Smallcap IT services company Happiest Minds Technologies is set to open its initial public offering on September 7 and the same will remain opened till September 9.

Equity shares after the completion of public issue will be listed on the National Stock Exchange and on BSE Limited.

The book running lead managers (BRLM) appointed for the public issue are ICICI Securities and Nomura Financial Advisory and Securities India, while KFin Technologies is the registrar to the IPO.

Here are 10 key things one should know before subscribing the issue:

1) Public Issue

The IPO comprises a fresh issue of Rs 110 crore and an offer for sale aggregating up to 3,56,63,585 equity shares by promoter and investor.

Promoter Ashok Soota will sell his 84,14,223 equity shares and investor CMDB II, a private equity fund managed by JP Morgan Investment Management Inc, will offload 2,72,49,362 equity shares via offer for sale.

2) Price Band

The company in consultation with merchant bankers has fixed its issue price band at Rs 165 to Rs 166 per equity share.

3) Public Issue Size

Happiest Minds plans to raise Rs 702 crore via initial public offering, at higher end of price band mentioned above.

4) Objectives of The Offer

The company proposed to utilise the net proceeds from the fresh issue towards long term working capital requirement and general corporate purposes.

It will not receive any proceeds from the offer for sale. Promoter Ashok Soota and investor CMDB II will be entitled to their respective portion of the net proceeds of the offer for sale.

5) Lot Size

Investors can bid for a minimum of 90 equity shares and in multiples of 90 equity shares thereafter. The face value of the equity share is Rs 2 each.

6) Company Profile and Industry

Positioned as 'Born Digital. Born Agile', Happiest Minds focusses on delivering a digital experience to its customers. Its business is divided into three business units - digital business services, product engineering services, and infrastructure management & security services (IMSS).

It also offers solutions across the spectrum of various digital technologies such as Robotic Process Automation (RPA), Software-Defined Networking/Network Function Virtualization (SDN/NFV), Big Data and advanced analytics, Internet of Things (IoT), cloud, Business Process Management (BPM) and security.

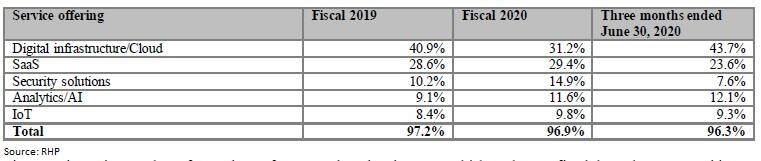

In FY20, 96.9 percent of its revenues came from digital services business.

As of June 2020, company had 148 active customers.

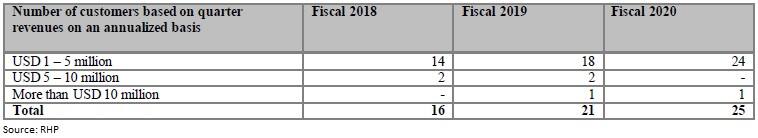

Company has one client with more than $10 million revenue and 24 clients with $1-5 million revenue range. It received 77.3 percent revenue from US clients, 10.9 percent from India and 9.8 percent from UK in FY20.

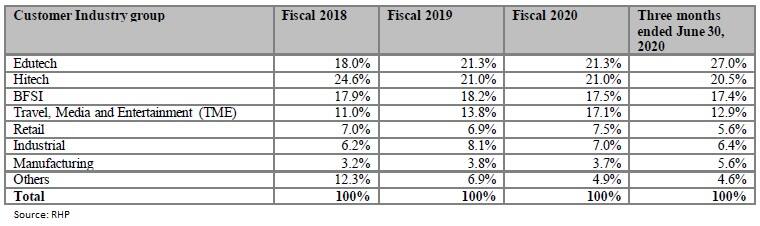

Contribution to total revenue by customer industry groups:

The Frost & Sullivan Report estimates the global digital services market of $691 billion in 2019 to grow at a CAGR of 20.2 percent to $2,083 billion by 2025. The agency also said the legacy IT market as a percentage of total technology spend is estimated to decline from 85.7 percent share in 2019 to 65 percent share by 2025, with digital spend making up the remaining 35 percent share by then.

