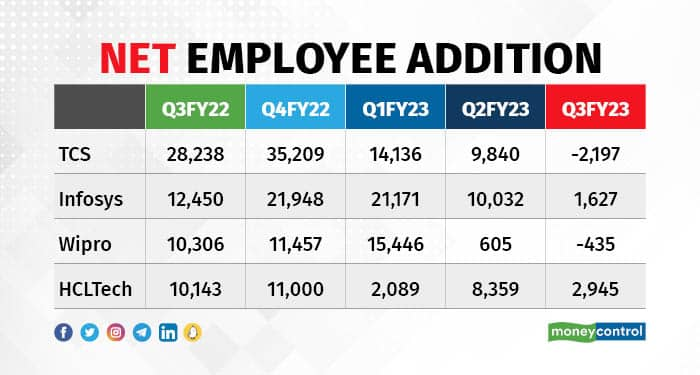

India’s top four IT companies hired 1,940 employees on a net basis in the third quarter of FY23, down 93 percent from the previous quarter.

The net addition by Tata Consultancy Services, Infosys, Wipro, and HCLTech had fallen 45 percent to 28,836 employees in the second quarter from the first quarter, when 52,842 employees were recruited.

The declining trend in headcount addition comes as the IT sector faces a cautionary demand environment, a challenging environment in certain verticals in major markets such as North America and Europe, and a slowdown in discretionary spends. Although a slowing hiring trend is often considered an indicator of easing demand, top executives of IT companies maintained this is not the case.

TCS said its headcount dropped by 2,197 employees from the previous quarter, while Wipro said there was a reduction of 435 employees. This was the first time in 10 quarters that the headcount at the end of a quarter for both companies was lower than in the previous quarter.

Infosys added 1,627 employees and HCLTech hired 2,945 employees, the most among the four companies. The net headcount of Infosys, TCS and Wipro has declined in each quarter of FY23.

The companies attributed the lower or negative net headcount addition in the third quarter to talent investments they made previously and said they are now working to make that talent productive.

Since Q1 of FY21, when all companies reported a net reduction in their headcount, their hiring has increased significantly thanks to unprecedented pandemic-accelerated demand for digital transformation. Following the reduction in headcount in April-June 2020, during the first wave of the pandemic, the net addition of the four companies increased dramatically between Q2 of FY21 and Q4 of FY22.

The four companies cumulatively added 17,076 employees in Q2 of FY21. By Q4 of FY22, it stood at 79,614.

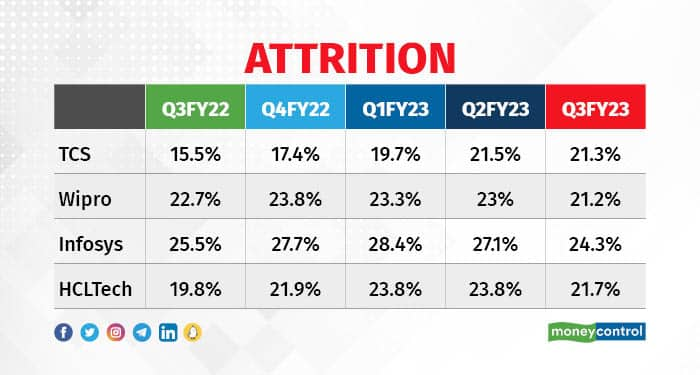

In the case of TCS, chief human resources officer Milind Lakkad said the company invested in fresh talent as well as in talent development to make them productive, and that investment coupled with tightening led to a negative headcount."That does not indicate anything on the demand side. Demand is high, we are just operating very efficiently right now," he claimed.Infosys CEO Salil Parekh said the company wants to ensure that all the talent it has hired is trained and ready to be deployed. Parekh said the company’s quarterly annualised attrition is trending downwards and in Q3 of FY23 it was at the lowest in seven quarters.Over the past four quarters, HCLTech added 11,000 employees in Q4 of FY22, which dipped to 2,089 in Q1 of FY23, spiked to 8,359 in Q2 of FY23 and again declined to 2,945 in Q3 of FY23. Chief financial officer Prateek Aggarwal said the company has focussed on hiring freshers and lateral hiring has reduced.Addressing the press after the company’s earnings last week, chief people officer Ramachandran Sundararajan said net addition is a function of attrition and campus hiring in the previous quarter, when they took in a higher number of freshers. He said gross hiring will be moderated when there is a significant drop in attrition.Asked if this was an indicator of demand, he said it looks at net headcount addition on a rolling 12-month basis and projecting a one-quarter snapshot for future quarters may not give the true picture.“We need to look at it on a trailing 12-month basis, so I don't see this as an indication of any moderation to growth,” he said.Attrition has been moderating as well, with a decline visible on a trailing 12-month basis.

