A day after the European Union (EU) slapped a phased embargo on Russian oil imports, the Organization of the Petroleum Exporting Countries plus (OPEC+) agreed to another modest monthly oil output increase, arguing that the producer group could not be blamed for disruptions in Russian supply. Incidentally, Russia is a member of this group.

In its May 5 meeting, the group also said that China's coronavirus lockdowns threatened the outlook for demand. OPEC+ agreed to raise its June production target by 432,000 barrels per day (bpd), in line with its existing plan to undo the curbs enforced in 2020 when the pandemic impacted overall oil demand.

Also Read: OPEC+ sticks to modest oil output hike despite price rally

There were calls from several countries that the group, which exercises significant power to influence global oil prices, pumps in some fuel to cool down prices. OPEC+ ignored these calls. With the Russian invasion of Ukraine that resulted in supply chain disruptions and high oil prices, OPEC’s stance over its oil output has come under fire.

Analysts reckon that EU’s sixth set of sanctions against Russia - the toughest one yet as it aims, among other things, to phase out supplies of Russian crude oil within six months, will drive energy prices further.

In a month's time, the EU also seeks to ban all shipping, brokerage, insurance, and financing services offered by its companies for the transport of Russian oil.

There seems to be no end in sight to the Russia-Ukraine war which has been raging for over two months. EU’s latest sanction exacerbates inflationary pressures. Will OPEC+ infuse more oil to heal the wounds sustained by the global economy?

This article, which is the second of a three part special series on the impact of the EU sanctions on Russia, will look at the role of OPEC+. The first story was a deep dive on the impact of the oil embargo on Europe.

Also Read: Explained| What does the EU ban on Russian crude oil mean for Europe

What are OPEC and OPEC+ ?The OPEC nations are responsible for producing 30 percent of the world’s crude oil output – about 28 million barrels per day – with Saudi Arabia being the single-biggest oil producer within the organisation, producing over 10 million barrels per day.

With 13 members at its core – mainly Middle Eastern and African countries -- OPEC was formed in 1960, to fix the global supply of oil and set its price. OPEC joined forces with 10 non-OPEC oil producers in 2016 – when oil rates were significantly low -- to create OPEC+.

The group of 23 oil-exporting countries – that together produce 40 percent of the world’s crude oil, meet every month in Vienna to decide the amount of crude oil output that needs be infused into global markets.

Notably, Russia – the world’s biggest exporter of crude and oil products combined, which produces over 10 million barrels of oil per day -- is also a member of OPEC+.

Also Read: Oil falls on uncertainty over Russian energy embargo by EU

Why isn’t OPEC+ boosting oil output?The US and UK – the world’s major importers of oil -- want OPEC+ to lower prices by putting more oil into the global market. US President Joe Biden and UK Prime Minister Boris Johnson have appealed to Saudi Arabia to increase its oil output.

However, if OPEC+ infuses more oil into global markets, it would likely be in favour of the Western importers, who are otherwise leaving no stone unturned to disrupt the Russian economy with hard-hitting sanctions. Since Russia is one of the two biggest partners in the alliance, OPEC+ has to maintain a balanced approach in its decisions.

Callum Macpherson, head of commodities at Investec, told Reuters that only Saudi Arabia and the United Arab Emirates had the capacity to scale up supply significantly, adding: "If they were to do so, the ensuing falling out with Russia could bring an end to OPEC+."

When the COVD-19 pandemic hit the world and almost all nations went into lockdowns, crude oil prices crashed due to lack of buyers. Due to this, OPEC+ slashed production by 10 million barrels per day to drive the price back up.

Demand for crude began to recover in June 2021 and OPEC+ gradually increased supply, putting an extra 400,000 barrels per day into global markets. However, after Russia invaded Ukraine, crude oil prices soared to as high as over $100 a barrel, but OPEC+ hasn't budged from its plan to gradually increasing supply.

