Madhuchanda Dey

Moneycontrol Research

Mahindra & Mahindra (M&M) started FY19 on a strong note, with both the automotive and tractor businesses reporting impressive numbers. The macro appears supportive for the tractor business. In the automotive segment, new product launches should help sustain the momentum. The company derives significant value from its subsidiaries. Its core business is still available at a compelling valuation for long term investors.

Quarterly snapshot

Adjusted for Goods & Service Tax rollout in the tractor business, revenue grew 22.8 percent at Rs 13,358 crore. Growth in automotive and farm equipment (predominantly tractor) stood at 22.6 percent and 24.2 percent, respectively. While volume growth in late teens was robust, the healthy topline performance resulted in economies of scale. The company managed significant margin expansion, with automotive and farm equipment earnings before interest and tax (EBIT) margin expanding 260 basis points year-on-year (YoY) and 250 bps, respectively. The blended margin saw a 260 bps spike to 15.8 percent.

However, investors have to bear in mind that the year-ago quarter witnessed a pre-GST impact, wherein the management made a provision of Rs 144 crore. Adjusting for the same, the growth in revenue, operating profit and profit after tax would have been 21.2 percent, 33.7 percent and 49 percent, respectively.

Automotive and farm segments EBIT surged 69.5 percent and 40.9 percent, respectively. Adjusting for the GST provision, growth stood at 49.2 percent and 27 percent, respectively.

The strong operating performance led to impressive bottomline growth.

Farm equipment division: Strong near term outlook M&M is the market leader in tractors and has been gaining market share for the last three-to-four years. While the tractor business experiences three-to-four years of upcycle, the management is optimistic that the strong momentum seen in FY19 might not wane altogether in FY20. It has revised its growth forecast for this segment from the erstwhile 8-10 percent to 12-14 percent for FY19.

A normal monsoon, high reservoir levels, in line Rabi harvest, hike in kharif minimum support prices and rise in non-farm income on the back of an increase in infrastructure activities are all providing strong opportunities for tractor sales.

Newly launched Trakstar (by subsidiary Gromax) has doubled its volume in the quarter gone by. It is seeing strong traction in farm machines, although the business is still quite small.

In the near term, the coming quarter (Q2) might be a tad soft as Diwali this year falls in November, but the overall outlook seems extremely promising. The company is carrying below industry inventory levels which is a strong positive. While it will have to grapple with a high base in FY20, the management is optimistic about 8-10 percent growth.

Automotive segment: Product launches critical M&M doesn’t seem overly worried about the impact of the recent 50 bps rate hike or the hike in fuel prices impacting the transport sector. The management alluded to strong demand from rural areas.

The automotive numbers definitely benefitted from a low base in the year-ago quarter, wherein volumes for passenger vehicles were lower due to slowdown in demand preceding GST. The same for commercial vehicles was impacted due to supply constraints arising from implementation of Bharat Stage IV norms. Heavy commercial vehicles (HCV) has been a stellar performer and now commands a market share of 5.7 percent. It doesn’t see significant impact from the recent axle load norms on HCV sales as the new vehicles will take time to hit the market.

The automaker has an interesting launch pipeline with U321 (a multi-purpose vehicle) by September and two more utility vehicles one before and one after Diwali. In the CV space, the Furio ICV (intermediate commercial vehicle) rollout is expected around Diwali. While 2019 is going to be relatively dull in terms of new launches, the success of upcoming launches will define the automotive outlook for FY20.

Undemanding valuation

A strong FY19 raises multiple questions about the sustenance of this strong showing going forward. While growth is likely to moderate, the valuation captures the same.

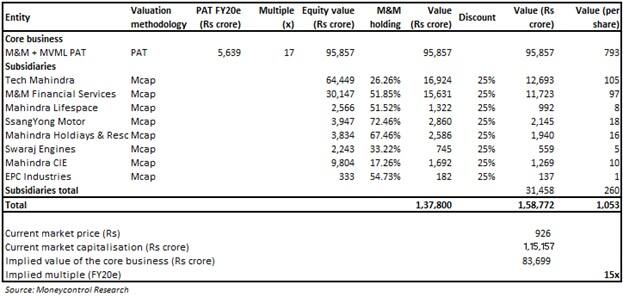

If we follow a sum-of-the-parts valuation (SOTP) and exclude the value of subsidiaries, the core automobile business trades close to 15 times FY20 projected earnings. Considering a decent outlook, this is at a steep discount to peer groups that typically trade at multiples of 17-20 times. There is headroom to catch up, riding on rural recovery and product innovation. Value investors should accumulate M&M for the long term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.