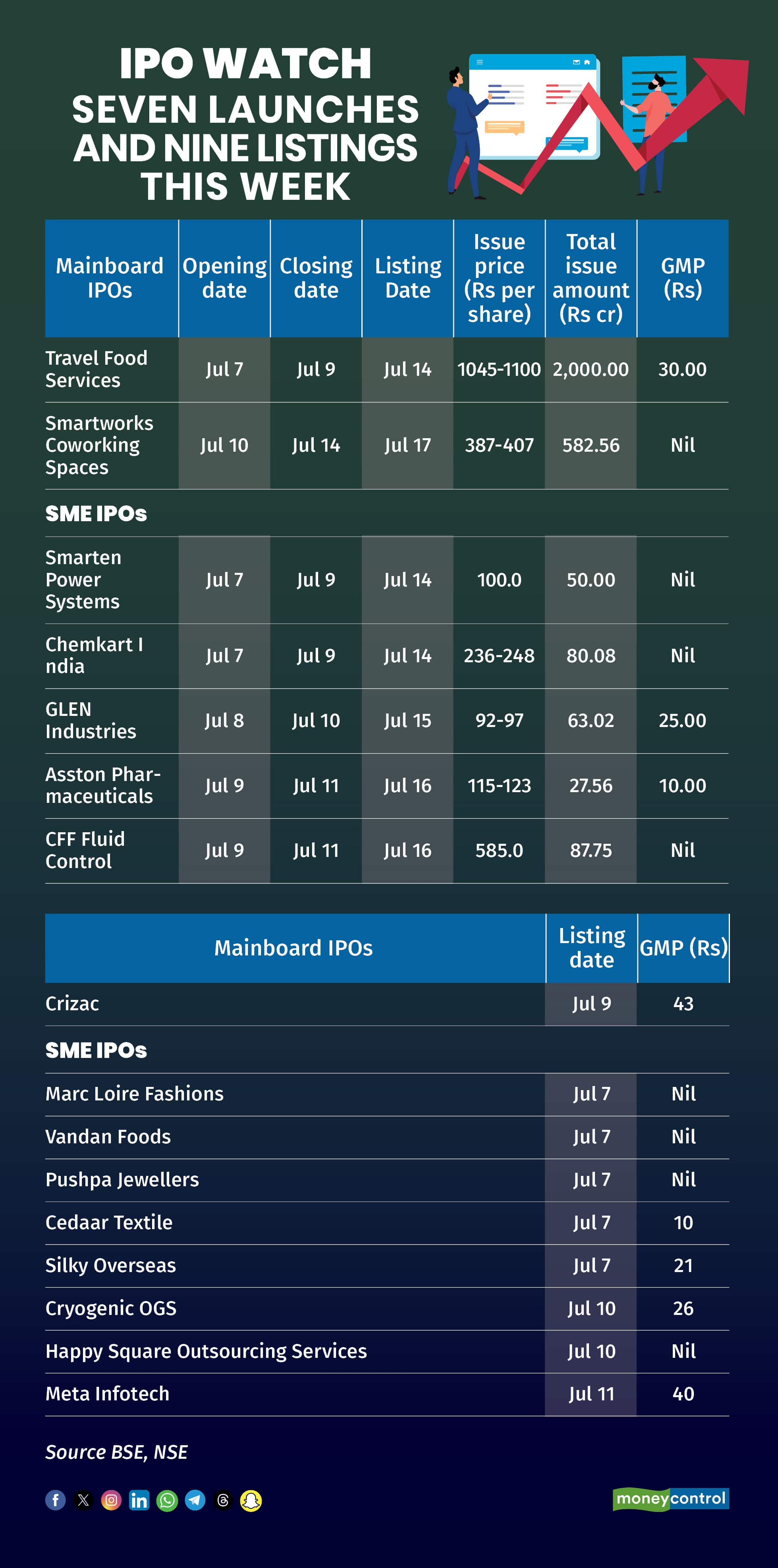

The week starting July 7 is expected to be busy for capital markets, with two large IPOs and five SME public issues opening for subscription, along with nine companies scheduled to list on the exchanges.

