The pharma space was remain in under pressure due to USFDA plant inspections, delay in approvals, pricing pressures in the quarter ended December 2017.

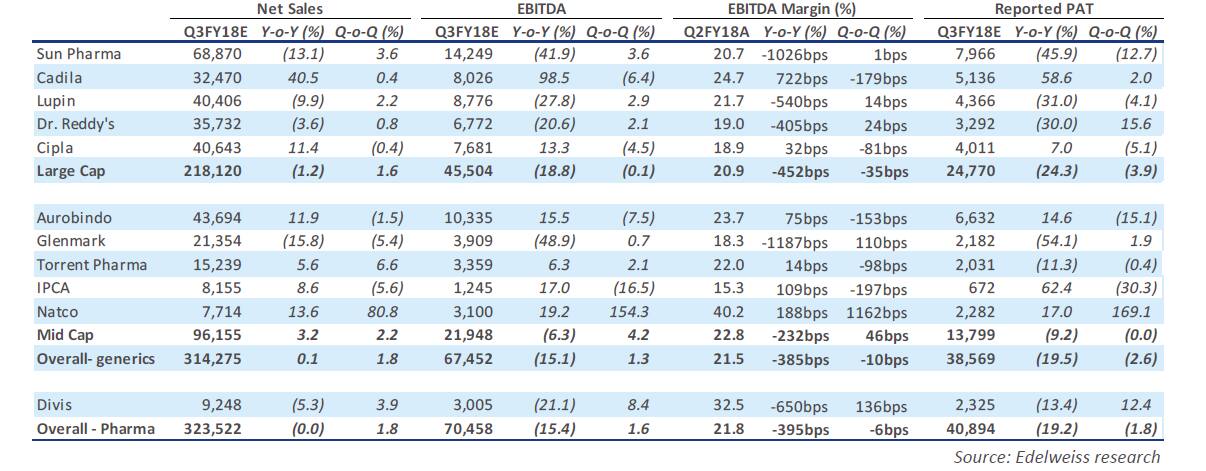

According to Edelweiss, revenue of the pharma companies are estimated to remain flat YoY, while EBITDA and PAT are likely to decline 15 percent and 19 percent, respectively, impacted by decline in US business and sharp appreciation in INR YoY against other major currencies.

The revenue from US market is expected to decline 11 percent YoY for the sector in constant currency (CC), as faster approvals, heightened competition and sustained pricing pressure to dent growth. However, the domestic sales are expected to grow 12 percent YoY on a low base.

The USFDA granted 246 nods in Q3FY18, which is the highest-ever approvals in a single quarter. Cadila Healthcare received 23 and Aurobindo Pharma got 18 approvals. Faster approvals have led to heightened competition and pricing pressure, suppressing overall sector’s earnings.

The firm believes that FY18 is likely to remain a disappointing year as appreciating rupee will be aggravated by US and domestic challenges. The top picks from the sector includes Dr Reddy’s Laboratories and Cadila Healthcare.

Nifty pharma index rose 5 percent during the quarter ended December 2017.

Edelweiss expects Dr Reddy's Laboratories' US revenue to grow 3 percent sequentially benefitting from new launches like gRenvela, gClolar and ram up in gDoxil. While in Cadila Healthcare expect 12 percent growth in the domestic business.

Cipla is expected to report flat revenue, while India business is expected to grow 12 percent YoY.

Divis Laboratories' topline to decline by 5 percent and EBITDA margin is expected to decline 650 bps YoY due to operating deleverage and 4 percent rupee appreciation over the past 1 year.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.