Hyundai India Share Price Listing Highlights: Hyundai Motor India shares close in red at Rs 1,820.40 after tepid debut

Hyundai India Stock Price Listing Latest News Today (October 22): Hyundai Motor India, the largest public offering in India's history, had a subdued debut on D-Street today. Following a lackluster listing at Rs 1,931 per share, the company's stock continued to decline. At the end of the day's trade, Hyundai Motor India shares closed in red at Rs 1,820.40 at BSE. However, the lukewarm response in the primary market has not dented Hyundai's brand value. After the IPO, Hyundai Motor India has become the fifth most valuable automaker in India. As of October 22, 2024, its market capitalisation stands at over Rs 1.59 lakh crore.

-330

October 22, 2024· 15:42 IST

Hyundai India Share Price: Hyundai Motor India shares close in red at Rs 1820.40 after tepid debut

After muted debut in the Indian primary markets, Hyundai Motor India's stocks closed in red today. As Nifty and Sensex extended losses to end at two–month low, Hyundai Motor India closed at Rs 1820.40 apiece at BSE.

-330

October 22, 2024· 15:14 IST

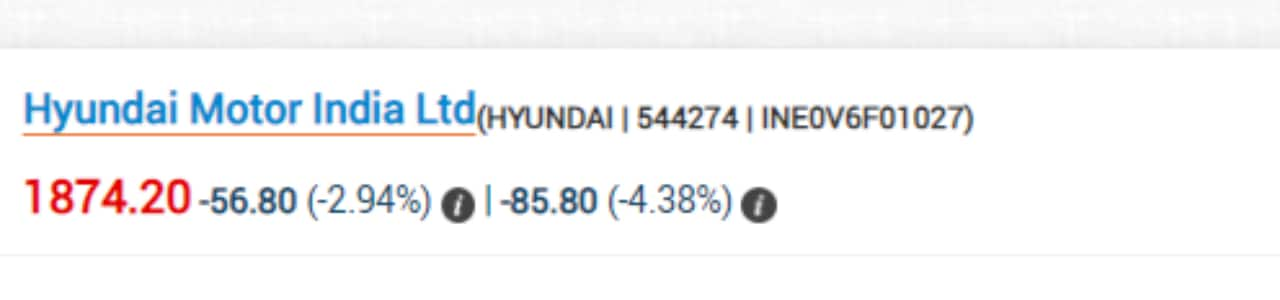

Hyundai India Share Price: Here's look at Hyundai's stock price at National Stock Exchange

We told you situation at BSE. Now, we bring you the NSE numbers. Different stock exchange, same story.

-330

October 22, 2024· 15:04 IST

Hyundai India Share Price: What's happening in Bombay Stock Exchange right now

Since the time of listing, the shares of Hyundai Motor India have been trading in red. There was a minor recovery. This is the latest stock prices of HMIL at BSE

-330

October 22, 2024· 14:35 IST

Hyundai IPO, India’s biggest share sale, is also its most expensive

- South Korean car manufacturer Hyundai spent Rs 624 crore ($74 million) on the Rs 27,855-crore IPO of its Indian arm, Hyundai Motor India Ltd, the highest a company spent to list on Indian stock exchanges.

- Hyundai Motor India had a weak debut on October 22, listing at Rs 1,934 on the National Stock Exchange, below the offer price of Rs 1,960.

- Hyundai spent 2.24 percent of the issue size in various fees, final IPO documents filed by the company show. (Read More)

-330

October 22, 2024· 13:57 IST

Hyundai India Share Price: Emkay says Hyundai Motor India's shares may fall to Rs 1,750

Brokerage firm Emkay has started coverage on Hyundai Motor India, assigning a price target of Rs 1,750 per share. This indicates a potential downside of 11% from its IPO price of Rs 1,960 per share.

