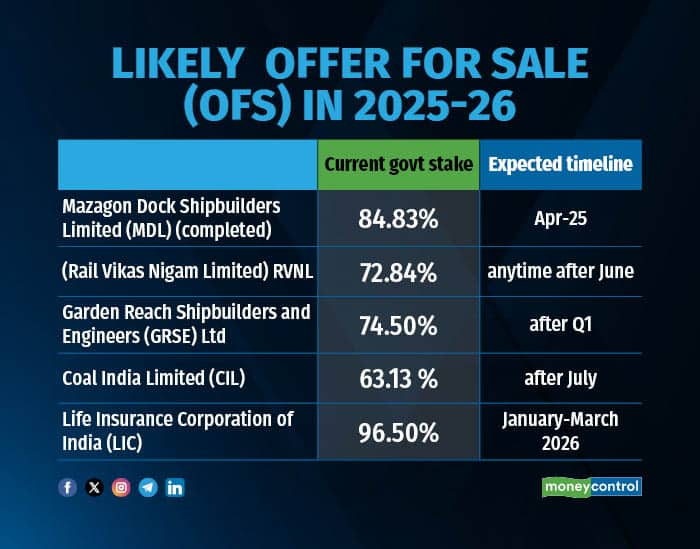

The government is planning to offload part of its shareholding in several public sector undertakings (PSUs), including Coal India, Life Insurance Corporation (LIC), Rail Vikas Nigam Ltd (RVNL), and Garden Reach Shipbuilders & Engineers (GRSE), through the Offer for Sale (OFS) route in the financial year 2025–26, two sources familiar with the development said.

The Offer for Sale in RVNL is expected anytime after the first quarter of FY26, while the LIC disinvestment could be scheduled for the fourth quarter. The LIC offering will be particularly crucial, given the heightened scrutiny following its 2022 listing and the subsequent performance of its stock. The planned disinvestments are expected to be staggered across the fiscal year and will be timed based on market appetite and company financials, they said. The move comes after the successful Rs 5,000-crore OFS in Mazagon Dock Shipbuilders Ltd (MDL), which was the first disinvestment of the current financial year.

“The RVNL OFS is likely this year. Transaction advisors have been appointed. After May, once the company’s financials for FY25 are available, roadshows will be held for investors,” a source told Moneycontrol. “GRSE is also being planned for OFS in 2025–26. Transaction advisors have been appointed for that as well,” the person added.

“The Government is looking at offloading stake in two major PSUs this fiscal – Coal India and LIC. Though in Coal India, the government's stake is closer to the 51 percent threshold. It is a good PSU and was the highest dividend contributor in 2024–25,” a second senior government official told Moneycontrol. “The Government is likely to come out with LIC OFS in the fourth quarter. Right now, the government’s major focus is on completion of the strategic sale of IDBI Bank first.”

In FY24–25, the government received a record Rs 74,016.68 crore in dividend receipts from central public sector enterprises (CPSEs). Coal India Limited emerged as the top contributor, remitting Rs 10,252.09 crore in dividends to the exchequer.

The government currently holds a 63.13 percent stake in Coal India, 96.50 percent in LIC, 72.84 percent in RVNL and 74.50 percent in GRSE.

The renewed emphasis on OFS also reflects the Centre’s pragmatic shift in disinvestment strategy. With delays in strategic divestments and asset monetisation, stake dilution through the OFS route is expected to serve as a key lever for raising non-tax revenue in FY26, while maintaining market discipline, they said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!