January 27, 2022 / 18:59 IST

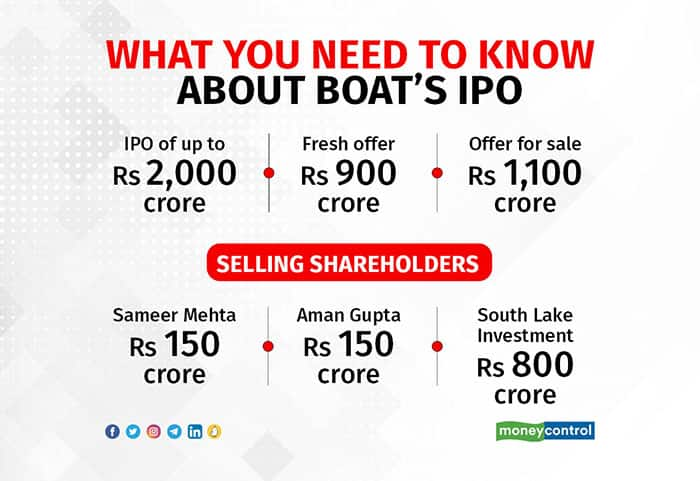

Direct-to-consumer (D2C) firm Boat, an Indian consumer electronics company owned by Imagine Marketing Ltd, has filed its documentswith the Securities Exchange Board of India (SEBI) for a Rs 2,000-crore initial public offering (IPO).Here are a few takeaways from Boat’s IPO Prospectus

Story continues below Advertisement

Despite having marquee investors, the founders of the company - Sameer Mehta and Aman Gupta - together own over 50% of shares in the company as each have 28.26% stake each.

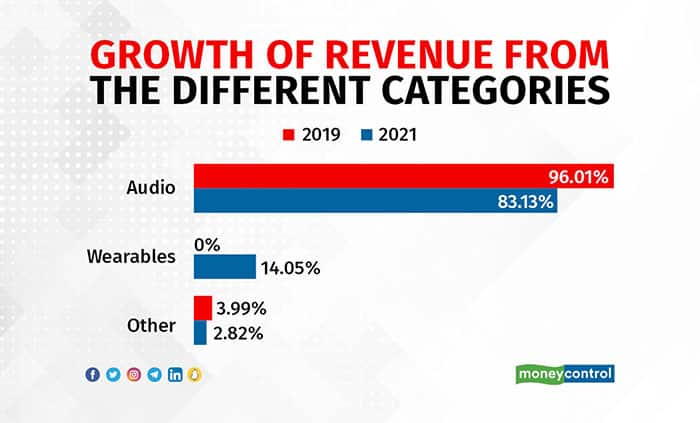

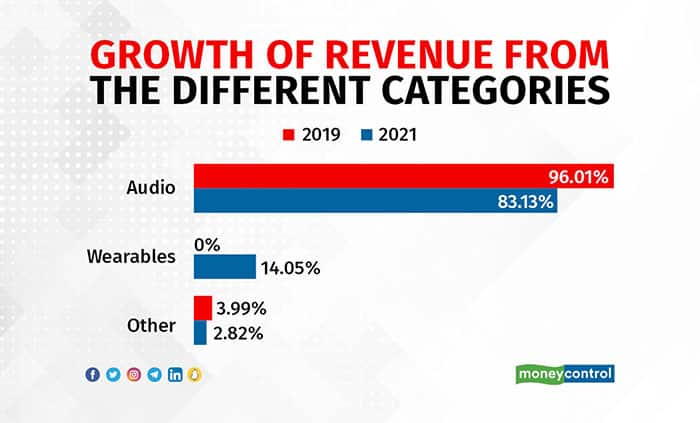

Boat has established leading market positions in volume and value terms in India across multiple, high-growth consumer categories including audio and wearables.

The Mumbai-based D2C brand heavily relies on online marketplaces which the company has also highlighted as a risk factor.

Story continues below Advertisement

The company has also added that a potential geopolitical tension between India and China could affect the company’s business.

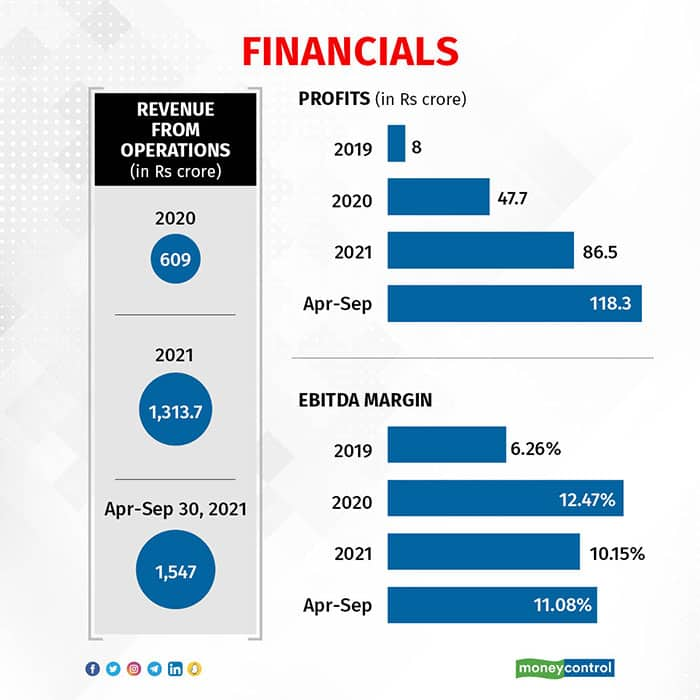

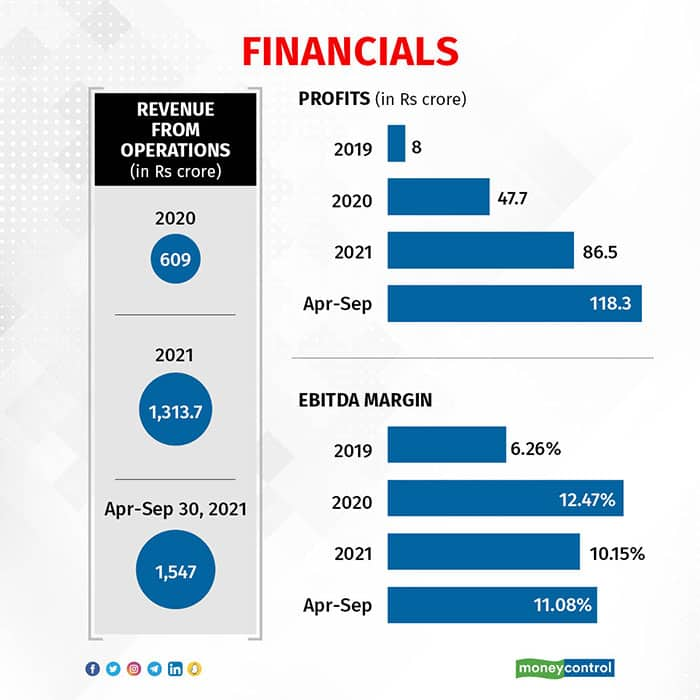

Last year, between April and September of 2021, the company clocked Rs 1,547.8 crore with a total revenue of Rs 1,553.1 crore. In FY21, it posted Rs 1,313.7 crore in earnings from operations, which was a significant rise from Rs 609 crore in FY20.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!