-330

October 22, 2024· 12:58 IST

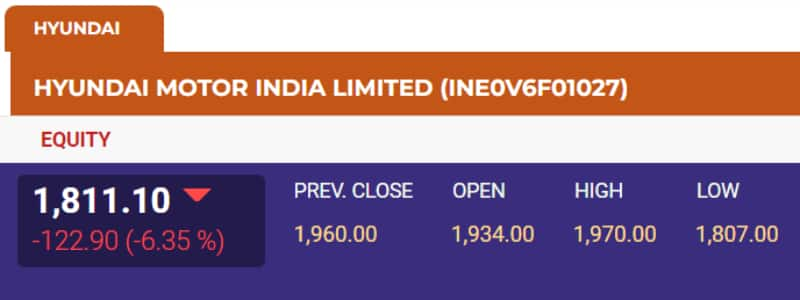

Hyundai India Share Price: Hyundai Motor India stocks fall nearly 6% post listing

- Shares of Hyundai Motor India Ltd, the Indian arm of South Korean automaker Hyundai, on Tuesday made a muted market debut and further fell by nearly 6 per cent against the issue price of Rs 1,960.

- The stock listed at Rs 1,931, reflecting a decline of 1.47 per cent from the issue price on the BSE. Later, the stock made some recovery and hit a high of Rs 1,968.80, up 0.44 per cent. But, it failed to carry the momentum and further tanked 5.81 per cent to Rs 1,846.

- On the NSE, the stock made its debut at Rs 1,934, down 1.32 per cent. Later, in the trade shares of the firm tumbled 5.88 per cent to Rs 1,844.65. (PTI)

-330

October 22, 2024· 12:46 IST

Business news live: Allianz mulls ending decades-old Bajaj Insurance JVs in India, reports Bloomberg

Allianz mulls ending decades-old Bajaj Insurance JVs in India, reports Bloomberg

-330

October 22, 2024· 12:40 IST

Hyundai India Share Price: Decoding Hyundai Motor India's list day fall

- Seven of India's 10 largest IPOs, including Hyundai India, reported listing day losses ranging from 5% to 27%, according to data from Dealogic.

- While Hyundai's market valuation is much smaller than Indian market leader Maruti Suzuki's $45 billion, analysts have expressed concerns over the narrower gap in their price-to-earnings (P/E) ratios.

- The issue had valued Hyundai at 26 times its fiscal 2024 earnings, not far off the multiple of 29 for Maruti. (Reuters)

-330

October 22, 2024· 12:24 IST

Hyundai India Share Price: Hyundai Motor India is second-largest original equipment manufacturer

- Hyundai Motor India is the second-largest original equipment manufacturer (OEM) and the second-largest exporter of passenger vehicles, holding a 14.6% share of the domestic market.

- In September, Hyundai sold 64,201 units, reflecting a 10% year-on-year decline. So far in 2024, the company has sold 5.77 lakh units, a figure that remains flat compared to the same period last year.

-330

October 22, 2024· 12:07 IST

Hyundai India Share Price: What HMIL COO said at listing ceremony

Journey from Santro to IPO has been challenging but immensely satisfying, says Hyundai Motor India COO Tarun Garg

-330

October 22, 2024· 11:59 IST

Hyundai India Share Price: Hyundai Motor India vs Maruti Suzuki - What brokerage firm Emkay says

Maruti Suzuki India Ltd, currently rated as a "Reduce" by Emkay is encountering comparable near-term growth challenges. However, according to a CNBC-Tv18 report, Emkay favors Maruti over Hyundai Motor India, highlighting its advancements in operational and financial metrics, even though its SUV mix is smaller.

-330

October 22, 2024· 11:43 IST

Hyundai India Share Price: Motilal initiates coverage on HMI with a 'BUY' rating

- HMC’s technological prowess in emerging technologies that can be adapted to domestic requirementssuperior financial metrics

- A relatively premium brand perception

- Better alignment with industry trends.

- We initiate coverage on HMI with a BUY rating and a TP of INR2,345, premised on 27x Sep’26E earnings (vs. 26x for MSIL)

-330

October 22, 2024· 10:58 IST

Hyundai India Share Price: 'Investors with a long-term outlook may consider holding the stock'

Despite the discounted listing, Hyundai Motor India's strong fundamentals—being the second-largest passenger vehicle manufacturer in the country and its strategic focus on the SUV segment—continue to bolster its long-term growth prospects. Investors with a long-term outlook may consider holding the stock, as future performance is expected to be driven by the company's competitive market position and ongoing product innovations.

