Energy, metal and cement companies have emerged as stars of the ongoing Q3 results season with the highest on-year surge in net profit, propelled by an upswing in the capex cycle, robust demand and healthy margins.

In contrast, IT and FMCG players have posted lackluster numbers of the December quarter amid macroeconomic headwinds in the West and anaemic volume growth in rural markets.

Among major corporates that have announced their December quarter earnings so far, Indian Oil Corporation has clocked the biggest year-on-year jump in net profit at a whopping 1,071 percent.

Also read: Here are stocks with maximum 'buy' calls as Budget uncertainty endsThe state-owned oil major reported a consolidated net profit of Rs 8,577 crore in the December quarter, compared to Rs 732 crore in the same period a year ago.

The profit surge was on the back of a boost in marketing margins as a freeze on petrol and diesel prices despite a fall in input crude oil prices helped recover losses incurred when rates were high in 2022-23.

This boosted the bottomlines of other PSU oil majors like BPCL and HPCL as well, with their Q3 net profit vaulting up to 206 percent.

The other major gainers have been metal, power and cement companies.

The government’s massive infrastructure push, as reflected by record budgetary allocations towards capital expenditure, is having a multiplier effect on the economy and crowding in private investment.

JSW Steel’s Q3 net profit surged five-fold YoY to Rs 2,450 crore, while Jindal Steel reported a 272 percent jump at Rs 1,928 crore.

Tata Steel swung to a consolidated net profit of Rs 522.14 crore in the December quarter from a net loss of Rs 2,501.95 crore in the year-ago period, helped by robust domestic demand offsetting weakness in Europe.

Indian EBITDA exceeded expectations by 15 percent, reaching Rs 8,300 crore, while consolidated EBITDA stood at Rs 6,260 crore, surpassing analyst estimates by 35 percent.

Steel companies are reaping the benefit of government infrastructure spending but rising coking coal costs have capped profits.

“Demand is strong in India, steel consumption in India has grown by 10-12% YoY. In the last quarter steel prices in India dropped by 3-4% compared to a 7%-8% drop in international prices,” Axis Securities said in a note.

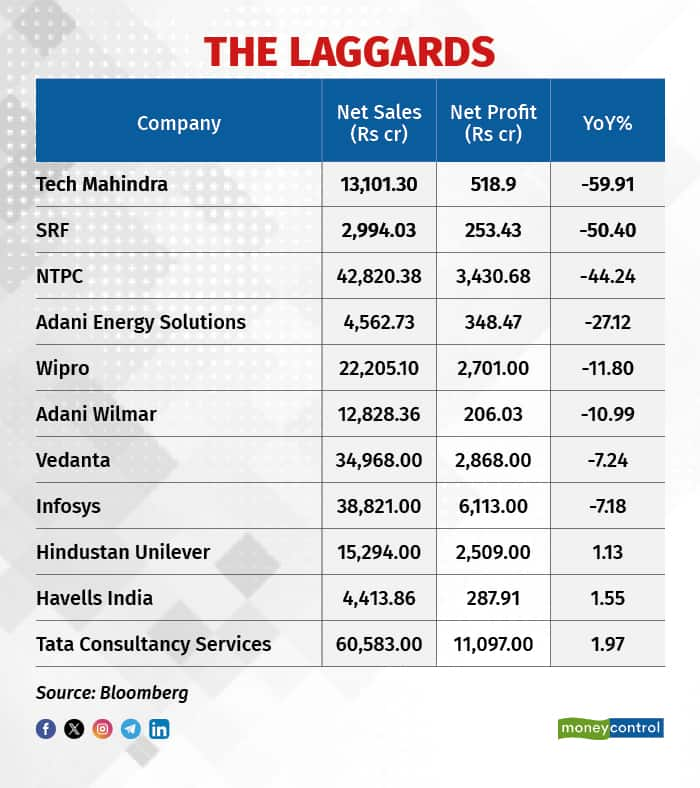

The LaggardsElevated interest rates and weak consumer sentiment in the US and Europe – the biggest markets for domestic software firms – have made the going tough for Indian IT majors.

The slowdown in discretionary spends has led to delays in decision-making as well as deal conversions for software services companies.

Tech Mahindra saw the biggest on-year plunge in Q3 net profit (down 60 percent) followed by Wipro (down 12 percent) and Infosys (down 7 percent).

TCS, India's largest IT services company, posted a 2 percent rise in Q3 net profit at Rs 11,058 crore.

“We feel that the near-term outlook of the Indian IT players is not very optimistic due to prevailing macroeconomic uncertainty in the US and Europe ,” said Rajesh Sinha, Senior Research Analyst at Bonanza Portfolio. "Most of the IT companies have revised their guidance downward, citing a challenging demand environment and declining growth in the industry."

Also Read: TCS, Infosys, Wipro, HCLTech net employees addition drops 93% in Q3FY23Demand sentiment remained under pressure for consumer goods companies, as sustained inflationary woes and a slower-than-expected rural recovery impacted consumption. Urban markets remained resilient in comparison.

India’s largest fast-moving consumer goods (FMCG) company Hindustan Unilever Ltd (HUL) reported a consolidated net profit of Rs 2,509 crore for the December quarter, an increase of just 1.13 percent from the year-ago period.

According to the company, sluggishness in food and refreshments (F&R) and other segment was due to higher commodity prices, leading to consumers down-trading.

The management commentary on demand remained unexciting, domestic brokerage firm Emkay Global said. “Demand recovery remains a hope on the emergence of tailwinds. Reinforcing the general trade moat is now an added pressure, with changes in distributor margin structure,” it added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!