The phased embargo on Russian oil imports announced this month by the European Union (EU) has posed grim prospects not just for Europe, but also for major Asian crude importers, including India. For a country that imports more than 85 percent of its oil needs, the embargo on Russian crude is likely to cause a major economic headwind.

It comes at a time when the global economy is battling constant inflationary pressures and supply-chain disruptions after the Russian invasion of Ukraine. The oil crisis triggered by the Russia-Ukraine war, among other factors, has also come to bite the Indian economy; retail inflation surged to a near eight-year high of 7.79 percent in April.

Also Read: Consumer price inflation surges to near-8-year high at 7.79% in April

Soaring inflation was worrying enough to compel the Reserve Bank of India (RBI) to reverse the rate cycle in an unscheduled off-cycle meeting on May 4, when it raised its key interest rate by 40 basis points to 4.4 percent. One basis point is one-hundredth of a percentage point. Some European countries, such as Hungary and Slovakia, which are completely dependent on Russia for their crude oil imports, are not supporting the embargo.

Also Read: Explained| What does the EU ban on Russian crude oil mean for Europe

Embargo impact

Global energy prices are likely to surge once the Russian oil embargo is implemented and all 27 EU governments agree to the proposed ban.

In its sixth set of sanctions against Russia and the toughest one yet, the EU, among other things, is seeking to ban Russian oil imports within six months and refined products by the end of 2022.

Notably, India defended its policy to import Russian crude on the same day that the EU announced the gradual oil embargo on Russia.

“International prices would further shoot up if a consumer as large as India discontinued its strategy of importing oil from diversified sources,’’ the government said in a statement, without making any reference to the EU's decision, and added that it was important to "ensure access to affordable energy for our citizens".

The government, however, clarified that energy purchases from Russia "remain miniscule in comparison to India’s total consumption".

Interestingly, this comes at a time when India has become the largest customer of Russia’s Urals crude oil on the back of steep discounts offered by the Vladimir Putin government, which is struggling under international pressure and increasingly low appetite for its oil in US and Europe.

Also Read: India defends Russian oil imports as EU proposes gradual ban

Oil at a discount?

Taking advantage of the geopolitical tensions, the world’s third-biggest oil importer is also trying to get deeper discounts on Russian oil and wants Russian crude at less than $70 a barrel on a delivered basis, according to Bloomberg.

The government has condemned the report and alleged that it tries to "sensationalise routine purchase of crude oil by Indian oil companies from Russia based on concocted source-based stories".

Even so, India is among a handful of nations that have been doubling down on Russian crude, defying international pressure and Western sanctions. But for how long? Aside from the global supply chain makeover concerns, and consistent pressure on input costs, will India be able to cover its energy requirements in the absence of Russian crude?

This article, the final of a three-part special series on the impact of the EU sanctions on Russia, will look at what the oil embargo means for India. The first story was a deep dive on the impact of the ban on Europe, and the second one looked at the role of OPEC+.

National interest first

At the 17th edition of the CNBC-TV18 India Business Leaders Awards (IBLA), Finance Minister Nirmala Sitharaman said that India has already started buying oil from Russia since it has come at a discount at a time when the country needs it.

"We have received quite a number of barrels. I would think about 3-4 days of (national) supply. I would put my country's national interest and energy security first," Sitharaman said. If fuel is available at a discount, why shouldn't India buy it, the finance minister said.

According to a Reuters report dated April 25, India bought more than twice as much crude oil from Russia in the two months since its invasion of Ukraine as it did in the whole of 2021, as refiners grabbed discounted oil that other nations have shunned.

Indian refiners placed orders for at least 40 million barrels of Russian oil since the invasion of Ukraine on February 24 for loading in the June quarter of fiscal 2022-23. This compares with total imports of Russian oil into India of 16 million barrels in the whole of 2021, according to Reuters.

Last year, two percent of its total oil imports or 12 million barrels of Urals crude, came from Russia. In 2022 so far, refiners have bought cheaper Russian oil to partly offset the impact of high crude prices.