Shivani Nyati, Head of Wealth, Swastika Investmart

-330

October 22, 2024· 10:52 IST

Hyundai India Share Price: Hyundai Motor turns India's 5th most valued automaker with Rs 1.59-lakh-cr MCap

- Hyundai Motor India Ltd has become the fifth most valuable automaker in India, with a market capitalisation exceeding Rs 1.59 lakh crore after its listing. The stock has also entered the ranks of the top 60 most valuable companies in India, though it listed over 1 percent below its issue price of Rs 1,960 per share.

- Maruti Suzuki India Ltd continued to lead the league with a market cap of Rs 3.83 lakh crore, followed by Mahindra & Mahindra Ltd at Rs 3.73 lakh crore, Tata Motors at Rs 3.32 lakh crore, and Bajaj Auto at Rs 2.93 lakh crore. (Read More)

-330

October 22, 2024· 10:42 IST

Mainboard IPOs cross Rs 1 lakh crore fund-raising for only the second time in history

- Mainboard initial public offerings (IPOs) have exceeded the mark of Rs 1 lakh crore in fundraising this year and this milestone has been achieved for only the second time in history.

- Altogether, 70 IPOs have been launched this year— the highest since 2007. Collectively, they have raised over Rs 1.03 lakh crore. In 2007, 100 IPOs were launched, raising Rs 34,179 crore. (Read More)

-330

October 22, 2024· 10:18 IST

Hyundai India Share Price Listing Live: Stocks slip after lukewarm debut

Here's what is happening in the stock market right now. After the lukewarm debut, Hyundai Motor India's shares slip

-330

October 22, 2024· 10:13 IST

Hyundai Motor India shares list at 1.32% discount to IPO price at Rs 1,934 apiece on NSE

- Hyundai Motor India shares made a weak debut on the exchanges on October 22 after listing at 1.32 percent discount at Rs 1,934 against its initial public offer (IPO) price Rs 1960 on the NSE.

- Hyundai Motor India, the Indian subsidiary of the South Korean automaker, saw a muted retail response to its initial share sale. However, strong demand from Qualified Institutional Buyers (QIBs) compensated for this, with the QIB portion being oversubscribed by nearly 700 percent, or 6.97 times. (Read More)

-330

October 22, 2024· 10:06 IST

Hyundai India Share Price Listing Live: Hyundai Motor India has lacklustre debut, lists at Rs 1,931

Hyundai Motor India has lacklustre debut, lists at Rs 1,931. The stocks of Hyundai motor India listed at Rs 1,931 on the BSE, slightly below the issue price of Rs 1,960, while on the NSE, it debuted at Rs 1,934.

-330

October 22, 2024· 09:57 IST

Hyundai IPO share price live: Emkay Global has begun coverage of Hyundai with a "Reduce" rating

We initiate coverage on Hyundai Motor India (HMIL) with REDUCE (TP of Rs1,750, at ~23x core Sep-26E PER, similar to MSIL) amid a lackluster ~5% EPS CAGR over FY24-27E. HMIL has established a strong franchise in India; however, lack of major launches (key growth driver historically in PVs) over the next 12-18M, muted ~5% capacity CAGR, higher royalty, and lower treasury income are likely to restrict EPS growth. While MSIL (REDUCE) also faces similar near-term growth challenges, we prefer it over HMIL given its catch-up on operational and financial metrics (even on lower SUV mix) with a much diversified product and powertrain mix and a higher growth optionality (potential small-car recovery, aggressive 8% capacity CAGR, 7-seater SUV launch in H2FY26E, and 10 new models by 2030) driving a superior 6%/10% revenue/EPS CAGR over FY24-27E.

