Inflow from domestic institutional investors seems to have regained momentum with investments scaling a six-month high in December but sustainability of investment remains a cause for concern.

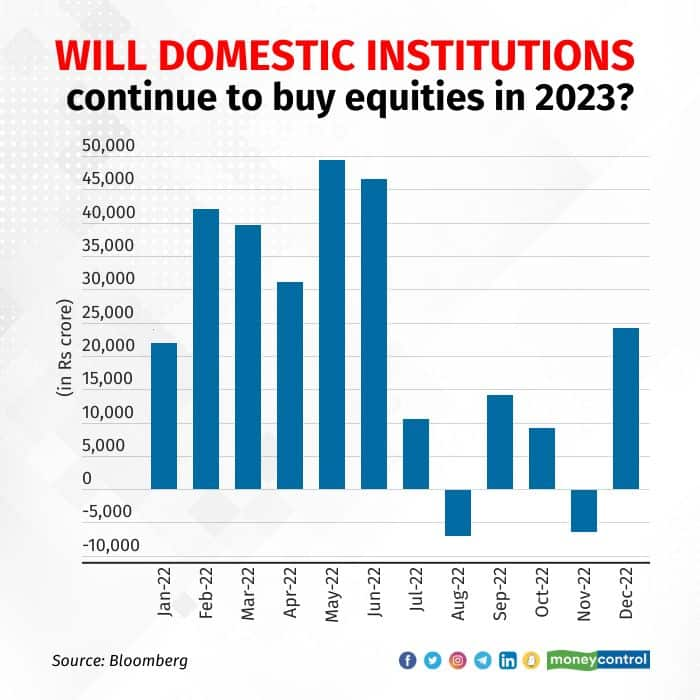

Domestic institutional investors (DII) picked up equities worth Rs 24,159 crore last month. In 2022, DIIs had bought Rs 2.76 trillion worth of Indian equities. In December, equity mutual funds recorded a healthy inflow of Rs 10,895 crore, while in November, systematic investment plans (SIP) reached an all-time high of over Rs 13,306 crore.

“We believe that as long as the growth story of corporate India is intact and the outlook is promising, buying may continue... we may see a few months where you may see profit booking from DIIs due to factors like higher redemption from investors, a changing macro-economic scenario, revision on growth outlook etc,” said Amit Nadekar, Senior Equity Fund Manager, LIC Mutual Fund Asset Management Ltd.

Some analysts also said that of late DIIs had started to buy Indian equities to take advantage of recent market corrections. In December, both the Sensex and Nifty had declined nearly 3.6% each amid a resurgence in Covid in China, fears of further tightening of rates by central banks around the world, and a looming recession. This could be a major opportunity for India to leverage its strength and gain more dominance in global markets, say the analysts.

Slow, but not quite outSince the beginning of 2022, DIIs have been buying at an average of over Rs 35,000 crore every month. The pace began slowing in July 2022, when DIIs started buying equities worth around Rs 5,000 crore monthly, on an average, provisional data from the NSE showed.

“One of the reasons for slowing down investments by DIIs recently may be that many investors shifted from equity to debt given the rising yields in debt markets. However, we believe that yields may have peaked. Therefore, we believe incremental money may flow into equity in 2023...auto, industrial and banking sectors, which are coming out of a long spell of drought, stood out on these counts and also offer good entry points from a valuation perspective. We expect these themes to do well in 2023,” Nadekar added

The year 2022 saw a series of challenges, including the Russia-Ukraine war, leading to fluctuations in crude oil prices, rupee weakness, rising interest rates, pandemic-induced global supply chain challenges and staggering inflation, which led to tighter financial conditions and weakened economic activity across the world. This led FIIs to sell around $16.8 billion in Indian markets. However, most of these macro concerns have eased and analysts expect inflation to soften and global central banks to pause or slow rate hikes.

India has not remained insulated from macro developments but has outperformed the global markets by a big margin due to the resilience of the domestic economy. Analysts expect that in 2023, DII buying will continue as India is in a sweet spot, given both domestic and global opportunities. The experts also believe that India is a structural story that will continue to unwind over the coming decades.

In 2022, inflows from domestic institutional investors overshadowed foreign portfolio investments and Credit Suisse sees this trend continuing. It expects $12 billion from insurance funds, $7-8 billion from the Employees’ Provident Fund Organisation and $18-20 billion from Systematic Investment Plans (SIPs) to sustain. Meanwhile, non-SIP retail flows might moderate due to higher rates.

According to BofA Research, a protracted recession in the US could mean FII outflows continue for some time. It expects — conservatively, as per its report — that just the Provident Fund, Pension Fund, Insurance Funds, and SIPs could contribute at least $20 billion to Indian equities in 2023, said the report.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.