In the case of TCS, chief human resources officer Milind Lakkad said the company invested in fresh talent as well as in talent development to make them productive, and that investment coupled with tightening led to a negative headcount."That does not indicate anything on the demand side. Demand is high, we are just operating very efficiently right now," he claimed.Infosys CEO Salil Parekh said the company wants to ensure that all the talent it has hired is trained and ready to be deployed. Parekh said the company’s quarterly annualised attrition is trending downwards and in Q3 of FY23 it was at the lowest in seven quarters.Over the past four quarters, HCLTech added 11,000 employees in Q4 of FY22, which dipped to 2,089 in Q1 of FY23, spiked to 8,359 in Q2 of FY23 and again declined to 2,945 in Q3 of FY23. Chief financial officer Prateek Aggarwal said the company has focussed on hiring freshers and lateral hiring has reduced.Addressing the press after the company’s earnings last week, chief people officer Ramachandran Sundararajan said net addition is a function of attrition and campus hiring in the previous quarter, when they took in a higher number of freshers. He said gross hiring will be moderated when there is a significant drop in attrition.Asked if this was an indicator of demand, he said it looks at net headcount addition on a rolling 12-month basis and projecting a one-quarter snapshot for future quarters may not give the true picture.“We need to look at it on a trailing 12-month basis, so I don't see this as an indication of any moderation to growth,” he said.Attrition has been moderating as well, with a decline visible on a trailing 12-month basis. Fresher additionOn fresher hiring, Sundararajan said that HCLTech hired over 22,000 freshers in FY23 and will get close to the target of 30,000 freshers for the year.“We may fall slightly marginally below that [fresher hiring target] and that's a moderation that we're doing because of the improvements in the retention rates… The extent to which we have seen attrition drop quarter-on-quarter for the last couple of quarters, I think that's significant and it is very encouraging,” Sundararajan said.Wipro, which initially set a target of 30,000 freshers for the year, is expected to close with hiring 22,000 freshers. It added 3,000 freshers in Q3, and about 5,000 are expected to be added in Q4.Wipro’s CHRO Saurabh Govil told Moneycontrol that the company had invested in talent ahead of time and has low utilisation.

Fresher additionOn fresher hiring, Sundararajan said that HCLTech hired over 22,000 freshers in FY23 and will get close to the target of 30,000 freshers for the year.“We may fall slightly marginally below that [fresher hiring target] and that's a moderation that we're doing because of the improvements in the retention rates… The extent to which we have seen attrition drop quarter-on-quarter for the last couple of quarters, I think that's significant and it is very encouraging,” Sundararajan said.Wipro, which initially set a target of 30,000 freshers for the year, is expected to close with hiring 22,000 freshers. It added 3,000 freshers in Q3, and about 5,000 are expected to be added in Q4.Wipro’s CHRO Saurabh Govil told Moneycontrol that the company had invested in talent ahead of time and has low utilisation.

“We have a bench (strength), where utilisation can go up. We have headspace of four or five percentage points by utilisation. We are hiring and training them and keeping them ready to manage demand. From a supply-chain perspective, we don't see a challenge,” Govil said.

Infosys hired about 6,000 freshers during the quarter, and TCS around 7,000.

Campus hiring in FY23 is expected to be significantly lower than last year, according to Saran Balasundaram, CEO of tech recruitment firm Han Digital. “Last year, about 4.8-5.2 lakh were successfully hired. This financial year, successful campus hires will not be more than 3.8 lakh,” he said.

Anshuman Das, CEO of Careernet, expects campus hiring in calendar 2023 to be hit as companies honour offers they have already made.

“A lot of the company's campus hiring plans are reasonably muted, 50-60 percent down from last year’s number,” he said.

Based on the current hiring, intent and mood, all types of hiring is impacted, said TeamLease Digital CEO Sunil Chemmankotil.

“I don't think they will considerably reduce fresher hiring but it will definitely not be to the tune of what they hired last year. Somewhere around 3 lakh hiring will still happen in freshers,” he said.

New normal?

Lateral hiring, too, has reduced, Balasundaram said. There were 1.3 million job changes in FY22 and in the first three quarters of FY23, there have not been more than 800,000 job shifts, he said.

“The job churn will be less than 1 million this financial year (FY23), which is about a 30 percent dip from last year,” he said.

He added that attrition backfills are taking a backseat, particularly as companies align their hiring requirements with people taken from campuses.

Das of Careernet said a lot of the hiring used to happen for attrition. However, he doesn’t expect a scenario where hiring slows down further, and said it has hit the bottom of the curve. While he said there will be more clarity in the next three months, he expects it to start rising by April.

Chemmankotil said companies went overboard in some areas when the market was bullish and those attritions are not getting refilled.

“When you have a good prospect base, a lot of service companies hire in excess because they would want to showcase the capability to a prospect,” he said.

Now, since discretionary spending is slowing down, companies may not backfill all attrition, he said. About 20 percent of all IT spend happens for legacy system replacements with the latest technology, but those budgets can be deferred, he said. The remaining 80 percent is when they work on actively building products and maintenance.

“There they will refill, but I think since discretionary spend budgets are not at the same level as what it was in the previous year, refills may not happen to that extent,” he said.

Han Digital’s Balasundaram expects a revival in the hiring market only by the third quarter of FY24.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.