.6 crore equity shares by the selling shareholders holding, the company said in its prospectus.

Also read - Five key takeaways from Boat's IPO prospectus

Investors, other than anchor investors, can bid for a minimum of 17 equity shares and in multiples of 17 equity shares thereafter. Hence retail investors can invest a minimum of Rs 14,722 per lot and their maximum investment would be Rs 1,91,386 for 13 lots.

Half of the total offer is reserved for qualified institutional buyers, 15 percent for non-institutional investors and the remaining 35 percent for retail investors.

6) Company ProfileVedant Fashions became the largest company in India in the men's Indian wedding and celebration wear segment in terms of revenue, OPBDIT and profit after tax in FY20. OPBDIT is operating profit before depreciation, interest and tax.

It is a one-stop-shop destination with a wide spectrum of product offerings for every celebratory occasion, having an asset-light business model, out sourcing majority of manufacturing operations, with a substantial majority of sales being generated through its franchisee-owned EBOs. As of September 30, 2021, it had a retail footprint of 1.2 million square feet covering 535 EBOs (including 58 shop-in-shops) spanning across 212 cities and towns in India, and 11 EBOs overseas across the United States, Canada and the UAE, which are countries with a large Indian diaspora.

Also read - Budget 2022: One IPO to decide fate of divestment for two years

According to CRISIL, its 'Manyavar' brand is a category leader in the branded Indian wedding and celebration wear market with a pan India presence, as of FY20.

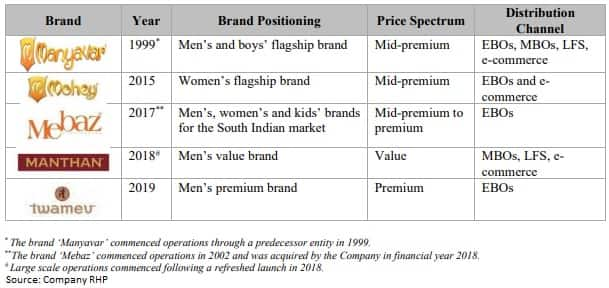

Brand Positioning

In the six months ended September 2021, the company generated 44.76 percent of its sales from franchisee-owned EBOs from Tier I cities, 38.64 percent from Tier II cities and 13 percent from Tier III cities. The remaining 3.59 percent was from international markets.

In India, the branded market is expected to grow at 18-20 percent between FY20-FY25, primarily due to an increase in the availability of branded Indian wedding and celebration wear.

The company intends to focus on further enhancing its leadership position in the organized Indian wedding and celebration wear market and establishing its dominance in the premium and value segments of the men's Indian wedding and celebration wear market through brands, Twamev and Manthan, respectively, and in the women's Indian wedding and celebration wear market through brand, Mohey that was launched in 2015.

It does not have an exact comparable peer among listed companies in India.

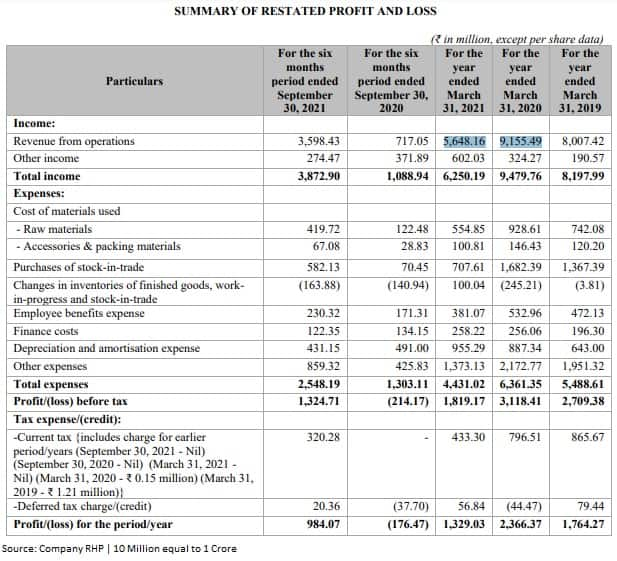

7) FinancialsThe Manyavar operator clocked a profit of Rs 98.41 crore in six-month period ended September 2021 against loss of Rs 17.64 crore in corresponding period last fiscal. Revenue from operations during the same period increased significantly to Rs 359.84 crore from Rs 71.7 crore YoY. Its numbers in 6MFY21 impacted by Covid-19 crisis.

In the financial year FY21, it recorded profit of Rs 132.9 crore, much lower compared to Rs 236.63 crore reported in previous year due to Covid-led nationwide lockdowns. Revenue also declined to Rs 564.82 crore from Rs 915.55 crore during the same period.

In FY21 and six months period ended September 30, 2021, 90.14 percent and 88.09 percent of its sales, respectively, generated by franchise-owned exclusive brand outlets (EBOs), with the remaining by multi-brand outlets (MBOs), large format stores (LFSs) and online platforms and mobile application.

Ravi Modi, Shilpi Modi, and Ravi Modi Family Trust are the promoters of Vedant Fashions, having a shareholding of 76.38 percent in the company. Promoters and promoter group's shareholding in the company stood at 92.40 percent at the time of filing RHP.

The remaining 7.6 percent stake is held by investors including Rhine Holdings which has 7.19 percent stake in the company.

Promoter Ravi Modi is the Chairman and Managing Director on the company's board, and his wife Shilpi Modi is the Whole-time Director.

Sunish Sharma is the Nominee Director, while Manish Mahendra Choksi, Abanti Mitra, and Tarun Puri are the Independent Directors.

Rahul Murarka is the Chief Financial Officer of the company.

Also read - Adani Wilmar IPO Day 2| Issue fully subscribed, retail portion booked 1.74 times

9) Grey Market PremiumVedant Fashions shares are trading at Rs 916-946 per share in the grey market, a 6-9 percent premium over upper price band of Rs 866 per share, as per the IPO Watch and IPO Central.

10) Listing & Allotment DateAfter closing the public issue on February 8, the company will finalise IPO share allotment on February 11. The funds will be refunded to unsuccessful investors by February 14 and equity shares will be credited to demat accounts of eligible investors by February 15.

Equity shares will be listed on the BSE and the National Stock Exchange of India on February 16.

Axis Capital, Edelweiss Financial Services, ICICI Securities, IIFL Securities, and Kotak Mahindra Capital Company are the promoters of the company, while Kfin Technologies is the registrar to the offer.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.