-330

October 22, 2024· 09:51 IST

Hyundai IPO share price live: Hyundai Motor India at Rs 1,931 apiece in pre-open

What's happening in pre-opening trade. A few moments from now, Hyundai will be listed. In pre-open, Hyundai Motor India is at Rs 1,931 apiece

-330

October 22, 2024· 09:49 IST

Hyundai IPO share price live: What Nomura says about Hyundai IPO

- Company riding on style & technology

- Ongoing premiumisation should drive high-quality growth

- Estimate company to deliver an 8 percent volume CAGR over FY25-27 driven by 7-8 new models (including facelifts)

- EBITDA margin to improve to 14 percent by FY27 from 13.1 percent in FY24

- Believe volume CAGR & EBITDA margin will be led by improving mix, cost reduction & operating leverage

- Overall, estimate company to deliver a 17 percent earnings CAGR over FY25-27

-330

October 22, 2024· 09:43 IST

Hyundai IPO share price live: 'IPO ensures shareholders and HMIL continue to grow together,' says Executive Chairman, Hyundai Motor Group

"HMIL is an integral part of the Hyundai community. Now, we are taking the next big step. With the IPO, HMIL shows the company is a key part of India. IPO ensures shareholders and HMIL continue to grow together," says Chung Eui-sun, Executive Chairman, Hyundai Motor Group

-330

October 22, 2024· 09:38 IST

Hyundai IPO share price live: Hyundai Motor Group Executive Chairman met PM Modi ahead of listing

Ahead of the D-street debut, Hyundai Motor Group Executive Chairman Euisun Chung met Prime Minister Narendra Modi in New Delhi. "Mr Chung invited the Honourable PM for the opening of the Hyundai plant in Pune, Maharashtra. This will be a game changing investment for HMIL. We are grateful to the Govt of India and Govt of Maharashtra for their support in all aspects relating to this plant," Hyundai Motor India said in a post on X.The Hyundai Motor Group Executive Chair, Mr. Euisun Chung met the PM of India, Mr. Narendra Modi and discussed on subjects related to the future of mobility. Due to India's diverse market & reformist approach, Hyundai attaches great priority to working closely with India.(1/3) pic.twitter.com/iAfuWqguja

— Hyundai India (@HyundaiIndia) October 21, 2024

-330

October 22, 2024· 09:35 IST

Hyundai IPO share price live: Macquarie initiates coverage of Hyundai Motor with an 'Outperform' rating

Macquarie has initiated coverage of Hyundai Motor with an "Outperform" rating and a target price of Rs 2,235. The firm regards Hyundai as a key player in the premium passenger vehicle segment and believes it should command a higher price-to-earnings (PE) multiple compared to its peers. Macquarie notes that Hyundai's market share in crucial segments has either stabilized or improved from recent lows, thanks to a favorable product mix and premium positioning. Additionally, they anticipate potential benefits from various powertrain options, including the capabilities of the company's parent, as well as possible market share gains.

-330

October 22, 2024· 09:33 IST

Business news live: Nirmala Sitharaman addresses at Columbia University event

- "Despite the increasingly complex global environment, India’s macroeconomic fundamentals remain sound, acting as a strong foundation upon which to build future growth. In 2013, India was the 10th largest economy in the world at market exchange rates," says Sitharaman

- "Presently, it is the fifth-largest economy, and the IMF has projected it to become the third-largest economy by 2027. India’s contribution to global growth is projected to see an increase of 200 basis points in the next five years," says Sitharaman

- "India’s good economic growth can be attributed to its astute COVID-19 management, coupled with a series of measures undertaken by the Government to strengthen its manufacturing capabilities, focus on digital and financial systems, simplification of regulatory procedures, and enhancement in ease of doing business," says Sitharaman

-330

October 22, 2024· 09:27 IST

Hyundai IPO share price live: Hyundai Group's top bosses light diya

From Hyundai Motor India's COO Tarun Garg to all top management of Korean parent company, leaders of the auto giant light diya at listing ceremony. WatchListing ceremony of Hyundai Motor India Limited will be starting soon at our exchange @nseindia. Watch the ceremony live.https://t.co/CnPgVCZxa7#NSEIndia #listing #IPO #StockMarket #ShareMarket #HyundaiMotorIndiaLimited @ashishchauhan

— NSE India (@NSEIndia) October 22, 2024

-330

October 22, 2024· 09:23 IST

Hyundai IPO share price live: Listing ceremony begins

With Indian national anthem being played out, the glitzy listing ceremony of Hyundai Motor India has begun at the National Stock Exchange. With top brass of Korean parent company in full attendance, Hyundai Motot India plays out short film in Hindi during the ceremony.