7) Financials

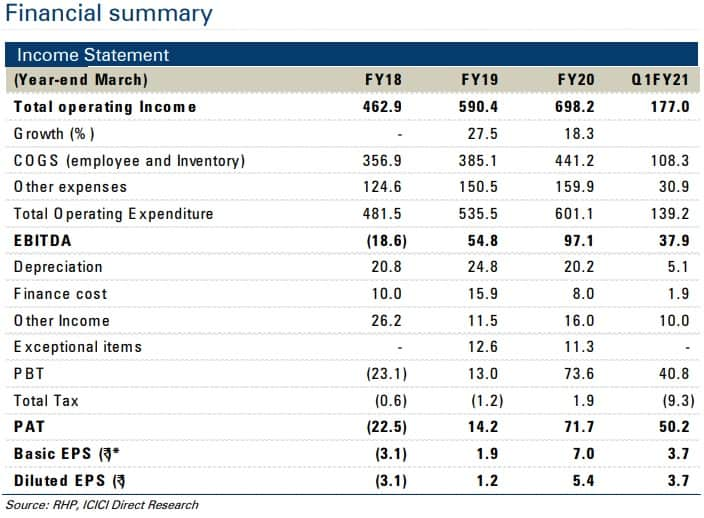

Its compounded annual growth rate (CAGR) in total income at 20.8 percent and EBITDA 285.3 percent between FY18 and FY20.

In the three months ended June 2020, its total income was Rs 1,86.99 crore, EBITDA was Rs 47.82 crore and restated profit for the quarter was Rs 50.18 crore.

8) Strengths and Strategies

Strengths

=Strong brand in digital IT services

=Growing high revenue generating customer accounts with a high proportion of repeat revenues and revenues from mature markets

=End-to-end capabilities spanning the digital lifecycle from roadmap to deployment and maintenance

=Strong R&D capability with depth in disruptive technologies creating value through newly engineered solutions

=Agile engineering and delivery

Strategies

=Acquire new accounts and deepen key account relationships

=Further investments in centers of excellence (CoEs) and digital processes

=Strengthen existing partnerships and enter into new partnerships with independent software vendors

=Domain led approach towards customer acquisition and revenue generation in specific verticals

=Attract, develop and retain skilled employees to sustain service quality and customer experience

=Selectively pursue strategic acquisitions

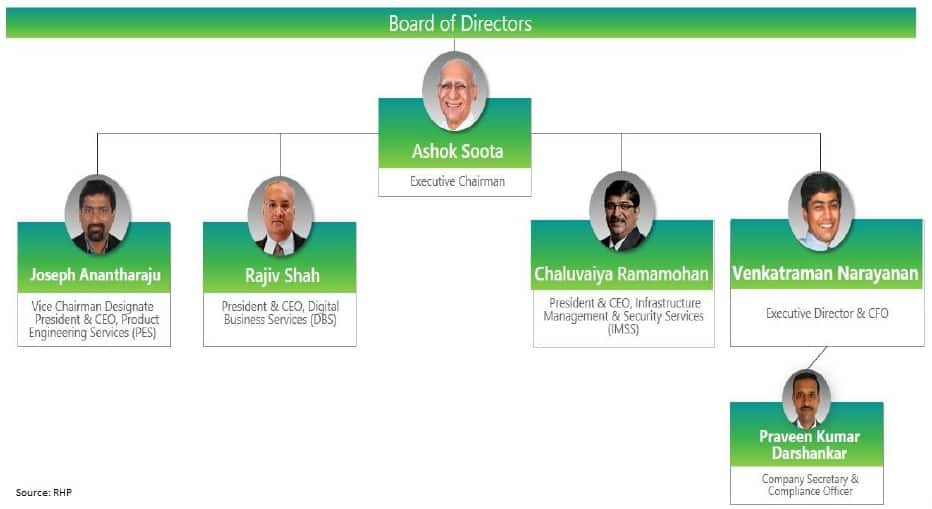

9) Management and Shareholding

Promoter Ashok Soota is the Executive Chairman and Director of the company. Prior to founding Happiest Minds, Ashok was the founding Chairman and Managing Director of MindTree which was acquired by L&T Group. He was the vice chairman of Wipro and senior vice president of Shriram Refrigeration Industries prior to co-founding MindTree.

Venkatraman Narayanan is the Executive Director and Chief Financial Officer of the company.

Avneet Singh Kochar is the Non-Executive Director, while Anita Ramachandran, Rajendra Kumar Srivastava and Shubha Rao Mayya are Independent Non – Executive Directors.

Promoter Ashok Soota held 48.83 percent stake in the company, followed by CMDB II 19.43 percent, Ashok Soota Medical Research LLP 12.80 percent and Happiest Minds Technologies Share Ownership Plans Trust 4.07 percent, as per the RHP filed in August 2020.

10) Allotment and Listing

Tentatively the company will finalise the basis of allotment on September 14, while the refunds or unblocking of funds from ASBA accounts which did not get any share in allotment will take place on September 15.

Shares will be credited to accounts of eligible investors on September 15 and the trading in shares will commence from September 17.

Company said this above timetable was indicative in nature and did not constitute any obligation or liability on company, the selling shareholders or the BRLMs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!