After a strong run in first half of 2021, the Indian primary market is expected to see continued action in July and the rest of the year.

The corporates wanting to raise funds from the market have been choosing the IPO (initial public offering) route lately. 39 corporates garnered nearly Rs 60,000 crore in last one year.

Although there was a lull in the primary market for a few weeks during the peak period of COVID second wave, 24 companies raised Rs 39,000 crore via IPOs in just the first half of 2021. Meanwhile, corporates raised around Rs 21,000 crore in second half of 2020 via IPOs.

In fact, benchmark indices also witnessed consolidation during April-May when the number of COVID cases were rising amid second wave. The number of daily new coronavirus cases peaked at around 4 lakh in early May.

But in June, the secondary and primary markets recovered and benchmark indices - Nifty and Sensex - hit fresh record highs. The BSE Sensex rallied more than 10 percent while the BSE Midcap index gained 26 percent and Smallcap index registered a 39 percent gains in first half of CY21.

Healthy momentum in the secondary market, ample liquidity in the system with global central banks keeping their monetary policies loose and greater participation of retail investors have been some of the factors keeping the IPO Street abuzz.

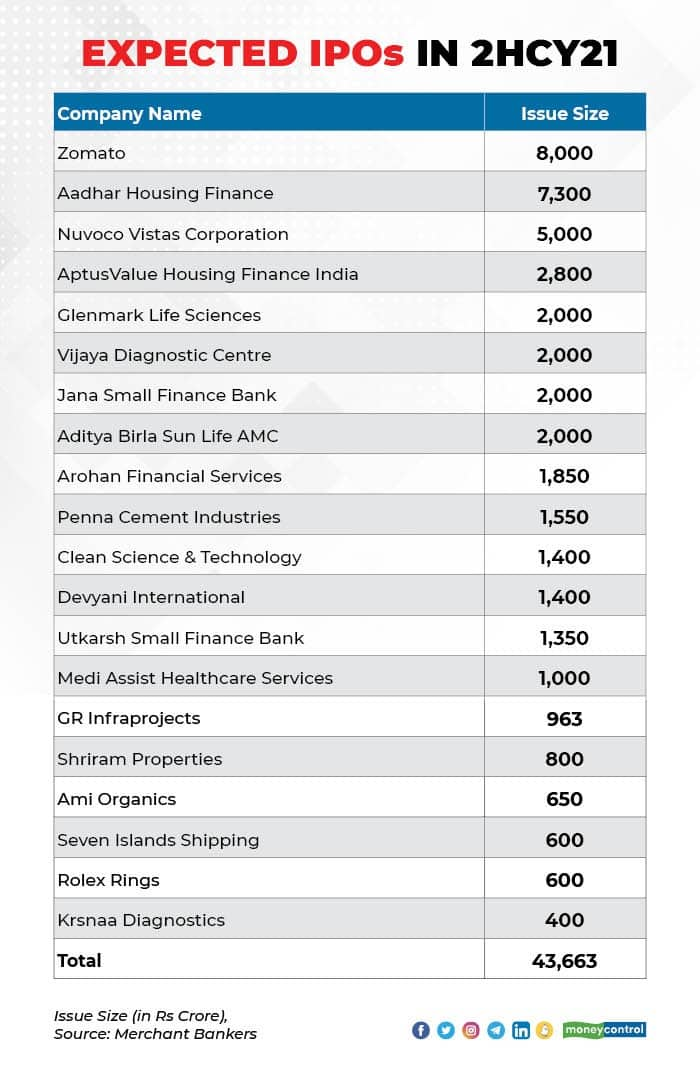

At least 20 companies, including Zomato, Aditya Birla Sun Life AMC and Rolex Rings, have already filed papers with Sebi for a public offer and are expected to launch their IPOs in the second half of 2021 to raise more than Rs 40,000 crore.

Out of these, 10 companies - GR Infra, Clean Science & Technology, Glenmark Life Sciences, Utkarsh Small Finance Bank, Vijaya Diagnostic Centre, Nuvoco Vistas Corporation, Aadhar Housing Finance, Shriram Properties, Seven Islands Shipping and Ami Organics - are lined up to launch their issues in July to raise around Rs 22,000 crore.

Some other companies like LIC, NSE and Policybazaar are known to be working on their public offerings.

"Indian fundraising via IPOs is at a 13-year high because of flood of foreign money and unprecedented interest from retail investors. This has made India one of the hottest IPO markets in 2021," Gaurav Garg, Head of Research at CapitalVia Global Research told Moneycontrol.

"As the markets trade at record high levels, we will keep on seeing more companies hitting the primary market as overall positive sentiment is very important for success of any initial offering," he added.

Prashanth Tapse, VP Research at Mehta Equities, also expects more primary market offerings in the second half of 2021 as markets are at an all-time high and it is an ideal time to cash in the market euphoria by promoters.

According to him, investors' appetite is also likely to be high given better-than-expected listing performance from Shyam Metalics and Sona Comstar, followed by Dodla Dairy & KIMS Hospitals. "We assume most of the IPOs have been reasonably valued giving meaningful room for listing gains keeping investors interest in the game," he said.

Also, other names like Zomato, LIC and NSE are in the pipeline to make an offer and get listed in this FY22, said Tapse.

Astha Jain, Senior Research Analyst at Hem Securities, too, expects primary market to continue to show strong momentum in H2CY21.

"We are expecting issuances of approximately Rs 45,000 crore in coming months," she said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.