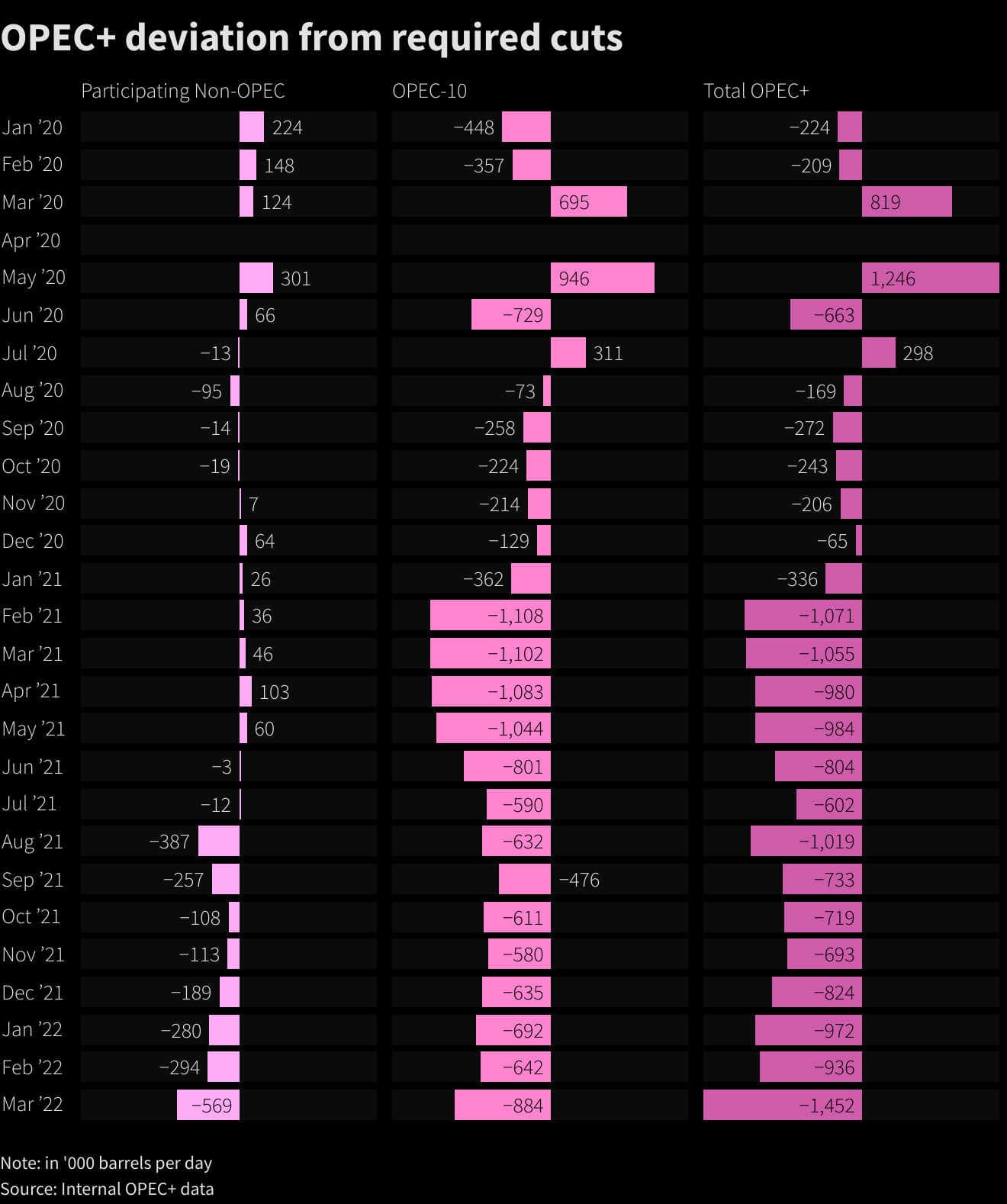

Another reason why OPEC+ isn’t rushing to increase output is because some of its members do not have sufficient oil to pump into the markets. It has to led to an overall OPEC+ shortfall – with Angola and Nigeria majorly responsible for the supply gap, according to Reuters. OPEC+ pumped 1.45 million bpd -- equal to 1.5 percent of world supply -- below its target in March.

OPEC+ deviation from required cuts (Graphic Credit: Reuters)

OPEC+ deviation from required cuts (Graphic Credit: Reuters)In March, when crude prices hit their highest since 2008 at more than $139 a barrel after Russia's invasion of Ukraine, the OPEC+ supply shortfall was a contributing factor to the record-setting mark.

Also Read: India defends Russian oil imports as EU proposes gradual ban

Way forwardThe EU’s oil embargo could deprive Moscow of a major revenue stream as around half of Russia's 4.7 million barrels per day of crude exports go to the EU. The ban will likely force Russia to reroute its flows to Asia and reduce production by a huge margin while the EU will compete for the remaining available supply.

"OPEC+ continues to view this as a problem of the West’s own making and not a fundamental supply issue that it should respond to," Macpherson told Reuters.

In the absence of Russian oil, the EU is likely to face higher energy bills and a slowdown of economic activity upon insufficient and moderately priced alternatives. OPEC Secretary-General Mohammad Barkindo said that it was not possible for other producers to replace Russian exports of more than seven million bpd. "The spare capacity just does not exist,” he said.

Analysts foresee the global market potentially losing up to two million barrels within six months if all 27 EU governments agree to the proposed sanctions against Russia, besides concerns of rebuilding the global supply chain network in a short period of time.

Also Read: Europe is about to ban Russian oil: What’s next?

Supply chain makeover‘’OPEC has failed to bridge the supply gap that we have already witnessed recently and in March too, OPEC and allies produced 1.45 mbpd below their output targets in March 2022,’’ said Sugandha Sachdeva, VP-Commodity & Currency Research, Religare Broking.

“Besides, rerouting spare capacity towards Europe would be a difficult task in a short period, after fulfilling the requirements of Asian buyers including China and India. Another concern is that rebuilding or makeover of the whole supply chain and distribution network in such a big region is not a small task, it takes years and huge capital to create a vast infrastructure,’’ she added.

In early Asian trade on Wednesday, oil edged lower, sustaining weakness that was caused by risks to demand from economic recession and on uncertainty of the embargo on Russian oil. Brent crude was last down 86 cents, or 1.1 percent, at $101.60 a barrel, while US West Texas Intermediate crude fell 80 cents, or 0.8 percent, to $98.96 a barrel.

Once the Russian oil ban and other latest sanctions roll out, the global economy is expected to witness an energy crunch which could raise the prices of refined products such as petrol, diesel, and aviation fuel. The high prices will fuel global inflation and discourage people from spending that would have otherwise supported economic recovery.

In the next and final installment of the series, read about what the EU ban on Russian crude oil imports means for India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.