-330

October 22, 2024· 09:10 IST

Hyundai IPO share price live: Nomura gives 'Buy' rating for Hyundai Motor India, sets target price at Rs 2,472

- Nomura has initiated coverage of Hyundai Motor with a buy rating and a target price of Rs 2,472.

- The company is leveraging style and technology, with its ongoing premiumization strategy expected to drive high-quality growth. The Indian car industry has significant growth potential, with current penetration at just 36 cars per 1,000 people.

- Hyundai Motor India (HMI) is well-positioned for healthy long-term growth due to its focus on style and technology. Key catalysts include capacity expansion in the second half of the year and the launch of several new models, including four electric vehicles, over the next 3-4 years.

-330

October 22, 2024· 09:07 IST

Hyundai IPO share price live: Why wait and watch policy is the best - explains this expert

Ajay Bagga, a market expert, told ET that the passenger vehicle segment is sluggish, and Indian auto companies are not trading at any discounts, leading investors to pay a high premium overall. He advises that this is not the best time to make purchases. Regarding IPOs, Bagga recommends a "wait and watch" approach, particularly in light of the inflated listing gains observed in the SME and other segments.

-330

October 22, 2024· 09:01 IST

Hyundai IPO share price live: Why analysts are advising caution

- The company confirmed in its DRHP that reduced cash levels may necessitate borrowing, potentially impacting its profitability and financial health.

- Analysts express concerns that Hyundai Motors India is facing increased financial pressure just as it initiates its growth plans.

- Given this situation, experts advise caution on Hyundai's listing day, recommending that investors wait a few days for the stock price to stabilize before making any decisions.

- Predictions indicate limited price movement on listing day, with the stock potentially trading Rs 100 to Rs 150 below the issue price after listing.

- This price dip could attract retail and HNI investors who missed out during the IPO, as well as QIBs looking to purchase at lower levels.

-330

October 22, 2024· 08:48 IST

Hyundai IPO share price live: A look at cash outflow of Hyundai Motor India

- Analysts indicate that Hyundai India has transferred two-thirds of its cash reserves to its Korean parent company over the past two years.

- Dividends paid to the parent company during this period amounted to Rs 17,900 crore, surpassing Hyundai India's entire profit after tax of Rs 17,800 crore over the last five years.

- In FY24 alone, just before the IPO, Hyundai India declared a substantial dividend of Rs 13,300 crore.

- This dividend is three times higher than that of FY23.

- It is nine times higher than the dividend declared in FY22.

- This aggressive cash outflow has reduced Hyundai India's bank balances to a third of their level two years ago, even as the company plans its largest expansion in decades.

-330

October 22, 2024· 08:42 IST

Hyundai IPO share price live: When Paytm's GMP crashed before market debut

Paytm's IPO exhibited a similar trend. Initially, its GMP suggested a premium of Rs 200 per share over the issue price of Rs 2,150. However, just a few days before the listing, it fell to a negative Rs 30 per share.

-330

October 22, 2024· 08:39 IST

Hyundai IPO share price live: What happened to LIC and Paytm - A look at GMP fluctuations

Previous large IPOs, including those of LIC and Paytm's parent company, One97 Communications Ltd, also experienced notable fluctuations in their grey market premiums (GMP). The LIC IPO, which launched in April 2022, saw its GMP initially trading at a modest Rs 63 above its issue price of Rs 949 per share, but it eventually turned negative.

-330

October 22, 2024· 08:29 IST

Hyundai IPO share price live: Analysts advise waiting for better entry

Analysts are of the view that non-institutional investors are wary of Hyundai's valuation, especially amid slowing growth in the automotive sector. Analysts further suggest the weak demand from retail investors and HNI was primarily because such large issues in the past have turned out to be a disappointment after listing. As a result of weak retail subscription, who only bid for half of the portion allocated for them, large institutions were allocated more shares than they expected. (Read More)

-330

October 22, 2024· 08:24 IST

Hyundai IPO share price live: Largest IPO in Asia this year

The Indian debut, in which the Korean group is selling a 17.5 percent stake, marks the country’s third-largest IPO ever in dollar terms. It is also the largest IPO in Asia this year and ranks as the second largest globally, following warehouse operator Lineage's $5.1 billion listing in the US, according to data from Dealogic.