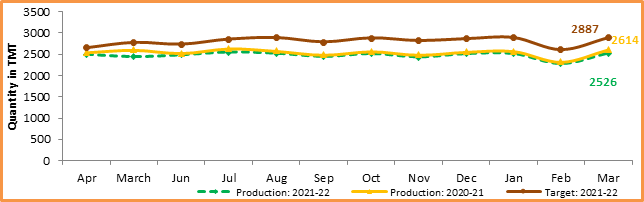

Also Read: March crude oil production at 2526.11 TMT, 12.49% lower than target

Decline in domestic oil output, high import bill

India's daily energy consumption requires around five million barrels of crude oil and a refining capacity of 250 million metro tonnes per annum (MMTPA), the petroleum ministry said, adding the country's oil companies were servicing 60 million visitors at their petrol pumps each day.

In fiscal 2021-22, India’s crude oil production fell 2.67 percent as state-owned ONGC produced less than the target. Crude oil production at 29.69 million tonnes in 2021-22 was 2.63 percent lower than the 30.5 million tonnes output a year back, and 11.67 percent below the target of 33.61 million tonnes, according to official data released by the oil ministry.

In March 2022 alone, the country’s crude oil production stood at 2526.11 thousand metric tonnes (TMT), 12.49 percent lower than the targeted 2886.55 TMT, according to government data.

Graphic Credit: Ministry of Petroleum and Natural Gas

Graphic Credit: Ministry of Petroleum and Natural Gas

Also Read: India's oil import bill doubles to $119 billion in FY22

Import dependence

The steady decline in domestic output has compelled the nation to rely more on imports. This almost doubled its crude oil import bill in FY22, led by high global energy prices.

India spent $119.2 billion in 2021-22, up from $62.2 billion in the previous fiscal year, according to data from the oil ministry's Petroleum Planning & Analysis Cell (PPAC). It spent $13.7 billion in March alone, when oil prices surged to 14-year high.

India’s merchandise export in April 2022 stood at $38.19 billion, down from $42.22 billion a month back, but imports did not fall by the same magnitude. Petroleum imports drove overall imports higher to $58.26 billion as against $60.74 billion in March, according to the latest commerce ministry data.

The import of petroleum and crude products accounted for 33.5 percent of imports in April. In value terms, $19.51 billion of these products were imported last month, registering a growth of 81.2 percent on a year-on-year basis.

Also Read: Crude oil hits 14-year high: Impact on economy and businesses

Impact on economy

Oil prices started to surge from January 2022 and rates crossed $100 per barrel in February before touching $140 per barrel in early March. Analysts reckon that global commodity price shocks will hurt the economy amid inflationary pressures.

“High crude prices are certainly very negative for the Indian economy as they feed into price pressures. As the economy has bounced back from the pandemic-led abyss, and demand is returning to pre-pandemic levels, rise in crude prices could again severely impact consumption and hurt the nascent recovery path,’’ said Sugandha Sachdeva, VP-Commodity & Currency Research, Religare Broking.

According to economists, global crude oil prices will witness volatility in the coming months, remaining sensitive to EU sanctions on Russia. Securities firms have also increased their crude oil price forecasts based upon significant external factors and macroeconomic indicators.

Also Read: Also Read: Explained | Will OPEC+ raise output amid soaring prices with EU’s ban on Russian oil?

A “structural problem”

In a research report released last month, ICICI Securities said that the broken demand-supply balance will not correct in a hurry. “What started as a supply shortage due to COVID-19/weather has now turned into a structural problem thanks to the Russia-Ukraine conflict. We do not really see the situation resolving anytime soon, and hence, assume crude prices of $85/bbl for FY23E,” ICICI Securities wrote in its report.

Motilal Oswal Securities wrote: “Crude prices will remain at record highs given the fundamental disconnect of the market. Global energy inventories remain low as energy producers significantly cut their spending over the past several years, resulting in lower supply.”

“Demand for energy continues to rebound and is closer to pre-pandemic levels. The resulting supply and demand imbalance is fertile ground for a sustained period of higher prices to $110 in coming sessions,’’ added Motilal Oswal.

Wall Street bank Morgan Stanley also trimmed India’s growth forecast for the next two fiscal years by 30 basis points due to a global slowdown and surging oil prices.

Economists see more rate hikes by the Reserve Bank of India in the coming months as inflation is set to remain elevated. All factors combined, both inflation and India’s current account deficit will likely get worse because of broad-based inflationary pressures and record-high commodity prices.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.