TVS Motor Company, India's third largest two-wheeler player, is likely to report impressive Q4 financial results, with volumes and product mix boosting revenue, and better pricing and benign commodity costs helping profitability.

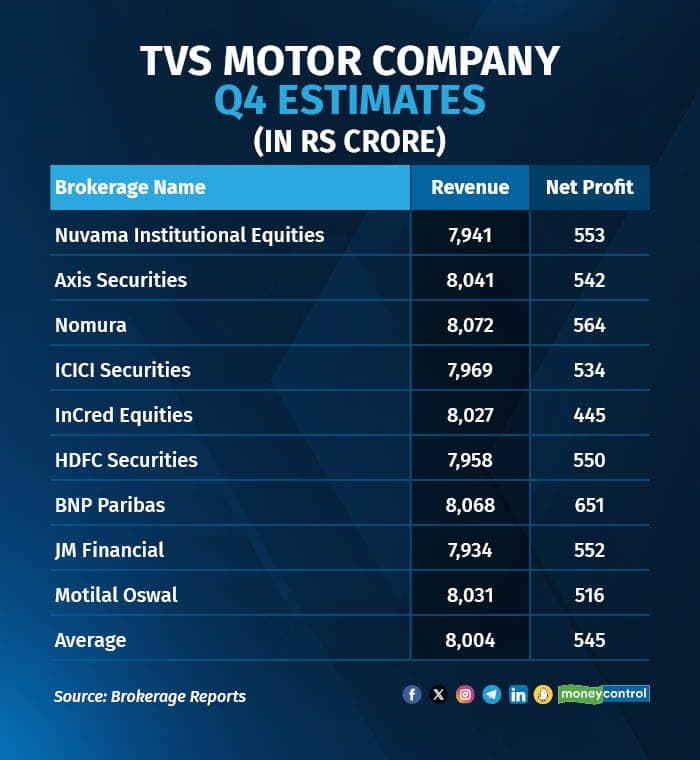

The Apache bike-maker is expected to see its fiscal fourth-quarter net profit rise to Rs 545 crore, up 33 percent from the year-ago period, according to a Moneycontrol poll of nine brokerage estimates. Revenue from operations is expected to jump 21 percent to Rs 8,004 crore during the same period.

Follow our live blog for all the market updates

TVS MOTOR COMPANY Q4 FY24 ESTIMATES

TVS MOTOR COMPANY Q4 FY24 ESTIMATES"Revenue growth YoY (would) be supported by robust volume growth,” Nuvama Institutional Equities said in a recent note.

TVS Motor’s EBITDA is expected to expand to Rs 893 crore in January-March, up over 31 percent on-year. EBITDA is earnings before interest, tax, depreciation and amortisation.

Nuvama said the EBITDA margin is likely to expand on better net pricing and higher share of exports. Axis Securities said, “EBITDA margins are expected to increase led by higher operating leverage, RM tailwinds partly offset by margin dilutive mix of EV scooters.”

On volumes, the Chennai-headquartered major reportedly sold 10.63 lakh units during Q4 FY24, translating to an increase of over 22 percent from the year-ago period.

TVS Motors shares have rallied 61 percent in the last one year, to Rs 1,980. Nifty rose 22 percent during the same period.

Going forward, it will be important to monitor how the company responds to a likely slowdown in the industry, and the increasing adoption of electric vehicles. “Key thing to watch out for is E-mobility initiatives and demand outlook,” Nuvama Institutional Equities said.

Some analysts are cautious. “Despite the strong R&D and product development capabilities, we do not see TVS remaining immune from the industry slowdown that we anticipate,” BNP Paribas said in a report. “Hence, despite gaining volume market share in ICE, we expect TVS' domestic volume growth to remain muted,” the brokerage further added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.