-330

October 22, 2024· 08:19 IST

Hyundai IPO share price live: What are market cues today?

The GIFT Nifty suggests a flat opening for the Indian markets as traders anticipate market movements. Meanwhile, US markets closed with mixed results, reflecting varied investor sentiments, while Asian markets are trading lower, indicating cautious trading in the region. This combination of factors sets the stage for a potentially subdued start to the trading day in India. (Check live updates)

-330

October 22, 2024· 08:15 IST

Hyundai IPO share price live: When did Hyundai Motor India IPO open for subscription

Bidding for the Hyundai Motor IPO began on October 15, 2024, and concluded on October 17, 2024. The allotment for the IPO was finalized on Friday, October 18, 2024, with the shares listed on the BSE and NSE on October 22, 2024.

-330

October 22, 2024· 08:08 IST

Hyundai IPO share price live: 'Valuation was very full'

A senior Mumbai banker, quoted by the Financial Times, remarked, "The valuation was very full." He pointed out that Hyundai’s pricing is approximately 26 times the earnings of its Indian unit, valuing it at 40 percent of the market capitalisation of its South Korean parent on the Seoul exchange. The banker further noted, ‘They didn’t leave much on the table.’”

-330

October 22, 2024· 07:49 IST

Hyundai IPO share price live: Who is the registrar of Hyundai Motor India's public offer

For this mega public issue, Kfin Technologies Limited was appointed as the registrar by the company.

-330

October 22, 2024· 07:46 IST

Hyundai IPO share price live: How Hyundai debut may set tone for other mega IPOs

- Shares of Hyundai Motor India Ltd. are set to start trading in Mumbai on Tuesday after a $3.3 billion initial public offering that was the South Asian nation’s largest ever.

- The debut may set the tone for a string of other billion-dollar-plus deals coming to the market in India, one of the world’s most vibrant venues for new share sales this year. It also comes amid what is the busiest week for Asia-Pacific listings in more than two years, as companies and major shareholders rush to close deals before the Nov. 5 election in the US.

- The IPO valued the Indian unit of South Korea’s Hyundai Motor Co. at about $19 billion. The parent sold a 17.5% stake in India’s second-largest carmaker in the deal. (Read More)

-330

October 22, 2024· 07:29 IST

Hyundai IPO listing price live: The acquisition of Kia Motors

In 1998, Hyundai acquired a 51% stake in Kia Motors after the latter faced bankruptcy. This acquisition followed Hyundai's successful bid against Ford, which had been interested in Kia since 1986. Although the two companies shared resources, they continued to operate under separate brands. In 2019, Kia made its entry into the Indian market with the launch of the mid-sized SUV, the Kia Seltos.

-330

October 22, 2024· 07:22 IST

Hyundai IPO listing price live: Hyundai's India entry - A look at the Santro success

Hyundai entered the Indian market in 1996 by establishing a manufacturing plant in Tamil Nadu. In 1998, the company launched the Santro, which quickly became a hit. The Santro’s appealing blend of affordability and design enabled Hyundai to firmly establish itself as a significant player in the Indian automotive sector.

-330

October 22, 2024· 07:20 IST

Hyundai IPO listing price live: How Hyundai transitioned to producing cars using its own tech

By 1988, Hyundai transitioned to producing cars using its own technology, marking a significant milestone for the company. In 1991, it developed its first in-house engine and transmission, achieving technological independence. This advancement enabled Hyundai to innovate and compete more effectively in the global automotive market.

-330

October 22, 2024· 07:18 IST

Hyundai IPO listing price live: Hyundai's global expansion

Hyundai began its international expansion by entering the UK market in 1982 and Canada in 1985, where the Pony quickly became a top-selling model. In 1986, Hyundai made its debut in the US with the Excel, a budget-friendly vehicle. The Excel achieved significant success, earning a spot on Fortune magazine’s list of 'Best Products #10.'

