India's merchandise exports closed FY22 at a new all-time high of $418 billion – a figure that may be exceeded once the final numbers are reconciled. But exports rarely rise in isolation.

The country's imports and the trade deficit for the financial year gone by don't make for pretty reading. The deficit could well worsen if global commodity prices remain elevated.

In FY22, India's merchandise imports amounted to $610 billion – 6.4 percent higher than what was imported in FY19, the previous record year for imports. Preliminary data for last month shows the trade deficit just fell short of the record high of $196 billion – set in FY13 – by around $4 billion.

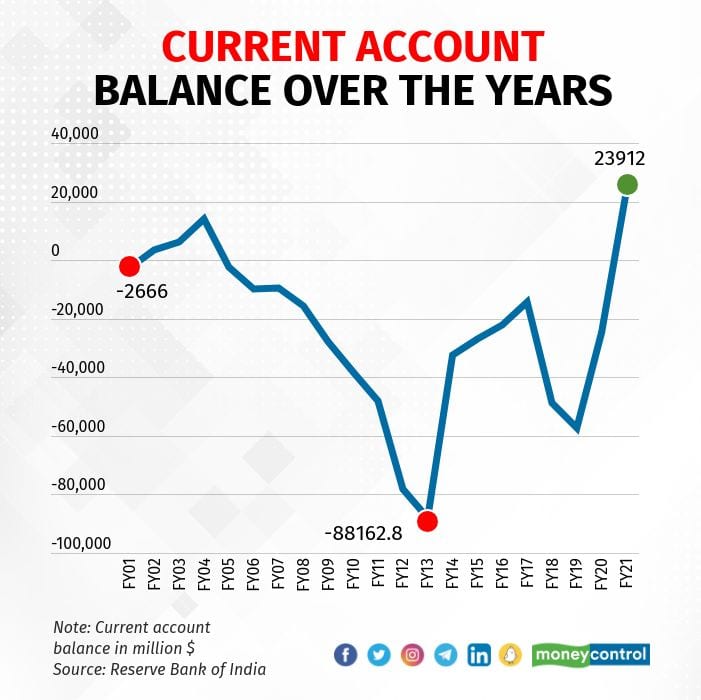

The sharp increase in the merchandise trade deficit has also led to a jump in the current account deficit (CAD).

Latest data released last week showed the CAD hit a nine-year high of $23 billion in October-December. The last time the CAD was higher was in the last quarter of 2012, as per Reserve Bank of India (RBI) data.

In October-December 2012, India had posted a CAD of $31.8 billion.

However, if global commodity and energy prices remain elevated, India's CAD may cross the $100-billion mark this year.

For April-December 2021, the CAD stood at $26.5 billion. Economists see it rising to $45-50 billion for the full FY22.

"The external balance, which had been a major factor of support for India for the past two years, has seen its vulnerability to higher oil prices decline over the years, but the simultaneous rise in prices of coal, natural gas, edible oils, and gold will weigh on the trade deficit," noted Rahul Bajoria, chief India economist at Barclays.

According to Bajoria, the CAD may rise to $105 billion this financial year – or 3.0 percent of GDP – assuming an average oil price of $105 per barrel.

Bajoria is not alone in forecasting such a sharp deterioration in the current account. Using an average price of Brent oil of $97 per barrel – the average of monthly future prices for the next 12 contracts – Acuite Ratings and Research has projected a CAD of $85 billion for FY23 as a base case. This would be just short of the record deficit of $88 billion, posted in FY13.

To be sure, much depends on the price of oil.

Using three different assumptions for oil prices, Kotak Economic Research arrived at different scenarios. An average crude oil price of $80 per barrel could result in a CAD of $71.8 billion, while oil at $100 per barrel would push the deficit up to $100.6 billion in FY23. The third scenario, where the price of oil is seen averaging $120 per barrel this year, sees the deficit at a huge $131.1 billion – nearly 50 percent higher than the current record high.

"The external sector matrix remains vulnerable from uncertainties arising from geopolitical risks, differential pace of policy normalisation by central banks, and global resurgence of COVID cases posing downside risks to global demand," Kotak Economic Research said in a note on March 31.

Undoubtedly, India is in a far better position now to handle the consequences of a large CAD. For one, the RBI's foreign exchange reserves, even without taking its forward book into account, is north of $600 billion. In recent weeks, the RBI has used this war-chest to defend the rupee, with its reserves falling by around $14 billion in the four weeks ended March 25. FY23 may see some more of the same unless global factors turn in India's favour.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.