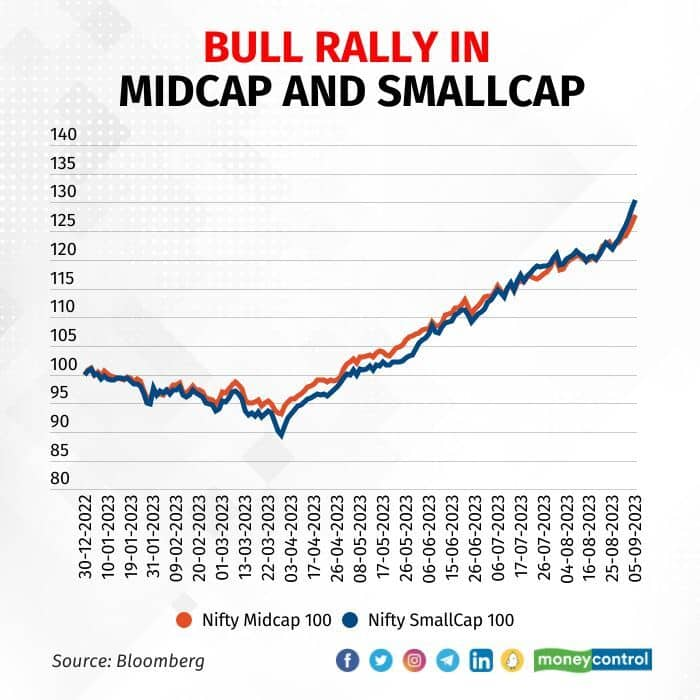

Bull run in mid-cap and small-cap stocks seems to be far from slowing down, despite concerns raised by analysts, with the Nifty Midcap 100 index charging past the 40,000 mark for the first time and the Nifty SmallCap index scaling a fresh all-time high on September 5.

The Nifty MidCap 100 index gained in 13 out of 15 sessions, while Nifty SmallCap index was in green in 12 out of 15 sessions. The indices jumped 6 percent and 8.4 percent during this period and advanced 27 percent and 30 percent so far this year.

Bulls in the small-cap and mid-cap space seem to have braved the caution sounded out by several brokerages over higher valuations. Nirmal Bang Equities CEO Rahul Arora suggests that the market is facing a shortage of attractive investment opportunities, as many decent stocks have been bought up and are no longer available at lower prices. As a result, investors are crafting stories for stocks they wouldn't typically consider, leading to previously overlooked stocks suddenly becoming expensive.

Nilesh Shah, Managing Director of Kotak Mahindra AMC, said in an interview to Business Line newspaper that investors should tread with caution in the small-cap and mid-cap space as there have been a lot of frothy valuations built up. While large-cap stocks are trading near their historical valuations, it will get justified as the economy grows and earnings upgrade becomes a realty.

Kotak Institutional Equities recently acknowledged the broad-based rally but remains uncertain about the factors behind for the rally and the divergent performance across sectors.

Certain sectors in the mid-cap and small-cap space deserve a re-rating, Kotak said in a report, referring to smaller private banks, healthcare services (hospitals) and real estate, as they had reasonable valuations prior to the rally and threw up a strong outlook. It was challenging to understand the rally in smaller consumption and IT services stocks, the brokerage said.

“This is particularly puzzling, considering the ongoing weak domestic demand in the consumption sector and the diminishing global demand for IT services,” the report said.

Few analysts, however, think that rally is likely to continue. Analysts said that investors are shifting their focus to fundamentally strong stocks that have faced recent setbacks. These stocks are benefiting from changing business cycles, positive outlooks expected to persist for the next few years, increased demand, improved financials, attractive valuations, and robust domestic economic factors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.