A day before the presentation of the interim budget, Nifty gained more than 213 points, and BSE Sensex strengthened by 612 points. Banks and financial services stocks saw some short covering, which lifted the key benchmark indices. With a 35-point contribution, HDFC Bank added the most to the Nifty gains. Put together, private banks, viz., HDFC Bank, ICICI Bank, and Axis Bank, contributed 63 points, or 30 percent, to Nifty gains. With the interim budget set to be announced, traders and investors will be planning their best strategies to deal with the markets on an eventful day.

Tune in to Moneycontrol for live budget coverage.

How to position your trades on budget day?According to Sriram Velayudhan, Senior Vice President, Alternative Research, at IIFL Securities, “Since it is an interim budget, not much hedging activity is seen in the market. It's reflected in the implied volatility as well. Implied volatility is currently not pricing in any uncertainty. The case would have been different had it been a full-fledged budget.

The market will surely look for cues on capital spending, likely reforms, etc. on budget day (February 1). However, the FOMC meeting details and the commentary will set the agenda for investors and traders. As of now, I see short positions being built into financials. If any positive development happens in this space, we could see decent short covering in financials. On a net basis, I do not see any big moves on this budget day. The range I am looking at is 21,000 to 21,800 in Nifty for the February series. For traders, it is always prudent to hedge long positions ahead of the event.”

The Nifty Private Bank index is up 2.09 percent in the past week. However, on a year-to-date (YTD) basis, the index is down by 5.07 percent. Some signs of short-covering were already seen a day before the interim budget.

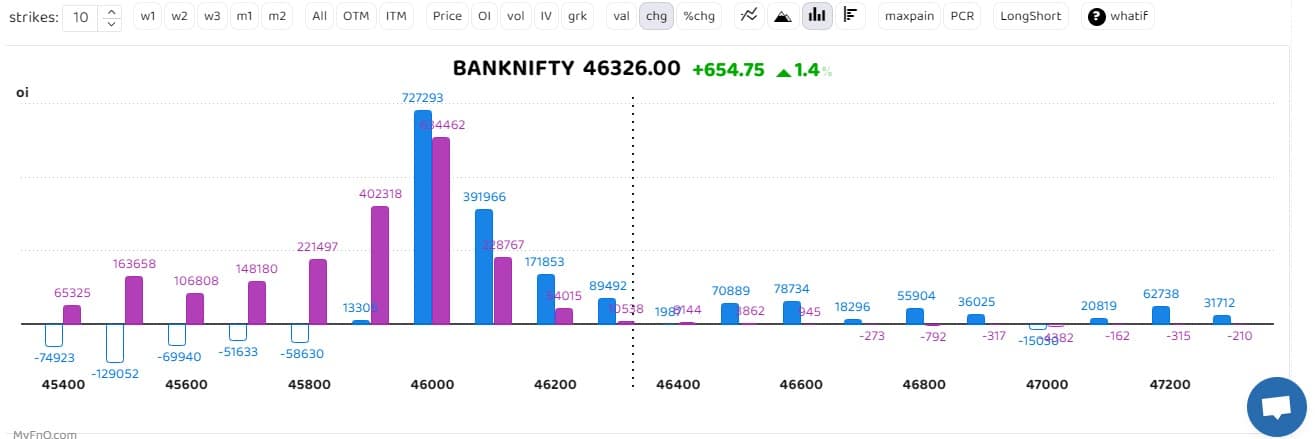

*Blue bars indicate calls open interest change. Purple bars indicate puts open interest change.

*Blue bars indicate calls open interest change. Purple bars indicate puts open interest change.

The market is expected to be volatile on February 1, not only because of the interim budget but also because of the earnings that will be announced that day. At least 88 companies are expected to announce their quarterly results on budget day, as per the BSE website. Adani Ports, Adani Enterprises, Arvind Smartspaces, TD Power Systems, Jupiter Wagons, Texmaco Rail, Indian Hotels, Pricol, and Titan are some of the companies that will declare results, adding to the overall volatility of the markets.

Sneha Poddar, AVP - Retail Research, Broking and Distribution, MOFSL, said, "Since the budget is (coinciding) with the US Fed outcome, we expect the market to see some volatility. Due to the upcoming general elections, we may see some populist schemes being included in the Interim Budget 2024-25, while they may also look at providing some relief on the personal income tax front.”

With higher volatility come bigger opportunities for strategy traders. Rajesh Palviya, SVP - Technical and Derivatives Research, Axis Securities, suggests, “Strategy traders can opt for budget day/weekly expiry (known as) (REPHRASED. IS IT OK?) Iron Butterfly. The strategy involves selling one lot of Nifty 21,550 Call at 151 and selling one lot of Nifty 21,550 Put at 155 while simultaneously buying one lot of 21,900 Call at 32 and buying one lot of 21,200 Put at 46. Both risk and reward in this strategy are limited, and the gains in the strategy at expiry will accrue between two levels, that is, 21,800 on the upside and 21,300 on the downside. A maximum profit of Rs 11,400 can happen if Nifty closes/expires at 21,550. On the other hand, if Nifty on expiry closes above 21,778 (upper BEP) or below 21,322 (lower BEP), then the strategy will start making a loss. The maximum loss will be limited to Rs 6,100 for any close above 21,900 or below 21,200.”

Sheersham Gupta, Director and Senior Technical Analyst at Rupeezy advises traders not to create aggressive positions. He suggests, “Market volatility tends to surge in the lead-up to the budget, and it is almost certain to crash post-budget." So one can look to create non-directional option writing strategies like short strangles. As the implied volatility falls, so will the option premiums. Contracts with a June or December expiry date will have higher premiums; so the fall in premiums will be greater in these series. So, a position created in far-month series contracts will give better profits.

The strike price selected for the short strangles should be far from At-The-Money (ATM) as they have more cushion to accommodate a steep rise or fall in the markets. So on the upside 24,000 and on the downside 20,000 can be chosen as the strike prices for the strategy. It should be noted that these strategies will require constant monitoring and adjustments.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.