After the European Union (EU) on May 4 announced a phased oil embargo on Russia in its sixth set of sanctions against the Vladimir Putin-led war in Ukraine, several countries, including India, stare at a crisis on cutting off Russian crude oil imports, besides what it could mean for the global economy—already reeling under inflationary pressures and supply chain disturbances.

The EU’s measures include phasing out supplies of Russian crude oil within six months and refined products by the end of 2022, European Commission President Ursula von der Leyen announced in the European Parliament in Strasbourg.

It also proposes to ban in a month's time all shipping, brokerage, insurance, and financing services offered by EU companies for the transport of Russian oil. The proposal, if agreed to by all 27 EU governments, would likely mark a watershed moment for Europe, which is heavily dependent on Russian oil to meet its energy requirements. In this backdrop, EU also faces an uphill task to find alternative supplies for weaning itself off the imports.

Among other new punishments, EU also announced sanctions on Russia's top bank and a ban on Russian broadcasters from European airwaves to deepen Moscow's isolation. Even though the EU, US, and UK have consistently tried to hit the Russian economy with hard-hitting sanctions, will global markets be able to withstand the relentless bloodshed or witness an unprecedented transformation on a war footing?

Also Read: What happens in Ukraine will have impact on Indo-Pacific: EU chief Ursula von der Leyen

How are EU and Russia dependent on each other for oil?

The phased oil embargo is EU’s toughest sanctions on Russia yet that has left European refineries scrambling for new crude suppliers. Russia is Europe's biggest oil supplier, providing just over a quarter of EU oil imports (equivalent to 26 percent) in 2020, data from the EU’s statistical office ‘Eurostat’ showed.

Russian oil makes up a fifth of oil refined in Europe, according to the International Energy Agency (IEA), a Paris-based agency gathering of the 31 mostly industrialised countries and much of the EU.

Since the start of what Russia calls a ‘special military operation in Ukraine’ two months ago, Europe has paid Russia €14 billion ($14.94 billion) for oil, according to research organisation the Centre for Research on Energy and Clean Air.

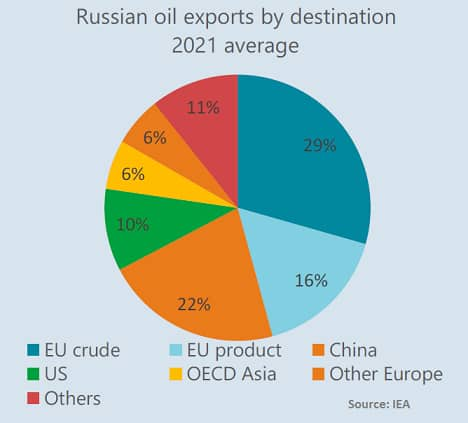

Before Russia’s invasion of Ukraine, the EU imported 2.2 million barrels per day (bpd) of crude oil from Russia and 1.2 million bpd refined oil products, according to the IEA. Europe is the destination for nearly half of Russia's crude and petroleum product exports.

Russian oil exports by destination (Graphic Credit: Reuters)

Russian oil exports by destination (Graphic Credit: Reuters)

