Finance Minister Nirmala Sitharaman on May 17 announced the fifth tranche of measures under the Atmanirbhar Bharat Abhiyan. These focussed on steps pertaining to MGNREGS, Health (rural and urban) and Education related, businesses and COVID-19, de-criminalisation of Companies Act, Ease of Doing Business, Public Sector Enterprises- related steps and state governments and related resources.

She had earlier said the announcement of measures under the economic stimulus package will be made in tranches.

The announcements under tranche 1 announced on May 13 included six measures for MSMEs, 2 for EPF, 2 for NBFCs and MFIs, 1 for DISCOMS, 1 for contractors, 1 for real estate sector, and 3 tax measures.

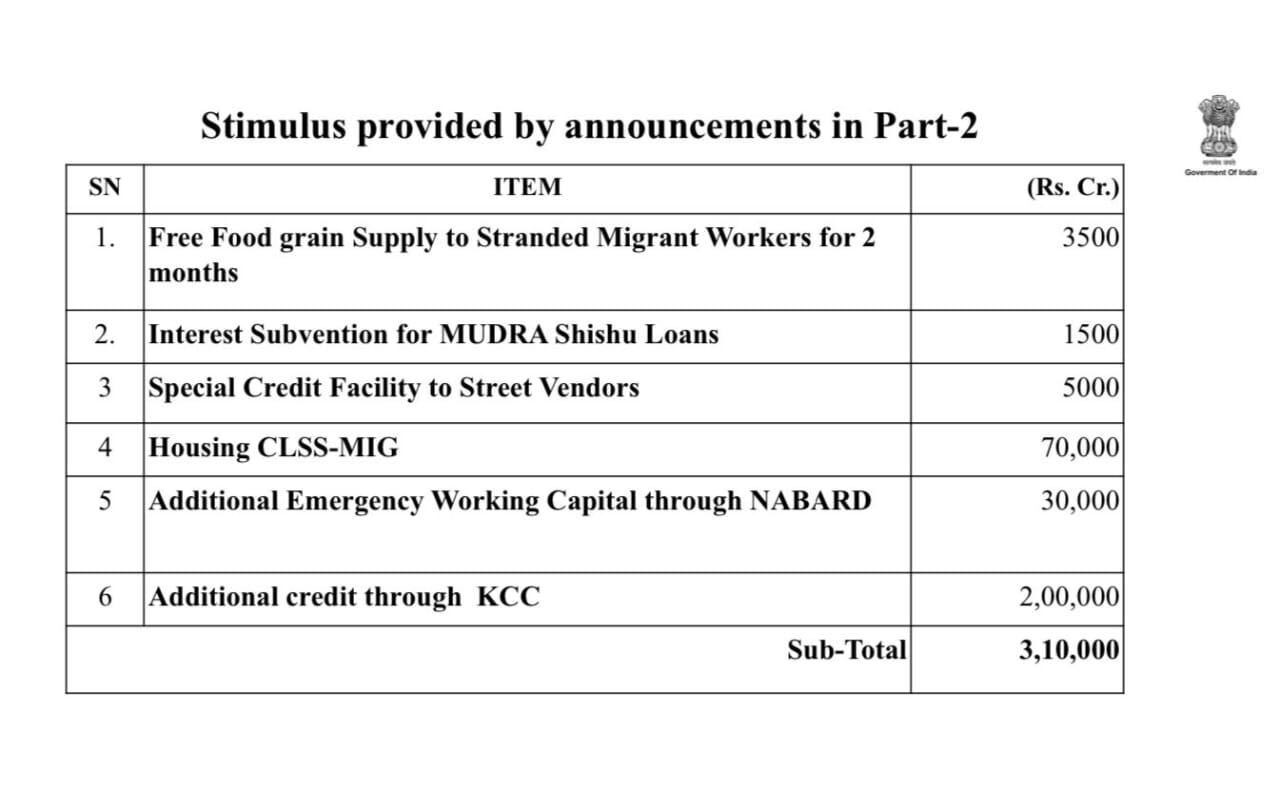

The second tranche on May 14 focussed on migrant workers, street vendors, small traders, self-employed people and small farmers.