The trend shows investor sentiment remains buoyant despite a rising scrutiny over valuations and subdued gains from recent listings.

While many recent IPOs have witnessed strong demand from both institutional and retail investors, several listings has failed to meet investor expectations. This has also reflected in the grey market premiums (GMP), that have suggest muted debut prospects for several upcoming issues.

For instance, the IPO of Travel Food Services which opens on July 7 is commanding a modest GMP of only 3 percent over its issue price. Smartworks Coworking Spaces, set to open on July 10, has not yet seen any GMP activity. Crizac, a large listing scheduled for July 9, is trading at a premium of just 15 percent in the grey market.

In the SME segment, five companies are set to list on July 7, though three have yet to see grey market activity. The other two are trading at modest premiums of 7 percent and 13 percent despite robust subscription from investors. On July 10, Cryogenic OGS and White Force are scheduled to list, with Cryogenic OGS commanding a GMP of around 55 percent, while White Force is trading just 6 percent above its issue price. Meta Infotech, slated for listing on July 11, is reflecting a 25 percent premium in the grey market.

Prashant Tapse of Mehta Equities said this paradox is due to larger IPOs (like HDB Financial Services) absorbing liquidity, making it harder for GMP to rise significantly, followed by valuation concerns as majority of the IPOs are being priced aggressively, leaving little upside on listing.

"We also see caution often spills over primary markets in last few weeks ahead of Trump Tariff deadline fueling the trend and softening GMP despite the undertone enthusiasm is optimistic", Tapse said.

In terms of new large offerings this week, Travel Food Services and Smartworks Coworking Spaces will launch their IPOs on July 7 and July 10, closing on July 9 and July 14, respectively. Travel Food Services plans to raise around Rs 2,000 crore, with a price band of Rs 1,045–1,100 per share. Smartworks is targeting a raise of around Rs 583 crore, with shares priced between Rs 387–407.

In the SME space, Smarten Power Systems and Chemkart India will open their IPOs on July 7, closing on July 9. Chemkart has set a price band of Rs 236–248 per share to raise around Rs 80 crore, while Smarten is offering shares at Rs 100 apiece to mobilize approximately Rs 50 crore. GLEN Industries will open its IPO on July 8 and close on July 10, aiming to raise around Rs 63 crore at a price band of Rs 92–97.

Further, Asston Pharmaceuticals and CFF Fluid Control Ltd will open their IPOs on July 9 and close on July 11. Asston has announced a price band of Rs 115–123 per share and is looking to raise Rs 27.6 crore. Details of CFF Fluid Control’s issue are awaited.

Independent market analyst Ajay Bagga said while Indian markets have been consolidating since hitting record highs in September 2024, primary market activity remains intense across both the mainboard and SME segments. With over Rs 1 lakh crore raised through IPOs, offer-for-sale (OFS), and QIPs - much of it from Indian promoters and private equity exits - there has been a notable diversion of liquidity from the secondary markets, which have largely been rangebound for the past nine months.

Listing this weekOn the listing front, nine companies are debuting this week, eight SMEs and one mainboard. On July 7, Marc Loire Fashions, Vandan Foods, Pushpa Jewellers, Cedaar Textile, and Silky Overseas list on the SME platform. Cryogenic OGS and Happy Square Outsourcing Services will list on July 10, while Meta Infotech will debut on July 11.

Crizac, the only mainboard listing, is scheduled for July 9. Notably, the IPOs of Cryogenic OGS and Happy Square will close on July 7, while Meta Infotech's public issue will close on July 8.

Given the tepid GMP trends and aggressive valuations, analysts expect investors to become more selective and price-sensitive going forward. It is increasingly evident that the IPO market is being driven more by short-term trading sentiment than by long-term investment conviction.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.