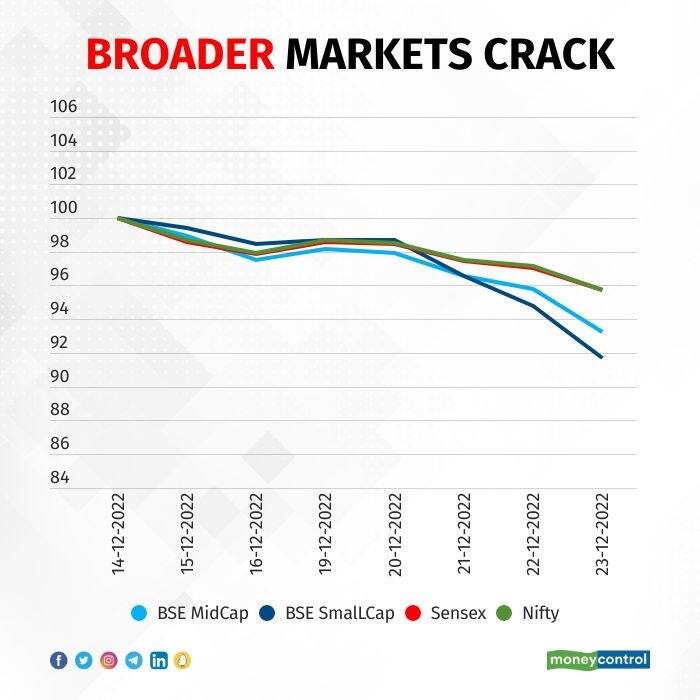

India's broader indices BSE Midcap and BSE Smallcap have turned negative with decline in six out of seven trading sessions led by losses in global equities.

The BSE Midcap index hit a two-month low to 24,762 points, down 2 percent, while BSE SmallCap touched a four-month low of 27,710 points, down 2.5 percent. Both the indices losses were steepest since September 26.

In the last six sessions, BSE Midcap lost over 6.3 percent and BSE Smallcap declined 7.8 percent. Year to date, both indices have slid 0.7 percent and 6 percent, respectively. Benchmark Sensex and Nifty lost nearly 1 percent on Friday and so far this year both were up nearly 3.5 percent each.

BSE MidCap and Smallcap were already under pressure and were not taking part in the recent rally after many analysts pointed out higher valuation compared to benchmark Sensex and Nifty index. The weak performance was also after both indices reported weaker than expected earnings in the September quarter.

Recently, BofA said in its outlook for 2023 that the large caps will perform better than midcaps and smallcaps as investors will look for safety amid volatility.

"Large caps can manage this challenge better than mid and small caps. Therefore, safety would be higher in large caps than in mid and small caps in 2023", said Dr VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Analysts said that 2023 is likely to be challenging for equities since the global economy is likely to witness a big slowdown. India’s growth,too, will be impacted by the global slowdown. Corporate earnings growth will be moderate, analysts expect.

"In bearish times, small and midcaps tend to fall more than the Nifty as normally retail traders/investors who have weak hands tend to get panicky and take profits or cut losses fast. Also the institutions take their own time in providing a floor to these stocks if found attractive," Deepak Jasani, Head of Retail Research, HDFC Securities, said.

He believes select smallcaps may do well in 2023. "Small caps are well positioned for a continued backdrop of elevated inflation and these are bigger beneficiaries of a multi-year theme: capex / reshoring. Services spending has also held up better than goods spending (and typically does so in recessions except Covid-induced), which benefits small caps," Jasani said. "Fed pauses and Fed cuts have typically been positive for smallcaps more than largecaps."

Global equities are under pressure amid expectations of recessionary fears in the US. The expectations that the US federal reserve is likely to raise rates further in its next policy to tackle inflation and jump in covid cases in China and Japan also weakened sentiments.

Earlier, Bank of Japan modified its yield curve control tolerance range while holding its ultra-low benchmark interest rates steady. Bank of Japan Governor Haruhiko Kuroda said the central bank will not hesitate to further ease its monetary policy if it’s necessary as the economy faces many uncertainties, according to a Bloomberg report.

Domestically, RBI minutes signalled another interest rate hike in its next policy meet and the advisories issued by the authorities on covid also dampened the sentiment.

“The equity market traded lower again mainly on account of the overarching influence of negative factors and news from overseas. Some of the recent macro numbers show the US economy still staying in relatively good health, but the news from China and Japan are not encouraging due to the larger number of Covid cases reported from several countries, and the impact of the same on global growth and economic activity in the coming months," said Dr Joseph Thomas, Head of Research, Emkay Wealth Management.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.