Marie Gold biscuits maker Britannia Industries is poised to report subdued Q4 earnings as muted rural demand and slower FMCG volume growth heightened the pricing pressures during the quarter.

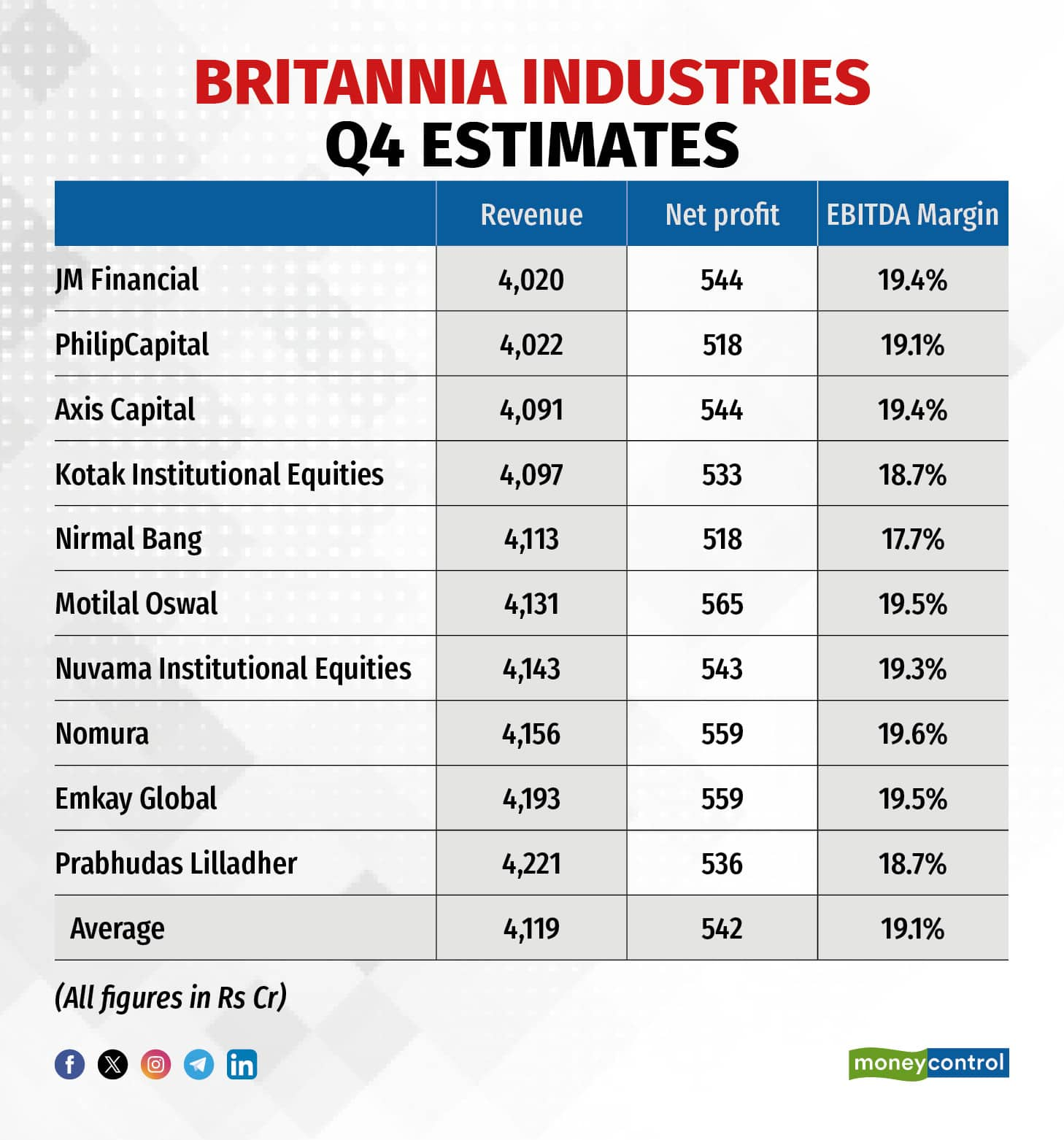

Britannia’s net profit is expected to fall almost three percent year-on-year to Rs 542 crore from Rs 558 crore in the same quarter previous year, according to a Moneycontrol poll of 10 brokerages.

The Bourbon biscuit distributor will see top-line growth of around 2.4 percent to Rs 4,119 crore during the quarter, up from Rs 4,023 crore during the March quarter of the previous fiscal. The EBITDA margin will correct by 80 bps YoY to 19.1 percent, according to the poll.

Prabhudas Lilladher said it expects Britannia’s business volumes to grow in the mid-single digits, with the five-year CAGR at around four percent as the operating environment remains challenging.

The biscuit maker will see its gross margins remain flat, despite premiumisation and correction in raw material prices, as they will be offset by the price cuts undertaken during the quarter. To remain competitive and drive volume growth, Britannia Industries has raised its grammage across its popular packs.

Also Read | Foreign investors cut stakes in FMCG firms as soaring input cost threatens Q4 earnings

Additionally, the resumption of focus on the Rs 5 SKU (stock keeping unit) to drive demand in the Tier-3 and rural segment is likely to help the company register better volume growth. But the rural demand still remains a laggard vis-à-vis urban.

As input prices have turned benign, increased competition from unorganised players will keep realisations under check while also impacting demand from the rural segment.

However, Nomura cautioned that while RM prices were low on a yearly basis, on a QoQ basis, quite a few commodities have started to turn inflationary. “Impact of the same could be seen in the coming quarters as companies will still have lower price inventory,” added the brokerage.

JM Financial said, “In our view, some amount of inflation is beneficial for staples as it provides pricing leverage and also keeps regional competition/aggressive promotions under check.”

Some of the key factors to monitor will be Britannia’s market share, the narrative surrounding rural demand and RM prices.

Britannia Industries' share price gained around 6 percent over the past six months, significantly underperforming the frontline Nifty 50 index that has jumped around 19 percent during the same time period.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.