Home First Finance Company, a technology-driven affordable housing finance company, is set to open its maiden public offer for subscription on January 21. This would be the third IPO in January 2021, after Indian Railway Finance Corporation, which closes today and Indigo Paints which is at present open for subscription.

The three-day public issue will close on January 25. The book running lead managers to the issue are Axis Capital, Credit Suisse Securities (India), ICICI Securities and Kotak Mahindra Capital Company.

The bidding for anchor book portion opens for a day on January 20, a day ahead of IPO opening.

Here are 10 key things to know before subscribing the issue:

1) About IPO

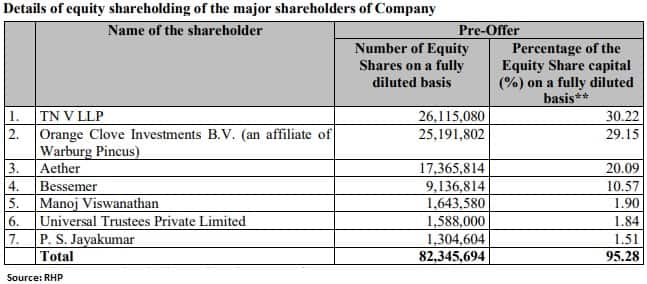

The Rs 1,153.72 public issue comprises a fresh issue of Rs 265 crore and an offer for sale of Rs 888.72 crore by promoters True North Fund V LLP and Aether (Mauritius), investor Bessemer India Capital Holdings II Ltd, and two individual shareholders.

The Rs 888.72 crore offer for sale consists Rs 435.61 crore by True North, Rs 291.28 crore by Aether, Rs 120.46 crore by Bessemer India Capital Holdings II and Rs 41.36 crore by two individual shareholders - PS Jayakumar and Manoj Viswanathan.

HFFC reduced its fresh issue size to Rs 265 crore from Rs 344.08 crore due to its pre-IPO placement to Orange Clove and employees.

The company issued over 22.40 lakh equity shares to Orange Clove Investments B.V., an affiliate of the global private equity funds managed by Warburg Pincus at a price of Rs 334.72 per share, for a consideration of Rs 75 crore, in October last year, and 1.22 lakh equity shares to its employees at a same price, for Rs 4.08 crore in November last year, through preferential issue.

Investor can put in a minimum bid of 28 equity shares and in multiples of 28 equity shares thereafter.

2) Price Band

The price band for the maiden public issue has been fixed at Rs 517–518 per equity share. The lower issue price band is 258.50 times the face value of equity share and the upper price band is 259 times the face value.

3) Objectives of Issue

The company will utilise the net fresh issue proceeds in FY22, towards augmenting its capital base to meet future capital requirements, arising out of the growth of business and assets.

The company will not receive any proceeds from the offer for sale. The offer for sale money will go to selling shareholders.

4) Company Profile

Home First is a technology driven affordable housing finance company that targets first time home buyers in low and middle-income groups. It was founded by Jaithirth Rao, PS Jayakumar and Manoj Viswanathan and commenced operations in August 2010.

It primarily offers customers housing loans for the purchase or construction of homes, which comprised 92.1 percent of its gross loan assets as of September 2020. The company serviced 44,796 active loan accounts till September last year.

As of September last year, HFFC had a network of 70 branches covering over 60 districts in 11 states and a union territory in India, with a significant presence in urbanized regions in Gujarat, Maharashtra, Karnataka and Tamil Nadu.

Total borrowings (including debt securities) as of September 2020 were Rs 2,636.58 crore. The company currently has an A+ (stable) rating from ICRA, which improved from A- in March 2017.

5) Competitive Strengths

a) It is a technology-driven company with scalable operating model.

b) It is a customer-centric organization and has developed strong relationships with customers by addressing their key concerns in availing housing finance.

c) It has deep penetration in the largest housing finance markets, with diversified sourcing channels.

d) The company has centralised, data science backed underwriting process.

e) It has set up a robust collections management system wherein approximately 93 percent of collections for the financial year

2020 were non-cash based, which eases stress on monitoring financial transactions and reduces cash management risk.

f) The company has well-diversified and cost-effective financing profile.

g) It has experienced management team with qualified operational personnel and marquee investors.

6) Strategies

HFFC intends to continue to scale up the business and improve operational efficiency and profitability through the following key strategies:

a) The company seeks to leverage technology to grow business and drive operational efficiency.

b) The company intends to expand business in a contiguous manner into regions with increasing urbanization, growing commercial activity and rising household incomes.

c) HFFC focusses on increasing the productivity of existing branches to drive growth.

d) The company intends to diversify the sources of funding to reduce dependence on term loans and optimise capital costs.

e) As the company increases the scale of operations and expands into new geographies, it intends to focus on enhancing risk management framework to maintain the credit quality of loan portfolio.

