Anubhav Sahu Moneycontrol research

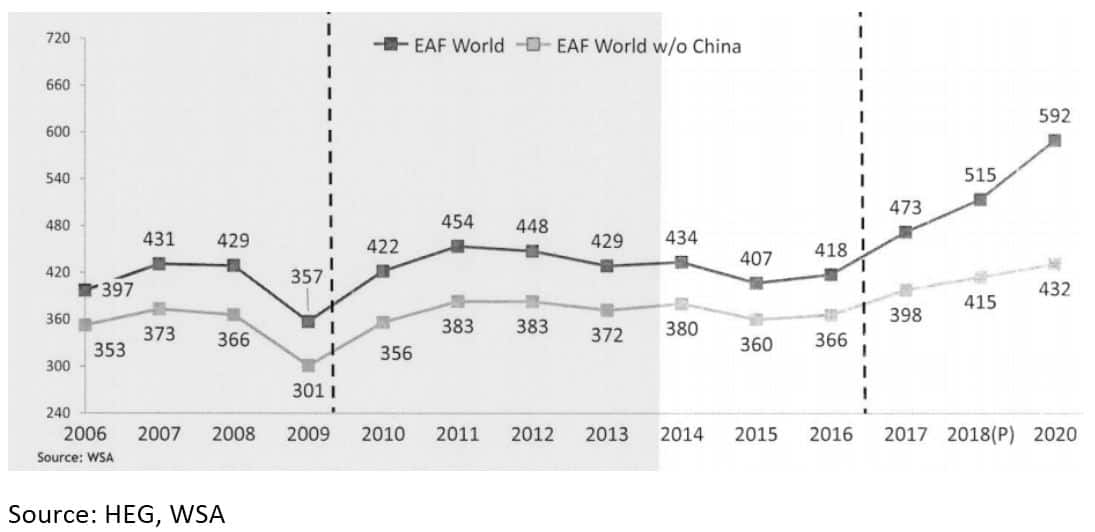

Graphite electrode manufacturers witnessed another set of stellar results benefiting from the higher usage of EAF (electric arc furnaces) route for Steel manufacturing and limited supply (time lag in getting Greenfield capacity is 4-5 years). While this keeps the free cash flow visibility intact for the graphite manufacturers in the medium term, raw material constraints in terms of limited needle coke supply cap the volume growth.

Also read: Graphite electrodes supply-demand dynamics: Let’s do the math, again!

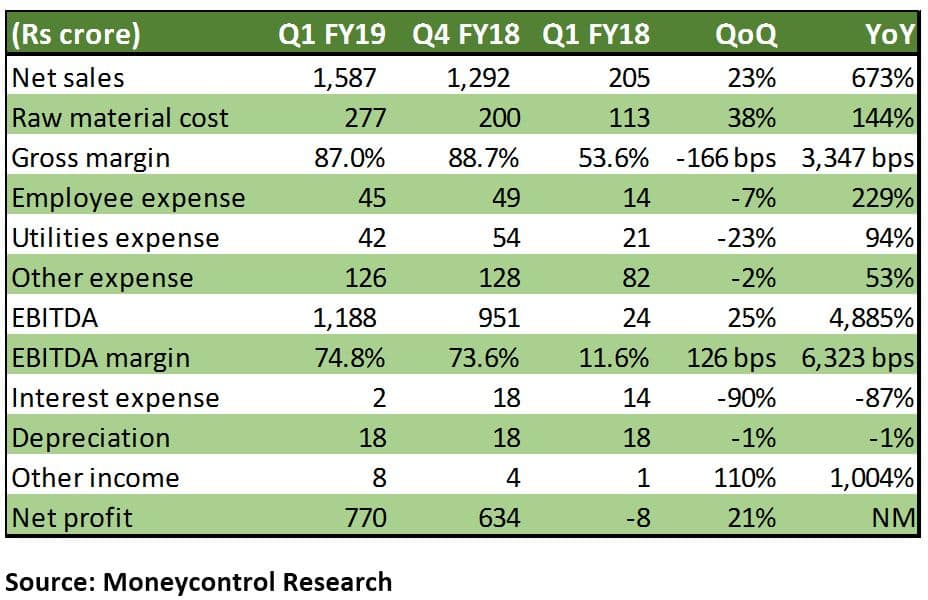

HEG’s quarterly update

HEG’s quarterly result witnessed another strong quarter with sales up 23 percent sequentially and exhibited the benefit of the change in pricing trend and progress in contract renewals for the graphite electrodes. With 82 percent capacity utilization, the company is broadly operating with the steady momentum partially impacted by the shortage in raw material (needle coke).

