Tech Mahindra is all set to report its Q2FY23 numbers on November 1, two weeks after its peers, TCS, Infosys, Wipro and HCL Tech, came out with their report cards.

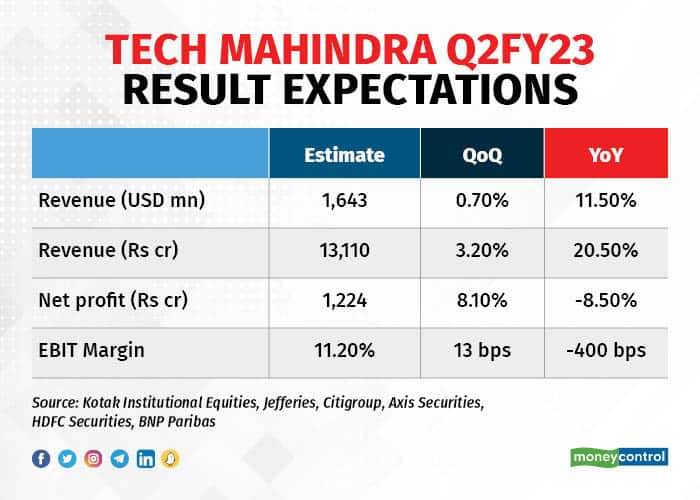

According to an average of estimates of six brokerages polled by Moneycontrol, consolidated profit after tax (PAT) for Tech Mahindra may jump 8.10 percent on a sequential basis but decline 8.5 percent year-on-year to Rs 1,224 crore in the second quarter of FY23 (July-September). Consolidated revenue is expected to increase 20 percent YoY to Rs 13,110 crore.

Analysts expect constant currency growth of 2.4 percent on a sequential basis. The muted growth will be on the back of the company’s weak product business and subdued enterprise segment, Elara Securities noted. However, the communication segment - which forms 40 percent of the company’s revenue - might see robust growth momentum driven by 5G demand.

Analysts at Jefferies and Kotak Institutional Equities are factoring in a 40 basis points inorganic contribution from Thirdware acquisition. On March 12, Tech Mahindra had announced the acquisition of Mumbai-based Thirdware Solutions in an all-cash deal for a total consideration of up to $42 million.

Tech Mahindra’s earnings before interest and taxes (EBIT) margins are seen improving marginally on a sequential basis by 13 basis points to 11.2 percent. “The company will likely absorb 90-100 bps impact of wage revision through operational tightening, aggressive cost-control measures, increase in utilization rates and rationalization of business,” noted Kotak Institutional Equities.

However, on a YoY basis, margins are set to decline 400 basis points.

Investors will be monitoring management commentary on deal wins and project pipeline. Analysts at KIE expect $700 million of net new deal wins with run rate consistent to achieve double-digit growth in FY23E.

Other key monitorables include impact on demand momentum in a slowing macro environment, hiring plans, pricing leverage, telecom deals and performance of acquired entities. Along with the results, its board of directors will also consider the proposal for payment of interim dividend for the financial year 2022-23, which investors will be keenly watching out for.

The stock ended 1.38 percent higher at Rs 1,063.45 on the National Stock Exchange on October 31. It has tumbled 40.42 percent in 2022 so far as the sentiment remains negative on IT stocks due to recessionary fears.

(Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.