Ratnaveer Precision Engineering IPO has seen a healthy response from investors on the first day of bidding on September 4, backed by retail investors and high networth individuals (HNIs).

The offer was fully subscribed within the initial hours of opening. Investors have bought 6.8 crore equity shares against offer size of 1.17 crore shares, resulting in a 5.77 times subscription, as per the bulk deals data available on exchanges.

Retail investors and HNIs provided great support to the issue, buying 7.65 times and 9.03 times their allotted quota respectively, while the portion set aside for qualified institutional buyers (QIB) was subscribed 5 percent.

The stainless steel-based products manufacturer has reserved half of the issue size for qualified institutional buyers, and 15 percent for HNIs. The remaining 35 percent is for retail investors.

The issue size has been reduced to 1.17 crore equity shares from 1.68 crore shares after the company mopped up Rs 49.5 crore from the anchor book, a part of QIB, on September 1, a day before the issue opening.

Also read: Ratnaveer Precision Engineering IPO opens: 10 key things to know before you bid

The Gujarat-based company is planning to raise Rs 165.03 crore via public issue comprising a fresh issuance of shares worth Rs 135.24 crore, and an offer-for-sale (OFS) of Rs 29.79 crore, by promoter Vijay Ramanlal Sanghavi, at the upper price band.

The price band for the offer, which closes on September 6, has been fixed at Rs 93-98 per share.

The net fresh issue proceeds will be utilised mainly for working capital requirements amounting to Rs 85 crore. The remaining money, excluding issue expenses, will be used for general corporate purposes, while the OFS money will go to selling shareholders.

Also read: Ratnaveer Precision Engineering IPO. Should you apply?

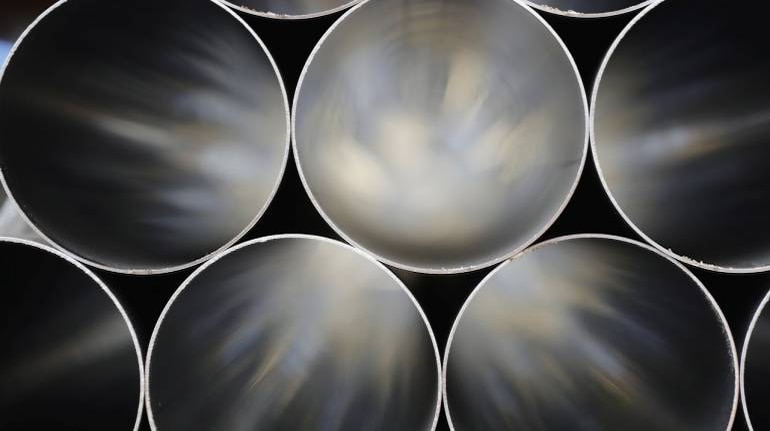

With four manufacturing units in Gujarat, Ratnaveer Precision Engineering provides finished sheets, washers, solar roofing hooks, pipes and tubes to several industries including building and construction, power, automotive, pharmaceuticals, oil and gas, electrical appliances, and kitchen appliances.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.