-330

October 22, 2024· 07:04 IST

Hyundai IPO listing price live: Know about South Korea's first domestic car

In 1967, Chung expanded his vision by founding Hyundai Motor Company. The following year, Hyundai launched its first vehicle, the Hyundai Cortina, in collaboration with Ford. However, due to differing strategic directions, Hyundai severed ties with Ford and formed a partnership with Mitsubishi. This collaboration resulted in the creation of South Korea’s first domestic car, the Hyundai Pony, in 1975.

-330

October 22, 2024· 07:01 IST

Hyundai IPO listing price live: Who are the book running lead managers for Hyundai IPO

Hyundai Share Price Live Updates: Morgan Stanley India Company Pvt Ltd, Citigroup Global Markets India Private Limited, JP Morgan India Private Limited, Kotak Mahindra Capital Company Limited and HSBC Securities & Capital Markets Pvt Ltd are the book running lead managers of the Hyundai Motor India's public issue

-330

October 22, 2024· 06:51 IST

Hyundai IPO listing price live: What is meaning of 'Hyundai'?

In 1946, Chung Ju-Yung founded a car repair shop in South Korea, naming it "Hyundai," meaning "modern." At the time, the country was recovering from World War II, and Chung recognized the urgent need for reconstruction. He established Hyundai Engineering and Construction, which played a crucial role in rebuilding the nation’s infrastructure. The company constructed 1,000 kilometers of highways, laying the groundwork for South Korea's future development.

-330

October 22, 2024· 06:44 IST

Hyundai IPO listing price live: It all started as car repair shop in 1946

Hyundai's evolution from a South Korean car repair shop founded in 1946 to a global automotive leader is highlighted by significant milestones, including the launch of the Hyundai Pony, expansion into international markets, and the acquisition of Kia Motors in 1998.

-330

October 22, 2024· 06:35 IST

Hyundai IPO listing price live: What volatility in GMP means

The GMP for Hyundai motor India's public offer has witnessed a rollercoaster ride. Since September, we have seen the GMP crashing. In last 24 hours, there was a slight recovery with a dip again. This fluctuation in the grey market premium indicates a shift in the investors' sentiments ahead of the D-street debut.

-330

October 22, 2024· 06:25 IST

Hyundai IPO listing price live: A look at recovery in GMP

A day ahead of its official listing, the shares showed signs of recovery in the grey market, with the premium rebounding to Rs 95, indicating a potential listing gain of around 5 percent.

-330

October 22, 2024· 06:23 IST

Hyundai IPO listing price live: What's the current GMP

While there was slight improvement in Hyundai Motor India's GMP yesterday. However, the grey market premium has dipped again. According to investorgain.com, the last updated GMP for Hyundai stood at Rs 45.

-330

October 22, 2024· 06:12 IST

Hyundai IPO listing price live: ' Flat to moderate' listing for Hyundai Motor India's public issue, says this expert

- Shivani Nyati, Head of Wealth at Swastika Investmart Ltd, suggested that the IPO could see a “flat-to-moderate” listing. However, she advised that “investors with a long-term perspective and the ability to navigate potential listing challenges may consider holding their investments post-listing.”

- Nyati concluded, “While immediate listing gains may be modest, we expect a steady debut, and Hyundai’s strong fundamentals make it an appealing long-term investment.”

-330

October 22, 2024· 06:10 IST

Hyundai IPO listing price live: Experts view Hyundai as long-term investment

Master Capital Services stated, “Hyundai Motor India, the second-largest automobile manufacturer in the country with a 15% market share, presents steady growth prospects despite concerns about short-term listing gains due to a subdued grey market premium. The company benefits from industry tailwinds, strong financials, and high demand for its SUV products. Hyundai's leadership in India's passenger vehicle market, combined with its strategic focus on electric vehicles, makes it a compelling long-term investment.”

-330

October 22, 2024· 05:59 IST

Hyundai IPO listing price live: How Hyundai Motor India's public issue impacted Indian Rupee

The Indian rupee closed at a record low of 84.0725 against the US dollar on Monday, weighed down by outflows from local equities and debt, as well as a stronger dollar index. However, traders noted that likely intervention by the central bank through dollar sales helped limit the rupee’s losses. Dealers also pointed out that outflows caused by Hyundai Motor transferring funds to its parent company in South Korea following its IPO added further pressure on the currency, a report said. Hyundai's stock listing marks the largest IPO in the country and the biggest global initial share sale of 2024.