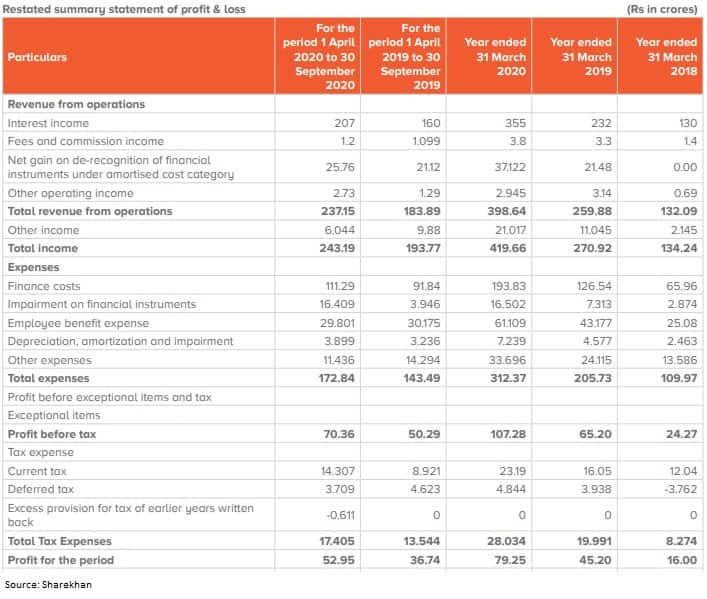

7) Financials and Peers Comparison

Its gross loan assets have grown at a CAGR of 63.4 percent between FY18 and FY20. The salaried customers account for 73.1 percent of its gross loan assets and self-employed customers 25 percent of gross loan assets as of September 2020.

As on September 2020 and March 2020, its Stage-3 loan assets expressed as a percentage of gross loan assets were 0.74 percent and 0.87 percent, respectively.

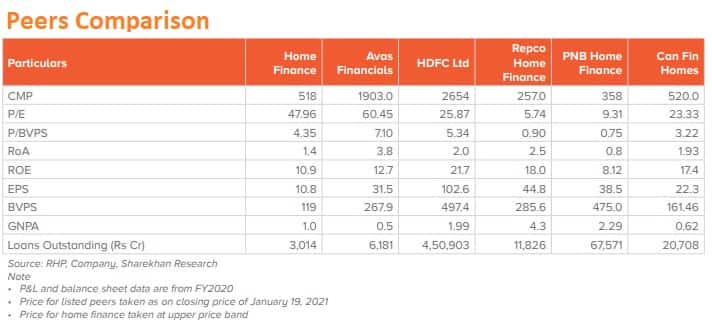

"A granular business with average ticket size of its housing loans of Rs 10.1 lakh, with an average loan-to-value on gross loan assets of 48.8 percent, as on September 2020 places it at lower competition intensity from banks and other peers. However, on a P/BVPS (of FY2020) basis, its valuation is on the higher side, as compared to peers," said Sharekhan in its note.

8) Promoters

True North Fund V LLP and Aether (Mauritius) are the promoters of the company. Promoters held 4,34,80,894 equity shares, comprising 52.85 percent of the pre-offer paid-up equity of the company, including 31.74 percent of True North.

9) Shareholding Pattern

10) Management

Manoj Viswanathan is a Managing Director and the Chief Executive Officer of the company. He has over 24 years of experience in consumer lending. Previously, he was associated with Computer Garage, Asian Paints India, Citibank and CitiFinancial Consumer Finance India as vice president of personal loans. He joined the company as a Director with effect from June 2010.

Deepak Satwalekar is the Chairman and Independent Director of the company. Previously, he was associated with Housing Development Finance Corporation as a director and HDFC Standard Life Insurance Company as the managing director and chief executive officer.

Sakti Prasad Ghosh and Sujatha Venkatramanan Independent Directors on the board, while Divya Sehgal, Maninder Singh Juneja, Rajagopalan Santhanam, Vishal Vijay Gupta and Narendra Ostawal are Nominee Directors.

Nutan Gaba Patwari is the Chief Financial Officer of the company. She is a certified chartered accountant from the Institute of Chartered Accountants of India. She has over 14 years of experience in finance. Prior to joining the company, she was associated with True North as a vice president – finance, Hindustan Unilever as an operations manager in supply management, ITC as assistant finance and Philip Morris Asia as manager of planning.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!