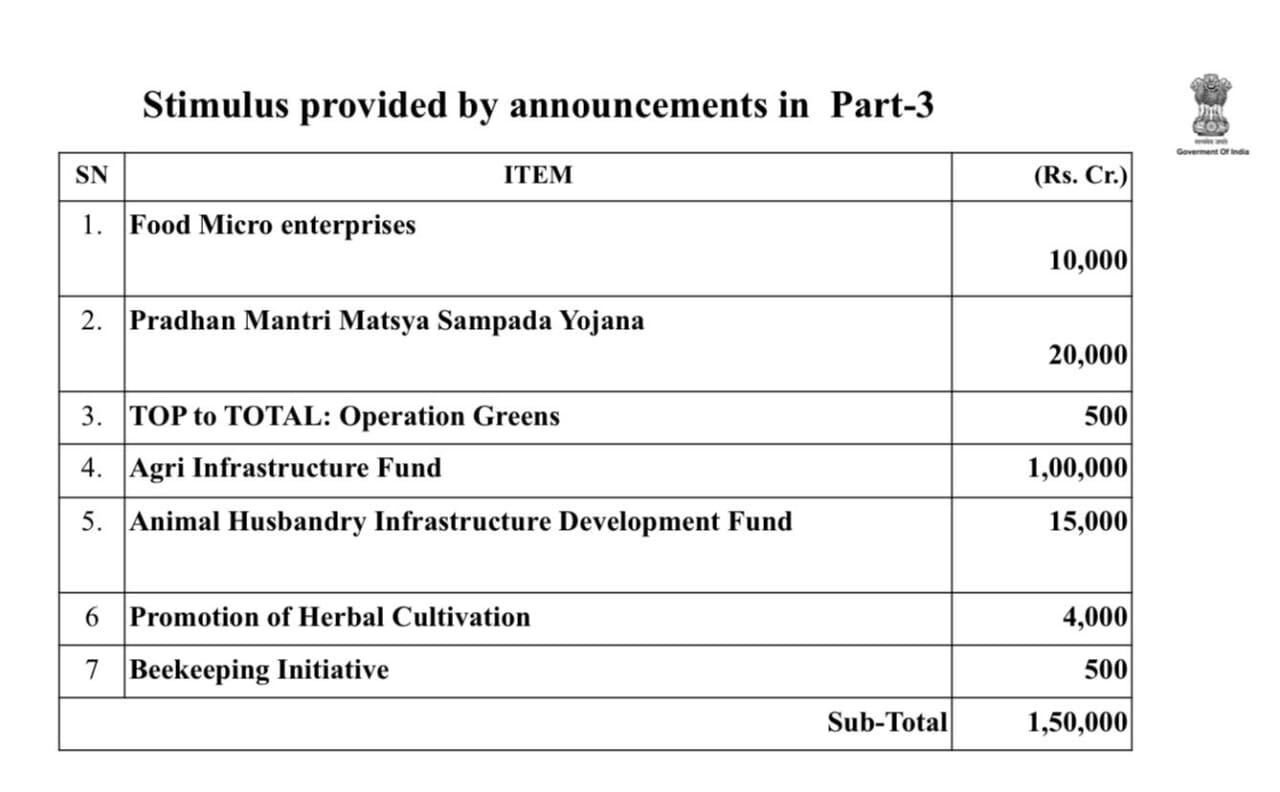

The third tranche on May 15 outlined measures for the agriculture and allied sectors, with a focus on small and marginal farmers.