-330

October 22, 2024· 05:51 IST

Hyundai IPO listing price live: A look at subscription breakup

As per the final status of the subscription, the QIB portion was subscribed nearly seven times, the segments reserved for HNIs and retail investors remained undersubscribed.

-330

October 22, 2024· 05:45 IST

Hyundai IPO listing price live: What was the price band of Hyundai Motor India's public issue

The price band for the offering was set at Rs 1,865-1,960 per share. However, demand from retail investors was sluggish due to concerns over high valuation, a decline in the grey market premium of shares, and generally weak demand in the auto sector during the festive season.

-330

October 22, 2024· 05:42 IST

Hyundai IPO listing price live: The GMP volatility

Amid the flood of the IPOs, the Hyundai Motor India's public issue stands out for its sheer size. the IPO witnessed a significant volatility in term of its grey market premium. From a dazzling high of Rs 570 in September last month, the GMP crashed on during the subscription period.

-330

October 22, 2024· 05:39 IST

Hyundai IPO listing price live: 'Not too many headwinds,' says Hyundai's top brass

The top management of Hyundai Group feel that there are not too many headwinds. The leadership of automaker is 'very optimistic' about the Indian auto market. The company is aiming for a single-digit growth this year on a high base of last year.

-330

October 22, 2024· 05:36 IST

Hyundai IPO listing price live: Road ahead for Hyundai Motor India

Ahead of the company’s IPO, senior executives of the auto major, in an interview with Moneycontrol, stated that their strategies are centered on exploring opportunities in introducing new models, advanced technologies, expanding into the EV segment, and focusing on premiumisation.

-330

October 22, 2024· 05:28 IST

Hyundai IPO listing price live: Who heads Hyundai Motor India

The Indian arm of the auto giant is led by a Korean - Unsoo Kim. He is the current CEO and Managing Director of Hyundai Motor India. Another Korean - Wangdo Hur - is currently serving as the CFO of the Indian subsidiary. However, an Indian - Tarun Garg - is occupying the chair of the COO.

-330

October 22, 2024· 05:21 IST

Hyundai IPO listing price live: CXOs and vertical heads of Hyundai Group flying in for today's ceremony

The listing of the Indian arm of the Korean automotive giant is seen as a significant milestone for the company, prompting a strong turnout from representatives of the parent firm at today's ceremony at the National Stock Exchange. Several CXOs and heads of key verticals, including autonomous vehicle planning and strategy, are expected to attend the event.

-330

October 22, 2024· 05:18 IST

Hyundai IPO listing price live: Hyundai Group CEO and Chairman among Korean top brass likely to attend the listing ceremony today

The highly-anticipated listing of Hyundai Motor India is scheduled for today, with a notable attendance from the company’s top leadership. Over two dozen officials from Korea are expected to be present at the event, including Hyundai Motor Group Executive Chairman and CEO Euisun Chung, as well as Jaehoon Chang, President and CEO of Hyundai Motor, according to sources familiar with the matter. (Read More)

-330

October 22, 2024· 05:14 IST

Hyundai IPO listing price live: Know key facts about India’s largest-ever public offer

Hyundai Motor India’s public offer, which opened for subscription on October 15 has seen a lot of volatility in terms of grey market premium and market buzz. While the early phase of subscription saw some hesitation, the public issue witnessed significant traction and was fully subscribed on the last day. As per the official data, at the end of Day 3, Hyundai Motor India IPO was subscribed 2.37 times.

-330

October 22, 2024· 05:08 IST

Hyundai IPO listing price live: Hello!

Good morning and welcome to our live coverage of Hyundai Motor India IPO’s D-street debut. What will happen today? Will it be a flat listing or get some moderate gains for investors? Can the debut match the hype of India’s biggest-ever IPO? Stay with us as we bring you all about the IPO, expert view, current grey market premium and much more.