As the raw material prices scale up, not surprisingly gross margin expansion cycle is stabilizing.

Pls read: Cash flow visibility remains intact

Sales realisation per ton is now higher by 26 percent sequentially. It’s noteworthy here that needle coke prices have a lag of six months from the time of contracts on account of processing time needed for manufacturing graphite electrodes. Due which a sharp increase in raw material cost recently would have a bearing on reported margins unless sales realisation improvement to continue with a similar momentum.

Sequentially, the operating performance has also improved as lower power expense and better operating leverage have aided EBITDA margin expansion of 126 bps.

Graphite India: strong uplift in realisation

Graphite India’s sales realisation has jumped 54 percent sequentially as the percentage of new contracts in the overall sales scaled up. Till Q4FY18, the company had to fulfill certain low priced contracts from both India and Germany. However, in the quarter under review, both HEG and Graphite India have similar margin profiles.

Further, both HEG and Graphite India have expectedly realized graphite electrodes sales at ~$14,000 -$15,000 per ton.

Table: Graphite India Q1

China factor remains supportive for Graphite electrode price

EAFs are increasingly replacing the induction furnaces/blast furnace method in China. Steel production in China through EAF route is expected to increase by three times in 2020 to 160 million tons (20 percent of total) vs. 52 million tons (5 percent) in 2016. As per Graphite India, around 56 new EAF furnaces are expected to come online in 2018 with an aggregate capacity of 60-70 million tons.

Needle coke supply: A key capacity constraint

As highlight earlier, Conoco Phillips is on the verge of debottlenecking its needle coke manufacturing plant (50-60,000 tons) with supply to the market expected by the end of current calendar year. This allays the short-term worry of raw material supply to some extent. Apparently, HEG has a six-monthly contract with Conoco Phillips for the needle coke supply.

On a medium to longer term, complete lack of any greenfield announcement for needle coke is puzzling given the fact that both end markets of needle coke: Lithium-ion (~15 percent usage) and graphite electrodes are witnessing promising growth outlook. HEG management clarifies the technology and the gestation period to get the new plant is a critical constraint. A typical Greenfield project may take more than 4-5 years for commission and post-completion, plant stabilisation may take another nine months.

Additional risks to monitor

Revenue exposure to Iran is one potential risk in periphery given the geopolitical situation. HEG, for instance, has a revenue exposure of 6-7 percent from Iran. However, given the history, HEG management is hopeful that current global trade diplomacy may not extend from oil to industrial products like graphite electrodes. Nevertheless, the company has contracts until September from Iran.

Another risk to monitor is the usage of petcoke by graphite electrode industry which currently is not allowed by the Supreme Court. However, the company is hopeful that this usage would be allowed after appropriate representation to the government as apparently, petcoke used in graphite electrode industry is of high grade with low Sulphur content and hence have a relatively limited adverse impact on the environment.

Going forward

As we highlighted earlier that we may already be past the peak of margin cycle as the impact of new needle coke contracts seeps into the income statement with a lag. This trend seems to be playing out.

However, on the volume front, the current market situation leads us to a dichotomy wherein, on the one hand, we have strong impetus from increasing EAF route of steel making supporting graphite electrode industry, while on the other hand there is a shortage of needle coke needed for graphite electrode. The very reason that there are no new greenfield projects been announced on needle coke front and at the same time there is a sharp increase in the number of EAF plants in China may be concealing few developments underneath which may include technological developments underway.

To resolve this mathematical impossibility, fresh investment for needle coke may follow at some point which may justify the time and technological risk of investing in needle coke facility. Or the competing mode of steel making, blast furnace, improvises in terms of environment salience and technology. Even if the later prospect emerges, it would take significant time and till that period the steady state of cash flow for the graphite electrode players can remain intact.

The point we are drawing to investors’ attention is that though there is still a compelling reason to add graphite players given the fundamental rationales, one should also keep in mind that cyclicality of the business is not totally absent. The industry remains exposed to numerous business-related risks –technological, environmental, end-market prospects, competing for technology and regulatory. Interestingly, due to regulatory reasons graphite industry players get significantly lower realisations from the domestic clients.

All in all, investors with a high risk appetite only should add a position to graphite electrode manufacturers.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.