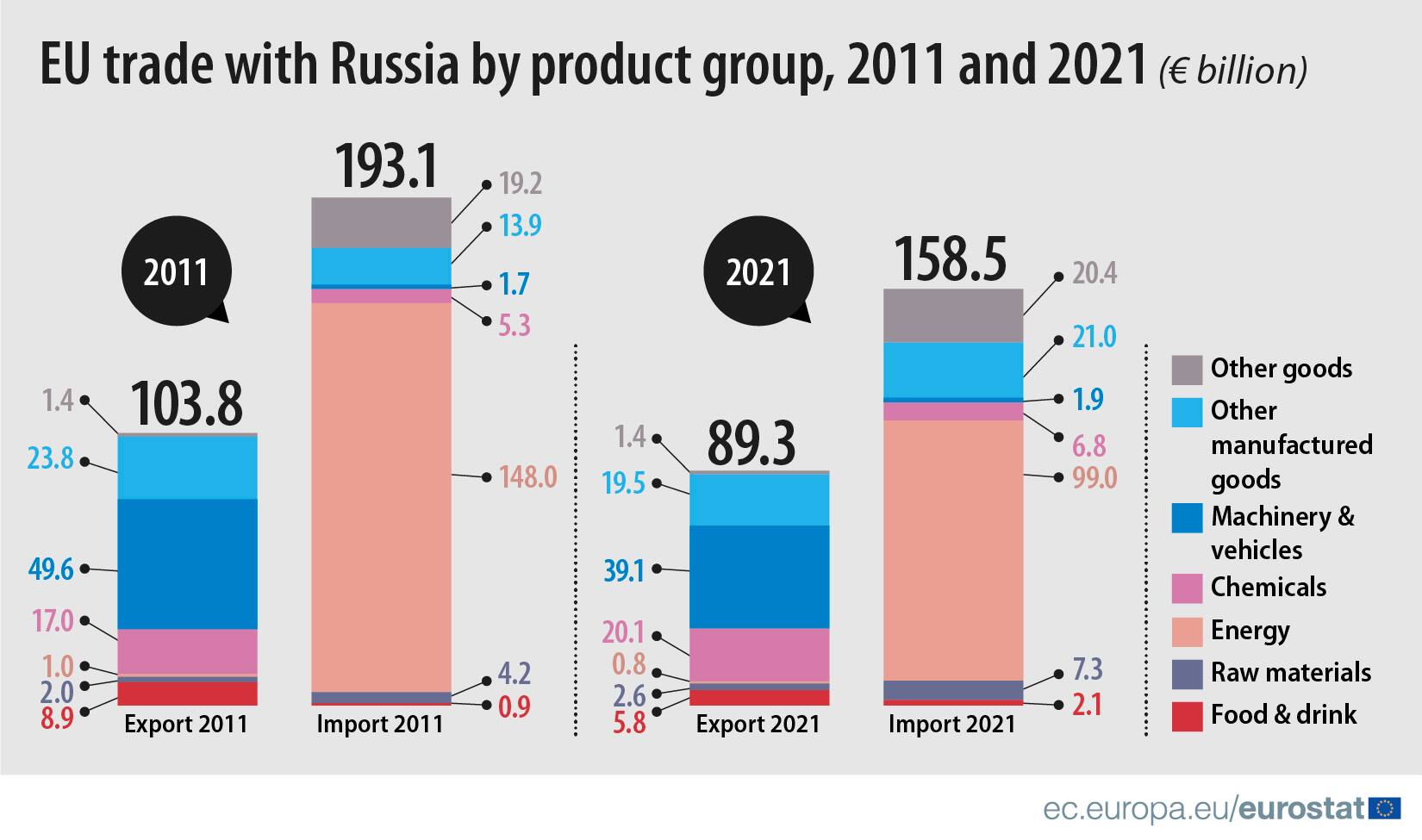

In 2021, Russia was the fifth-largest partner for EU exports, and the third-largest partner for EU imports, according to Eurostat. Eurostat data reveals that energy was the most imported product by the EU from Russia in 2021.

Energy represented 62 percent of EU imports from Russia last year, equivalent to €99 billion. However, it indicated a significant drop of 14.2 percentage points (pp), compared to 2011, when energy represented almost 77 percent of EU imports from Russia, equivalent to €148 billion. The abrupt fall in 2020 was linked to the reduction in energy demand due to the COVID-19 pandemic, according to the statistical office.

Energy represented 62% of EU imports from Russia last year (equivalent to €99 billion) (Graphic Credit: Eurostat)

Energy represented 62% of EU imports from Russia last year (equivalent to €99 billion) (Graphic Credit: Eurostat)

Also Read: Eurozone growth slows as inflation stays at record level

Dependence of EU countries on Russian oil

Some eastern EU countries are concerned that the ban would not allow them enough time to adapt, even though Hungary and Slovakia have been given time until the end of 2023.

Hungary imported 70,000 bpd or 58 percent of its total share from Russia and does not support the ban on Russian oil out of fear of its energy security, according to the IEA.

Slovakia has asked for a three-year transition period and the Czech Republic is in talks for the EU oil embargo exemption. Slovakia, at 105,000 bpd, got 96 percent of its 2021 oil imports from Russia.

Germany, which is the EU's largest economy, has said it is working to end imports of Russian oil by the end of the year. However, Germany’s Economy and Climate Action Minister Robert Habeck said that Germany could slip into recession with Russian energy embargo.

Additionally, Germany, Poland, and the Netherlands are Europe's biggest buyers of Russian oil. In Germany, 74 percent of diesel imports before the war came from Russia, data from consultancy FGE Energy shows.

Poland brought in 300,000 bpd or 63 percent in 2021. Both Germany and Poland are located on the northern route of the Druzhba pipeline - the main transit route for Russian oil exports to Europe.

Also Read: Europe is about to ban Russian oil: What’s next?

Overview

While announcing the sanctions on May 4, von der Leyen addressed Europe’s dependency on Russian oil, adding, "(Russian President Vladimir) Putin must pay a price, a high price, for his brutal aggression".

"Let's be clear, it will not be easy because some member states are strongly dependent on Russian oil, but we simply have to do it," she said.

Analysts have expressed concerns that the oil embargo poses a risk to the global economy and reckon that it could drive energy prices further.

"The price response to such measures will depend on how far they go in making Russia's 4.8 million bpd (barrels per day) of global exports unavailable as opposed to unpopular,’’ said Helima Croft, RBC Capital Market's head of global commodity in a note.

In the short term, it might imply negative consequences for the EU and global economy in terms of higher prices—not to mention retaliation risks (by Russia) on natural gas supplies, according to Simone Tagliapietra of the Brussels-based Bruegel think tank.

All EU governments are yet to agree on crucial aspects of the Russian oil embargo, including when it will take effect, how long the phase-out period will last for the existing contracts, and whether it will include all types of Russian oil.

With the phased sanction on oil, EU now faces the task of finding alternatives when energy prices have surged as it imports around 3.5 million barrels of Russian oil and oil products every day and also depends on Moscow's gas supplies.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!