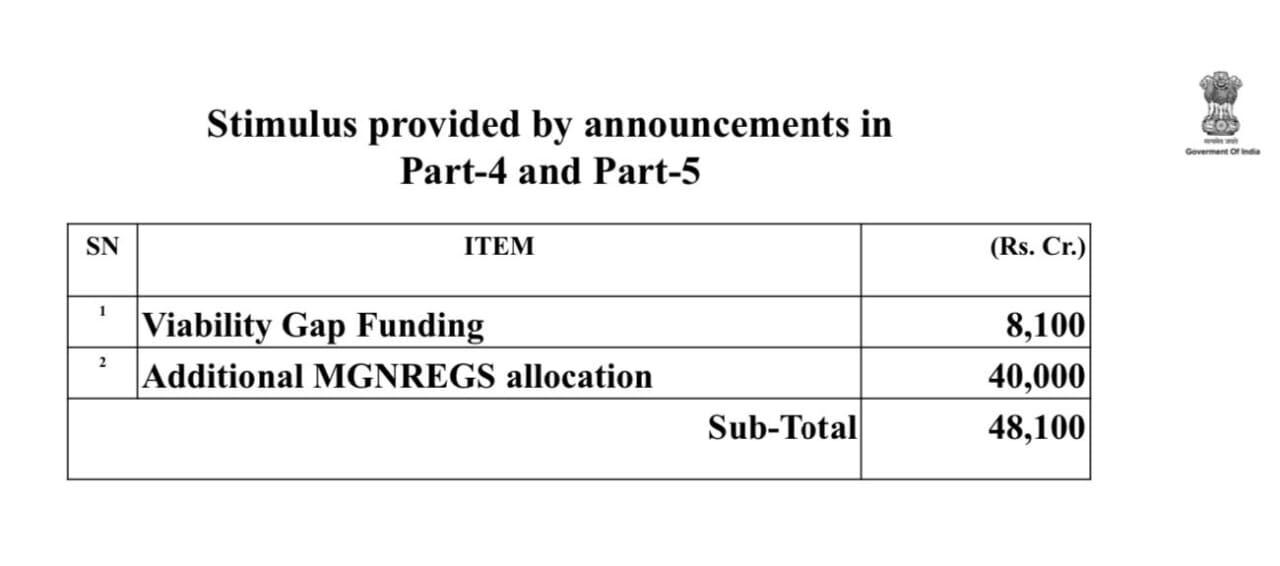

Tranche 4 focused sectoral reforms pertaining to mining, aviation, defence production, airspace management, airports and MROs, space and atomic energy.

Prime Minister Narendra Modi had on May 12 announced a Rs 20 lakh crore economic stimulus package, which he said is almost 10 percent of India’s gross domestic product (GDP). The package was aimed at aiding the country as it battles the economic effects of the coronavirus pandemic.

This Rs 20 lakh crore figure, however, includes the previous Rs 1.7 lakh crore stimulus package announced by Finance Minister Nirmala Sitharaman and steps taken by the Reserve Bank of India (RBI) since lockdown began on March 24 midnight. These earlier measures now together account to Rs 7.79 lakh crore of the complete package.

FM Sitharaman said the Centre has increased borrowing limits for states to 5 percent from 3 percent for FY21.

She added that states were already allowed to borrow 75 percent of their authorised limit from March itself, of which only 14 percent has been borrowed. States net borrowing ceiling for FY21 is Rs 6.41 lakh crore, based on 3 percent of gross state domestic product (GSDP).

FM Nirmala Sitharaman announced the fifth set of measures under the economic package today.

Additional Rs 40,000 crore were allocated for MGNREGS, above the budgetary estimate. Minimum threshold for initiating insolvency proceedings has been increased to Rs 1 crore from to Rs 1 lakh. This will help insulate MSMEs.

Borrowing limit for states for FY21 will be hiked to 5 percent from 3 percent of the GSDP. Additional resources worth Rs 4.28 lakh crore will be available to states.

On the question of why labourers are having to bear the full cost of train tickets, the FM said she isn't aware where this information is coming from. She had said earlier that 85% of the cost of tickets is being borne by the Centre and the remaining 15% by the states.

On the question ofthe fiscal deficit, FM said we are only in the month of May, and we have not even completed two full months of the fiscal year. We will talk a bit later about the fiscal deficit.

On the question on when can we expect GST dues to be given to the States, the FM said we are periodically talking about it. GST dues are clearly explained in the GST Council. All states' GST dues are due which we recognise for December, January, February, March. It has not been paid.

On the question of whether we can expect more bank mergers and privatisation going ahead, the finance minister said, no, I have not announced mergers.

MFEs: Rs 10,000 crore

PM Matsya Sampada Yojana: Rs 20,000 crore

TOP to TOTAL: Rs 500 crore

Agri infra fund: Rs 1 lakh crore

Animal husbandry infra development fund: Rs 15,000 crore

Promotion of herbal cultivation: Rs 4,000 crore

Beekeeping initiative: Rs 500 crore

Free food grain supply for migrant workers for 2 months: Rs 3,500 crore

interest subvention for MUDRA Shishu loans: Rs 1,500 crore

Special credit facility for street vendors: Rs 5,000 crore

Housing CLSS-MIG: Rs 70,000 crore

Additional emergency WCF through NABARD: Rs 30,000 crore

Additional credit through KCC: Rs 2 lakh crore